Governments of various countries in the Middle East & Africa installed 453 MW of wind power in 2022, the lowest since 2013, after a record year in new installations in 2021. The low installations in 2022 are due to delays in many awarded onshore wind projects from the REIPPP Bid Window 5 auction in South Africa and no wind capacity being awarded from the REIPPP Bid Window 6 auction due to the unavailability of grid capacity in the provinces of Eastern Cape and Western Cape. However, the number of wind projects are likely to increase in North Africa and Saudi Arabia, along with the projects from the REIPPP Bid Window 5 auction coming online. According to the report by the Global Wind Energy Council, a total new capacity of 17 GW is expected to be added in the next five years (2023–2027), of which 5.3 GW will be recorded from South Africa, 3.6 GW from Egypt, 2.4 GW from Saudi Arabia, and 2.2 GW from Morocco. Further, per the news released by Reuters in November 2022, the presidents of the UAE and Egypt signed an agreement to develop one of the world's largest onshore wind projects in Egypt. The 10 GW farm is expected to produce 47,790 GWh of clean energy annually and offset 23.8 million tonnes of carbon dioxide emissions. Hence, the development of the wind energy sector in the Middle East & Africa is expected to create a demand for wind turbine lubricants, as lubricants are used for lubricating various parts of wind turbines. This is expected to offer lucrative opportunities for the wind turbine lubricants market growth in the coming years.

The wind turbine lubricants market in the Middle East & Africa is segmented into Saudi Arabia, South Africa, the UAE, and Rest of the Middle East & Africa. South Africa is a prominent contributor to the market in this region. According to the Global Wind Energy Council, South Africa installed 515 MW of new wind power capacity in 2020. Senegal ranked second for new capacity established in 2020 by installing 103 MW of wind power capacity, followed by Morocco (92 MW), Jordan (52 MW), Iran (45 MW), and Egypt (13 MW), respectively. In 2020, Senegal inaugurated West Africa’s first large-scale wind farm, which will supply nearly a sixth of the country’s power requirements after reaching full capacity. With this wind farm, the country is expected to derive 30% of its energy from renewable sources. Saudi Arabia is also taking various initiatives for the development of its renewable energy sector. Such efforts by different country governments favor the growth of the wind turbine lubricants market in the Middle East & Africa.

Strategic insights for the Middle East & Africa Wind Turbine Lubricant provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Wind Turbine Lubricant refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Wind Turbine Lubricant Strategic Insights

Middle East & Africa Wind Turbine Lubricant Report Scope

Report Attribute

Details

Market size in 2022

US$ 2.71 Million

Market Size by 2028

US$ 4.13 Million

Global CAGR (2022 - 2028)

7.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Base Oil

By Product Type

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Wind Turbine Lubricant Regional Insights

Middle East & Africa Wind Turbine Lubricant Market Segmentation

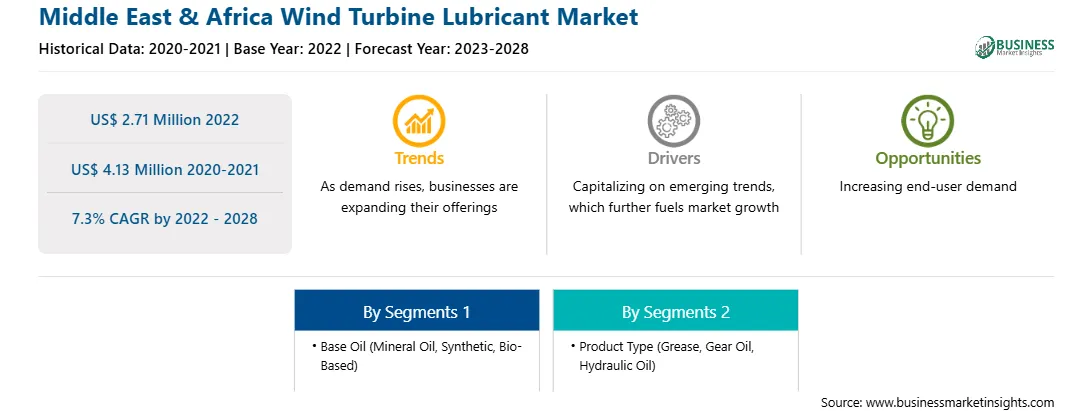

The Middle East & Africa wind turbine lubricant market is segmented into base oil, product type, and country.

Based on base oil, the Middle East & Africa wind turbine lubricant market is segmented into mineral oil, synthetic, and bio-based. The synthetic oil segment held the largest share of the Middle East & Africa wind turbine lubricant market in 2022.

Based on product type, the Middle East & Africa wind turbine lubricant market is segmented into grease, gear oil, hydraulic oil, and others. The gear oil segment held the largest share of the Middle East & Africa wind turbine lubricant market in 2022.

Based on country, the Middle East & Africa wind turbine lubricant Market is segmented into the Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa wind turbine lubricant market in 2022.

TotalEnergies SE, BP Plc, Phillips 66, Amsoil Inc, Chevron Corp, Exxon Mobil Corp, Fuchs Petrolub SE, Kluber Lubrication GmbH & Co KG, Shell plc, The Lubrizol Corp, and Afton Chemical Corp are some of the leading companies operating in the Middle East & Africa wind turbine lubricant market.

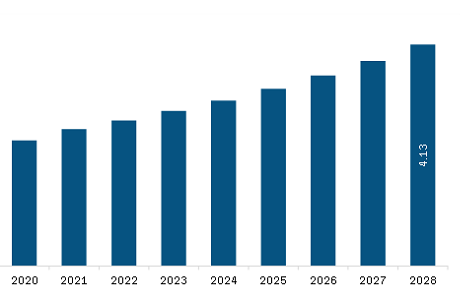

The Middle East & Africa Wind Turbine Lubricant Market is valued at US$ 2.71 Million in 2022, it is projected to reach US$ 4.13 Million by 2028.

As per our report Middle East & Africa Wind Turbine Lubricant Market, the market size is valued at US$ 2.71 Million in 2022, projecting it to reach US$ 4.13 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The Middle East & Africa Wind Turbine Lubricant Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Wind Turbine Lubricant Market report:

The Middle East & Africa Wind Turbine Lubricant Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Wind Turbine Lubricant Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Wind Turbine Lubricant Market value chain can benefit from the information contained in a comprehensive market report.