Growth of Cosmetics and Personal Care Industry

Evolving lifestyles of consumers, rising purchasing power in several countries, and quickening development of multifunctional personal care ingredients are the major factors contributing to the flourishment of the cosmetics and personal care industry. There is a huge need for high-quality ingredients, such as white oil. White oil aids the easy blending of personal care and cosmetic products. Moreover, because of its inertness it has application in cosmetic formulations as it resists moisture, maintains smoothness of the products. The elevated consumer demand for different cosmetic products can be associated with the high disposable incomes of people in this country, the growing inclination toward self-care products, and the ability of social media to enhance the customer reach of products. Moreover, people are increasingly embracing online platforms to purchase their cosmetics and skincare products. Furthermore, improving socioeconomic standards, and large-scale development of digital and manufacturing sectors are further benefitting the cosmetic industry in the country. Therefore, with the growth of the cosmetics and personal care industry, the demand for white oil is also increasing.

Market Overview

South Africa, Saudi Arabia, UAE, and rest of MEA are the key contributors to the white oil market in the Middle East & Africa. The production of food-grade lubricants and greasers, as well as the application of white mineral oil in baking pan oils and food packaging materials, are all common uses for this oil in the food industry. White mineral oil is also preferred in many culinary operations. The food and beverage (F&B) industry is driven by factors, including population expansion, high GDP per capita, and increasing tourist numbers, which have increased the chances for the growth of the Middle East & Africa white oil market in the region. White oil is also perfect for food additives because of its beneficial characteristics. According to estimates, chances for the expansion of the white oil industry would arise from increased food production and consumption in the region. Food consumption, for instance, is predicted to rise by 2.3% by 2025, reaching 52.4 million metric tonnes, according to Alpen Capital, a financial company in the UAE, with a larger focus on domestic production. Due to their greater populations, Saudi Arabia and the UAE utilized 46.8 million metric tons of food in the Gulf Cooperation Council (GCC) in 2021, accounting for 77.9%.Moreover, Israel's healthcare technology market is estimated to be worth US$ 6.2 billion by the International Trade Administration, of which US$ 2.4 billion goes to pharmaceuticals, and US$ 3.8 billion goes to devices, with imports accounting for more than 65% of the device market and 60% of the pharmaceutical market, respectively. White oil is frequently used in the pharmaceutical industry to create products, such as balm, creams, lotions, ointments, vaccinations, and others. The food processing industry employs white oil as a food lubricant on a large scale to increase the shelf life of food. Therefore, the growing demand for pharmaceutical products, packaging, processed food, and trade of agriculture products, which require food lubricants, packaging, and others composed of white oil, will boost the MEA white oil market in the region during the forecast period.

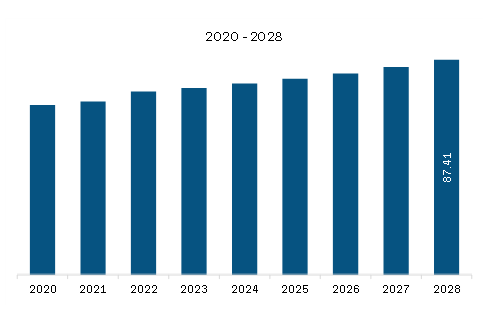

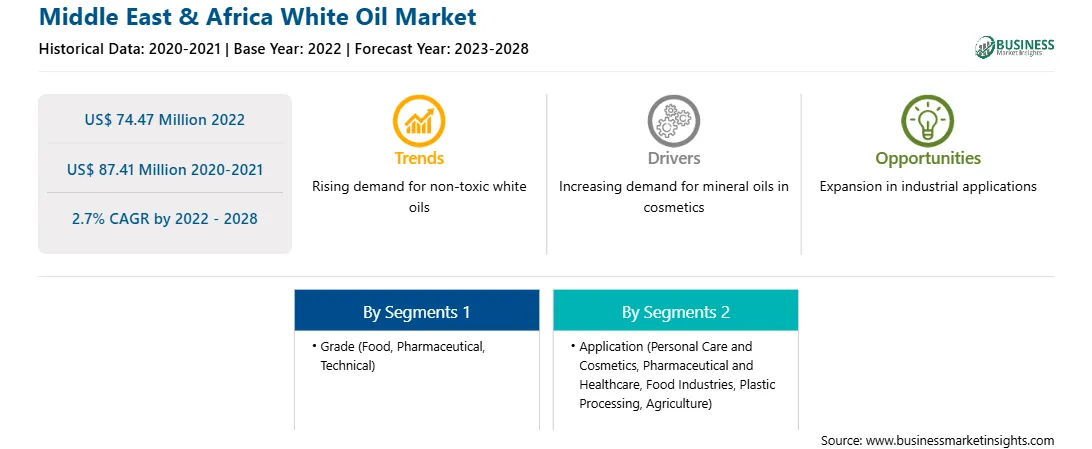

The white oil market in Middle East & Africa is expected to grow from US$ 74.47 million in 2022 to US$ 87.41 million by 2028. It is estimated to grow at a CAGR of 2.7% from 2022 to 2028.

Growth of Cosmetics and Personal Care Industry

Evolving lifestyles of consumers, rising purchasing power in several countries, and quickening development of multifunctional personal care ingredients are the major factors contributing to the flourishment of the cosmetics and personal care industry. There is a huge need for high-quality ingredients, such as white oil. White oil aids the easy blending of personal care and cosmetic products. Moreover, because of its inertness it has application in cosmetic formulations as it resists moisture, maintains smoothness of the products. The elevated consumer demand for different cosmetic products can be associated with the high disposable incomes of people in this country, the growing inclination toward self-care products, and the ability of social media to enhance the customer reach of products. Moreover, people are increasingly embracing online platforms to purchase their cosmetics and skincare products. Furthermore, improving socioeconomic standards, and large-scale development of digital and manufacturing sectors are further benefitting the cosmetic industry in the country. Therefore, with the growth of the cosmetics and personal care industry, the demand for white oil is also increasing.

Market Overview

South Africa, Saudi Arabia, UAE, and rest of MEA are the key contributors to the white oil market in the Middle East & Africa. The production of food-grade lubricants and greasers, as well as the application of white mineral oil in baking pan oils and food packaging materials, are all common uses for this oil in the food industry. White mineral oil is also preferred in many culinary operations. The food and beverage (F&B) industry is driven by factors, including population expansion, high GDP per capita, and increasing tourist numbers, which have increased the chances for the growth of the Middle East & Africa white oil market in the region. White oil is also perfect for food additives because of its beneficial characteristics. According to estimates, chances for the expansion of the white oil industry would arise from increased food production and consumption in the region. Food consumption, for instance, is predicted to rise by 2.3% by 2025, reaching 52.4 million metric tonnes, according to Alpen Capital, a financial company in the UAE, with a larger focus on domestic production. Due to their greater populations, Saudi Arabia and the UAE utilized 46.8 million metric tons of food in the Gulf Cooperation Council (GCC) in 2021, accounting for 77.9%.Moreover, Israel's healthcare technology market is estimated to be worth US$ 6.2 billion by the International Trade Administration, of which US$ 2.4 billion goes to pharmaceuticals, and US$ 3.8 billion goes to devices, with imports accounting for more than 65% of the device market and 60% of the pharmaceutical market, respectively. White oil is frequently used in the pharmaceutical industry to create products, such as balm, creams, lotions, ointments, vaccinations, and others. The food processing industry employs white oil as a food lubricant on a large scale to increase the shelf life of food. Therefore, the growing demand for pharmaceutical products, packaging, processed food, and trade of agriculture products, which require food lubricants, packaging, and others composed of white oil, will boost the MEA white oil market in the region during the forecast period.

Strategic insights for the Middle East & Africa White Oil provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 74.47 Million |

| Market Size by 2028 | US$ 87.41 Million |

| Global CAGR (2022 - 2028) | 2.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Grade

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa White Oil refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa White oil market Segmentation

The Middle East & Africa white oil market is segmented into grade, application, and country.

Based on grade, the market is segmented into food, pharmaceutical, and technical. The pharmaceutical segment registered the largest market share in 2022.

Based on application, the market is segmented into personal care and cosmetics, pharmaceutical and healthcare, food industries, plastic processing, agriculture, and others. The personal care and cosmetics segment held a largest market share in 2022.

Based on country, the market is segmented into South Africa, Saudi Arabia, UAE, and rest of Middle East & Africa. UAE dominated the market share in 2022.

Calumet Specialty Product Partners, L.P.; Chevron Corporation; EXXON Mobil Corporation; Petro-Canada Lubricants Inc; APAR; Sasol; Sonneborn LLC; and H&R GROUP are the leading companies operating in the white oil market in the Middle East & Africa.

Middle East & Africa White oil market Segmentation

The Middle East & Africa white oil market is segmented into grade, application, and country.

Based on grade, the market is segmented into food, pharmaceutical, and technical. The pharmaceutical segment registered the largest market share in 2022.

Based on application, the market is segmented into personal care and cosmetics, pharmaceutical and healthcare, food industries, plastic processing, agriculture, and others. The personal care and cosmetics segment held a largest market share in 2022.

Based on country, the market is segmented into South Africa, Saudi Arabia, UAE, and rest of Middle East & Africa. UAE dominated the market share in 2022.

Calumet Specialty Product Partners, L.P.; Chevron Corporation; EXXON Mobil Corporation; Petro-Canada Lubricants Inc; APAR; Sasol; Sonneborn LLC; and H&R GROUP are the leading companies operating in the white oil market in the Middle East & Africa.

The Middle East & Africa White Oil Market is valued at US$ 74.47 Million in 2022, it is projected to reach US$ 87.41 Million by 2028.

As per our report Middle East & Africa White Oil Market, the market size is valued at US$ 74.47 Million in 2022, projecting it to reach US$ 87.41 Million by 2028. This translates to a CAGR of approximately 2.7% during the forecast period.

The Middle East & Africa White Oil Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa White Oil Market report:

The Middle East & Africa White Oil Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa White Oil Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa White Oil Market value chain can benefit from the information contained in a comprehensive market report.