Wheat flour is a powder prepared by the grinding of wheat used for human consumption. Wheat variations are called "soft" or "weak" if the gluten content is low, and are known as "hard" or "strong" containing high gluten content. With the development of food processing technologies and an increase in the demand for vegan products, the wheat flour market has experienced tremendous growth during the past years. Gluten is a naturally occurring element in the wheat. It's the protein that is responsible for the shape of the baked goods. Glutens develop to be more elastic when the dough is kneaded.

Strategic insights for the Middle East and Africa Wheat Flour provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

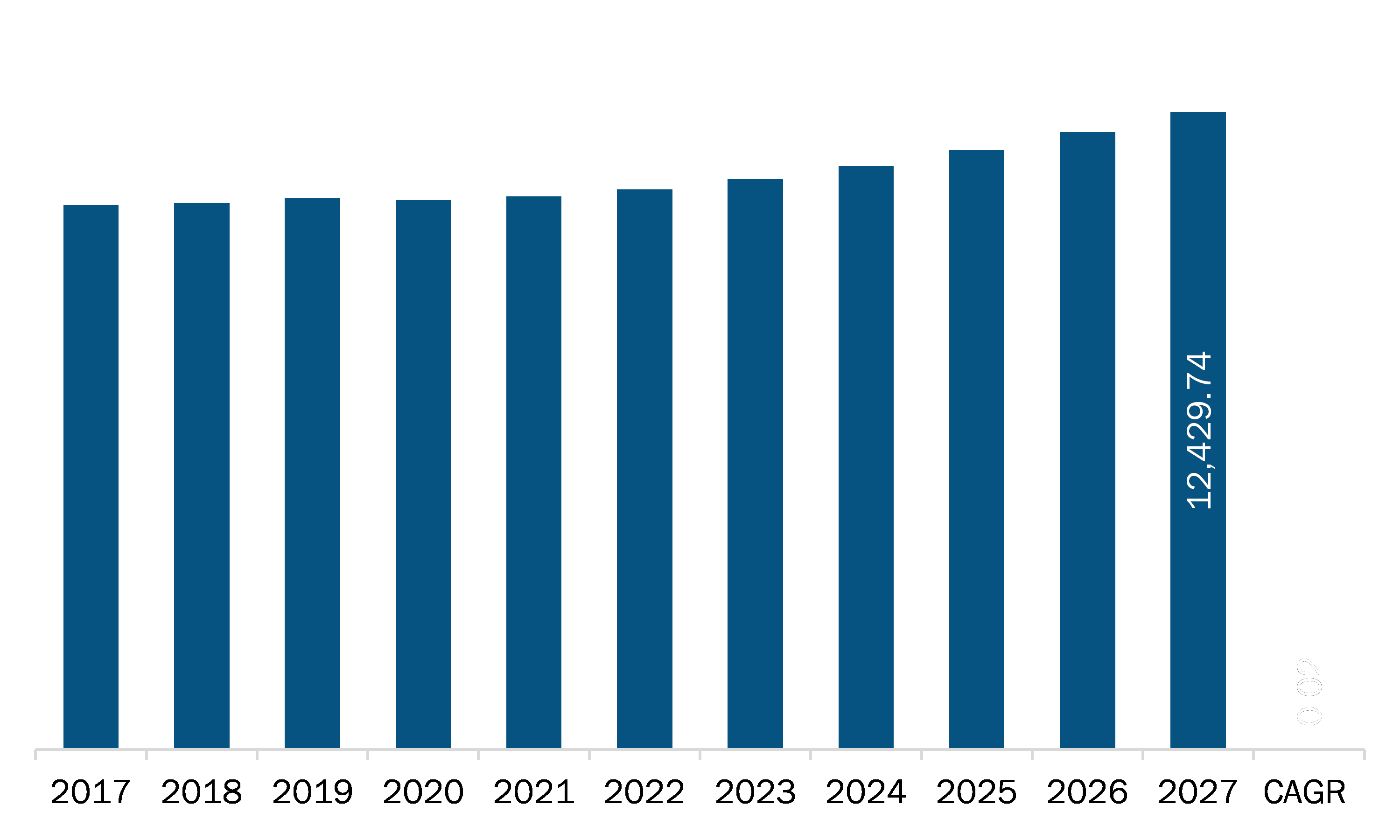

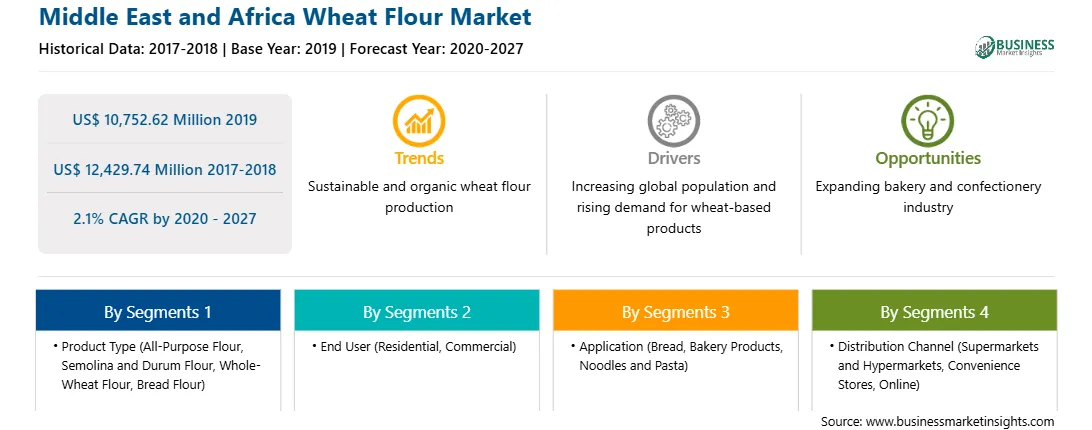

| Market size in 2019 | US$ 10,752.62 Million |

| Market Size by 2027 | US$ 12,429.74 Million |

| Global CAGR (2020 - 2027) | 2.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Wheat Flour refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The wheat flour market in MEA is expected to reach US$ 12,429.74 million by 2027 from US$ 10,752.62 million in 2019 and is expected to grow at a CAGR of 2.1% from 2020 to 2027. Surging demand for organic form of wheat flour is bolstering the growth of the wheat flour market in MEA. The organic form of wheat flour is cultivated without the incorporation of artificial fertilizers or harmful chemicals, pesticides and synthetic fertilizers. Currently, the demand for organic wheat flour is rising rapidly among western nations due to the growing trend of healthy lifestyle. The importance of organic farming has been understood with the wake of alarming health issues caused by harmful synthetic additives and chemicals. The organic form of wheat flour allows retention of essential nutrients without hampering the nutritional aspect of the product. The use of chemicals and fertilizers in conventional form of wheat flour mostly affects the health aspect and nutrient level. Consumers are increasingly seeking pure, organic, and highest quality food products, which, in turn, drives the demand for organic wheat flour. In terms of nutritional aspects, organic wheat flour is a rich source of vitamins, proteins, minerals, and fibers, and it is being extensively demanded in the preparation of cookies, pastries, muffins, and other bakery products. Growing population demanding more healthy food options, along with rising disposable income, has fueled the demand for organic form of wheat flour. The well-established nations South Africa and Saudi Arabia are experiencing massive growth in organic food. Moreover, favorable government regulations to promote organic wheat flour in the market are expected to fuel market growth.

However, COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Saudi Arabia has the largest COVID-19 cases in the Middle East and Africa region, and is followed by South Africa and UAE, among others. UAE was the first country in Middle East and Africa to report a confirmed case of coronavirus. Due to lockdown in Middle East and African countries, the fast food outlets, hotel and restaurants remain closed which led to the reduction in the retail sales of fast foods like burger, pasta & pizzas which has negatively impacted the market for wheat flour indirectly in the region.

The MEA wheat flour market is segmented into product type, end user, application, and distribution channel. Based on product type, the MEA wheat flour market is categorized into all-purpose flour, semolina and durum flour, whole-wheat flour, bread flour, and others. The bread flour segment dominated the market of the total market share during the forecast period whereas the whole-wheat flour segment is expected to register the fastest growth rate during the forecast period. Based on end user, the MEA wheat flour market is categorized into residential and commercial. In 2019, the MEA wheat flour market was dominated by the commercial segment. The application segment of MEA wheat flour market is sub-segmented into bread, bakery products, noodles and pasta, and others. The MEA wheat flour market was dominated by the bread segment. The MEA wheat flour market based on distribution channels has been segmented into hypermarkets and supermarkets, convenience stores, online, and others. The supermarket and hypermarket segment held a substantial market share during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the wheat flour market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Archer-Daniels-Midland Company, Acarsan Holding, General Mills Inc., George Weston Foods Limited, and KORFEZ Flour Group among others.

The List of Companies - Middle East and Africa Wheat Flour Market

The Middle East and Africa Wheat Flour Market is valued at US$ 10,752.62 Million in 2019, it is projected to reach US$ 12,429.74 Million by 2027.

As per our report Middle East and Africa Wheat Flour Market, the market size is valued at US$ 10,752.62 Million in 2019, projecting it to reach US$ 12,429.74 Million by 2027. This translates to a CAGR of approximately 2.1% during the forecast period.

The Middle East and Africa Wheat Flour Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Wheat Flour Market report:

The Middle East and Africa Wheat Flour Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Wheat Flour Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Wheat Flour Market value chain can benefit from the information contained in a comprehensive market report.