Wind tunnel experiments are being widely used by architects, engineers, and aerodynamicists to assess a broad range of structures, such as buildings, vehicles, and aircraft designs. The existing wind tunnel types used across multiple industries are low subsonic, transonic, supersonic, and hypersonic, based on the amount of wind speed they can produce. However, physical wind tunnels are being replaced by wind tunnel simulation in aerodynamic testing. Its primary use is to visualize air flows around an object to assess its aerodynamics. The simulator assists design engineers by optimizing lifting and dragging, detecting and eliminating high wind speed zones, increasing top speed, and reducing wind noise, thereby optimizing automotive, aerospace, and construction planning operations. Wind tunnel simulation results in elevated prototyping and manufacturing lead times, operational costs, and computational fluid dynamics (CFD) simulations, allowing engineers to study the aerodynamic loads and reduce the inaccuracies in wind tunnel test experiments.

Cloud-based simulation allows the user to run simulations in parallel to test multiple design iterations at the same time or investigate different aspects of a design simultaneously. Several prominent simulation providers and wind testing companies offer a range of advanced cloud-based wind tunnel solutions to meet the rising requirements of aerodynamics testing in multiple industries. Altair introduced HyperWorks Virtual Wind Tunnel, which is a vertical application designed to improve wind tunnel simulation for the automotive industry. The virtual tunnel provides a friendly, intuitive user environment and an auto-setup process. Additionally, the simulation results can be incorporated with the high-performance computing systems from within the HyperWorks Virtual Wind Tunnel environment. Koenigsegg, a renowned manufacturer of high-performance supercars, uses the ICON simulation software on a cloud-based-HPC system to reduce wind tunnel testing duration and processes. Simulation allows the company’s designers to access powerful computing resources remotely, reducing hardware expenses and maintenance costs. Therefore, the transformation of physical wind tunnels toward their virtual counterparts is paving the way for future MEA wind tunnel market trends.

With the new features and technologies, vendors attract new customers and expand their footprints in emerging markets. This factor is driving the growth of the MEA wind tunnel market and is expected to grow at a significant CAGR during the forecast period.

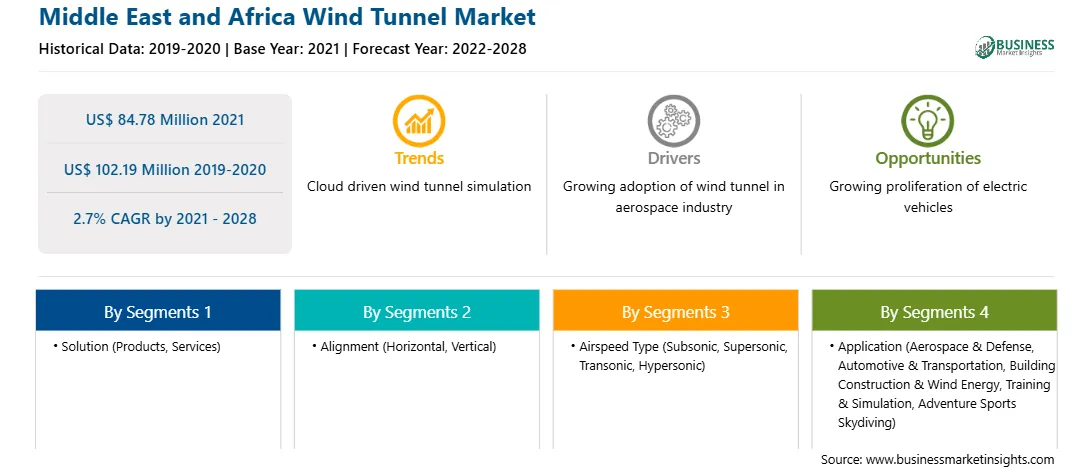

The MEA wind tunnel market is analyzed on the basis of solution, alignment, airspeed type, application, and country. Based on the solution, the market is bifurcated into services and products. The services segment is expected to continue its dominance during the forecast period. Wind tunnels' reduced operation & maintenance (O&M) costs and the easy availability of technical installation and maintenance drive the segment's growth. Based on alignment type, the market is bifurcated into horizontal and vertical segments. The horizontal segment accounted for a larger market share in 2020 and is expected to continue its dominance. Based on airspeed type, the market is segmented into subsonic, supersonic, transonic, and hypersonic. The subsonic segment held the largest market share in 2020. The rising demand for commercial aircraft and automotive testing services is the primary factor responsible for the growth of this segment. Based on application, the market is segmented into aerospace and defense, automotive and transportation, building construction and wind energy, training and simulation, adventure sports skydiving, and others. The aerospace and defense segment held the largest market share in 2020 and is expected to continue its dominance during the forecast period. The increased usage of wind tunnels for testing aircraft used for aerospace and defense applications is a major factor responsible for the segment's growth. Based on country, the market is segmented into Saudi Arabia, South Africa, the UAE, and the rest of the MEA. Furthermore, Aerolab; Boeing; Horiba Ltd; Lockheed Martin Corporation; Mahle GmbH; Mitsubishi Heavy Industries, Ltd; and RUAG are among the leading companies in the MEA wind tunnel market.

Strategic insights for the Middle East and Africa Wind Tunnel provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 84.78 Million |

| Market Size by 2028 | US$ 102.19 Million |

| Global CAGR (2021 - 2028) | 2.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Wind Tunnel refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa Wind Tunnel Market is valued at US$ 84.78 Million in 2021, it is projected to reach US$ 102.19 Million by 2028.

As per our report Middle East and Africa Wind Tunnel Market, the market size is valued at US$ 84.78 Million in 2021, projecting it to reach US$ 102.19 Million by 2028. This translates to a CAGR of approximately 2.7% during the forecast period.

The Middle East and Africa Wind Tunnel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Wind Tunnel Market report:

The Middle East and Africa Wind Tunnel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Wind Tunnel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Wind Tunnel Market value chain can benefit from the information contained in a comprehensive market report.