The MEA is projected to witness a swift growth in industrialization in the coming years. The Gulf countries are economically advanced, while the African countries are yet to match the economic status of the Gulf countries, such as the UAE and Saudi Arabia, due to lack of supporting infrastructure. At present, the Gulf countries are on the verge of adopting advanced HVAC systems. Growing population, rising middle-class income, and increasing efforts to motivate businesses other than oil & gas industries are among the factors that will provide ample growth opportunities to the unit heater market players in the MEA. Although the demand for HVAC system is low in the region, it is likely to surge with growing investments in the commercial and industrial construction sector in the coming years. Advances in design complements modern infrastructure is the major factor driving the growth of the MEA unit heater market.

The MEA unit heaters market is affected owing to disruption of the supply chain. Moreover, the closure of borders of countries, the supply chain of several components and parts have been disturbed. The demand for HVAC systems and unit heaters has been hit since the emergence of COVID-19 in the region. This has led to a loss of business among the HVAC systems and unit heaters manufacturers. Countries with higher manufacturing units such as Israel, Turkey, and South Africa, among others have witnessed critical scenarios in procuring various raw materials in 2020. Further, the construction activity in the region is among the rapidly growing industry. The UAE, Saudi Arabia, and Qatar, represent the forerunners in the GCC construction industry. The outbreak of COVID-19 virus had paused several construction activities in the countries mentioned above in 2020. However, from the Q1 of 2021, the market players experienced growth in adoption of unit heaters in MEA.

Strategic insights for the Middle East and Africa Unit Heater provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

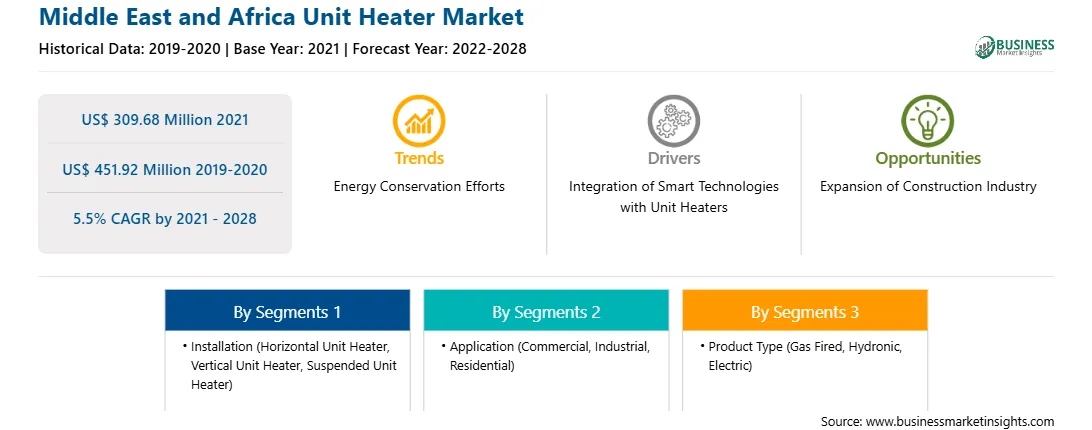

| Market size in 2021 | US$ 309.68 Million |

| Market Size by 2028 | US$ 451.92 Million |

| Global CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Installation

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Unit Heater refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The unit heater market in MEA is expected to grow from US$ 309.68 million in 2021 to US$ 451.92 million by 2028; it is estimated to grow at a CAGR of 5.5% from 2021 to 2028. Major unit heater manufacturers are focusing on offering energy-efficient products that offer optimal heating, exhibit low maintenance and operational costs, and operate with decreased emission levels. For instance, Modine Manufacturing Company launched a new unit heater named Affinity, which features a dual heat exchanger, power exhauster, and separated combustion chamber, thereby emitting less CO2 levels and increases the overall heating efficiency. Rising demand for low-noise operations, integration of electric heaters with solar panels, growing use of sensors to automatically adjust the temperature, and elevated efficiency at lower costs are the factors driving the growth of the unit heaters market. The manufacturers are focusing on the implementation of new motor designs with low-noise fans, and the integration of thermostat, remote control option, and screen display in unit heaters. Further, increase in demand for energy-efficient equipment in the food & beverages, manufacturing, chemicals, pharmaceutical, oil & gas, and other sectors is boosting the unit heater market growth.

The MEA unit heater market is segmented on the basis of installation, application product type, and country. By installation, the MEA unit heater market is bifurcated into horizontal unit heater, vertical unit heater, and suspended unit heater. The horizontal unit heater segment dominated the market in 2020 and vertical unit heater segment is expected to be the fastest growing during the forecast period. On the basis of application, the unit heater market is segmented into commercial, industrial, and residential. The commercial segment dominated the market and industrial segment is expected to be the fastest growing during the forecast period. On the basis of product type, the unit heater market is segmented into gas fired, hydronic, electric, and others. The hydronic segment dominated the market and electric segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the unit heater market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Armstrong International Inc.; Dunham-Bush Limited; Kroll Energy GmbH; Reznor HVAC; Thermon Industries, Inc.; and Trane are among others.

The Middle East and Africa Unit Heater Market is valued at US$ 309.68 Million in 2021, it is projected to reach US$ 451.92 Million by 2028.

As per our report Middle East and Africa Unit Heater Market, the market size is valued at US$ 309.68 Million in 2021, projecting it to reach US$ 451.92 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The Middle East and Africa Unit Heater Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Unit Heater Market report:

The Middle East and Africa Unit Heater Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Unit Heater Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Unit Heater Market value chain can benefit from the information contained in a comprehensive market report.