The growth of the population, combined with a looming water crisis, is moving the Earth toward a major food crisis. The impact of climate change is variable and unpredictable, thereby adding pressure on the food system. For example, higher CO2 levels increase some crop yields but reduce their nutritional values. Further, warmer temperatures lead to the growth of many new pests and weeds. In addition, extreme temperatures lead to droughts or excessive rainfall, thereby preventing crops from growing. Vertical farming can be part of the solution as it uses less water and allows farmers to control the climate needed for the crops. For instance, the UAE is building the world's largest indoor farm. The country's dry climate, low soil quality, and occasional locust plagues make indoor farming a more economical and feasible alternative. Vertical farms do not use soil for farming. They use little water (compared to traditional agricultural practices) and a combination of natural and artificial lighting. Also, the manufacturers' strategic activities are further driving the adoption of vertical farming. For instance, companies such as Signify and Valoya are developing better lighting solutions, resulting in a decrease in the costs of running a vertical farm.

Saudi Arabia had the highest COVID-19 cases in the MEA region and is followed by Turkey and the UAE. The UAE was the first country in the Middle East and Africa to report a confirmed case of COVID-19. However, support by the government during the COVID-19 outbreak will offer opportunities in the region. For instance, in October 2020, FAO launched a pioneering project to provide capacity building and technical support for Jordan's Integrated Agri-Aquaculture (IAA) farming systems. The project was designed to train unemployed agricultural engineer graduates and farmers, set up a knowledge base, and research “Hydroponics and Aquaponics” farming units. Furthermore, it aimed to support youth and women's employment by creating employment opportunities in aquaponics and hydroponics.

Vendors can attract new customers and expand their footprints in emerging markets with the new features and technologies, thereby driving the Middle East & Africa vertical farming crops market. The Middle East & Africa vertical farming crops market is expected to grow at a significant CAGR during the forecast period.

Strategic insights for the Middle East and Africa Vertical Farming Crops provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 19.12 Million |

| Market Size by 2028 | US$ 66.00 Million |

| Global CAGR (2021 - 2028) | 19.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Crop Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Vertical Farming Crops refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

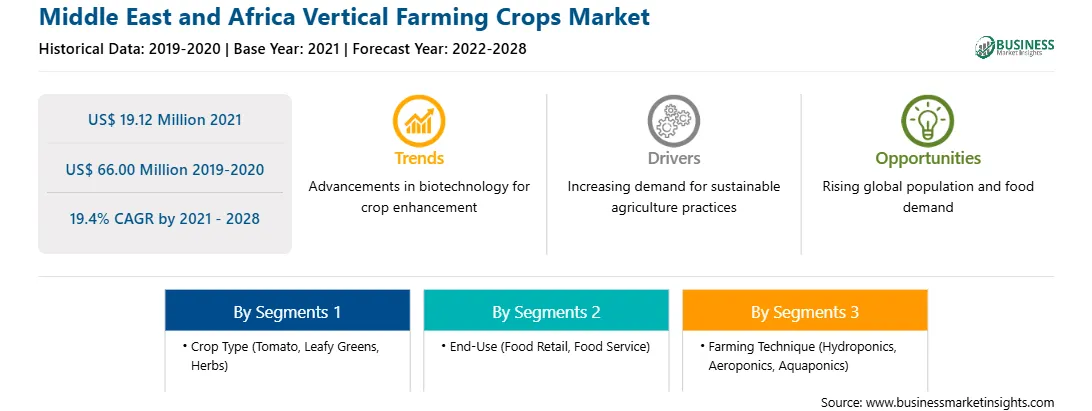

The Middle East and Africa Vertical Farming Crops Market is valued at US$ 19.12 Million in 2021, it is projected to reach US$ 66.00 Million by 2028.

As per our report Middle East and Africa Vertical Farming Crops Market, the market size is valued at US$ 19.12 Million in 2021, projecting it to reach US$ 66.00 Million by 2028. This translates to a CAGR of approximately 19.4% during the forecast period.

The Middle East and Africa Vertical Farming Crops Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Vertical Farming Crops Market report:

The Middle East and Africa Vertical Farming Crops Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Vertical Farming Crops Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Vertical Farming Crops Market value chain can benefit from the information contained in a comprehensive market report.