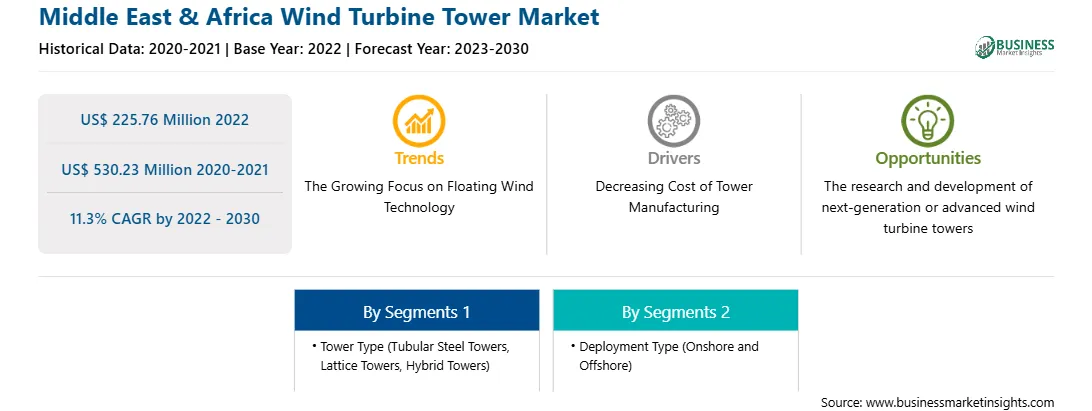

The Middle East & Africa wind turbine tower market was valued at US$ 225.76 million in 2022 and is expected to reach US$ 530.23 million by 2030; it is estimated to grow at a CAGR of 11.3% from 2022 to 2030.

Technological advancement in wind energy can reduce the operational cost in the near future. In terms of wind turbine towers, the manufacturing of taller towers can unlock the higher potential of the wind turbine. Stronger winds are normal at higher heights; sometimes, it is beyond the reach of conventional turbines. An average 17-meter increase in height can offer the additional clearance required for longer blades to attain those high-altitude winds. In addition, the application of concrete structures for offshore wind turbines provides many advantages over towers made of only steel, which include a longer lifespan and more durability. The taller wind turbine towers and concrete-based turbine towers have more potential in wind energy projects than conventional towers, which is one of the future trends for the wind turbine tower market.

Egypt, South Africa, and Saudi Arabia are some of the major markets for wind turbine towers in the Middle East & Africa. These countries are substantially contributing to wind energy production, which is further increasing the market growth. The prime aspects responsible for the market growth are the improved initiatives for using green energy sources to meet the growing power demand reducing dependency on fossil fuels coupled with supportive government policies.

As per the Global Wind Energy Council in April 2022, the Middle East & Africa are expected to add 14 GW of new wind power capacity by 2026. These new wind power capacity additions in the MEA are primarily led by South Africa (5.4 GW), Egypt (2.2 GW), Morocco (1.8 GW), and Saudi Arabia (1.3 GW). In the MEA, onshore wind energy power generation technology has evolved over the last five years to increase the power generation capacity to cover more sites with lower wind speeds in the Middle East & Africa. In May 2022, Savannah Energy built a 500 MW capacity renewable energy power plant in the Republic of Chad, which includes a 100 MW wind farm that will serve N’Djamena city under a new agreement signed with the Chadian government. In 2023, ACWA Power installed the largest wind turbine in the Bukhara region of Uzbekistan. ACWA Power’s 500 MW wind farm is anticipated to feature 79 of the biggest wind turbines in Central Asia and is projected to generate over 1,650 GWh of electricity yearly. It will reduce carbon dioxide emissions by 750 tonnes per year. Thus, the addition of wind farms in renewable energy is strengthening the renewable energy capacity, lowering the emissions and dependence on fossil fuel-based power, which is expected to further fuel the market growth of wind turbine towers during the forecast period. Also, the increasing investment in the construction of wind farms in the region is raising the demand for wind turbine towers. This is further pushing the manufacturers to produce more efficient turbine towers, further boosting the market growth.

Strategic insights for the Middle East & Africa Wind Turbine Tower provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 225.76 Million |

| Market Size by 2030 | US$ 530.23 Million |

| Global CAGR (2022 - 2030) | 11.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Tower Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Wind Turbine Tower refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa wind turbine tower market is segmented based on tower type, deployment type, and country. Based on tower type, the Middle East & Africa wind turbine tower market is segmented into tubular steel towers, lattice towers, and hybrid towers. The tubular steel towers segment held the largest market share in 2022.

Based on deployment type, the Middle East & Africa wind turbine tower market is bifurcated into onshore services and offshore services. The onshore services held a larger market share in 2022.

Based on country, the Middle East & Africa wind turbine tower market is segmented into Saudi Arabia, Egypt, South Africa, and the Rest of Middle East & Africa. South Africa dominated the Middle East & Africa wind turbine tower market share in 2022.

Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Valmont Industries Inc, Nordex SE, and Cs Wind Corp are some of the leading companies operating in the Middle East & Africa wind turbine tower market.

1. Vestas Wind Systems AS

2. Siemens Gamesa Renewable Energy SA

3. Valmont Industries Inc

4. Nordex SE

5. Cs Wind Corp

The Middle East & Africa Wind Turbine Tower Market is valued at US$ 225.76 Million in 2022, it is projected to reach US$ 530.23 Million by 2030.

As per our report Middle East & Africa Wind Turbine Tower Market, the market size is valued at US$ 225.76 Million in 2022, projecting it to reach US$ 530.23 Million by 2030. This translates to a CAGR of approximately 11.3% during the forecast period.

The Middle East & Africa Wind Turbine Tower Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Wind Turbine Tower Market report:

The Middle East & Africa Wind Turbine Tower Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Wind Turbine Tower Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Wind Turbine Tower Market value chain can benefit from the information contained in a comprehensive market report.