Middle East & Africa Uninterrupted Power Supply Market

No. of Pages: 103 | Report Code: BMIRE00031121 | Category: Electronics and Semiconductor

No. of Pages: 103 | Report Code: BMIRE00031121 | Category: Electronics and Semiconductor

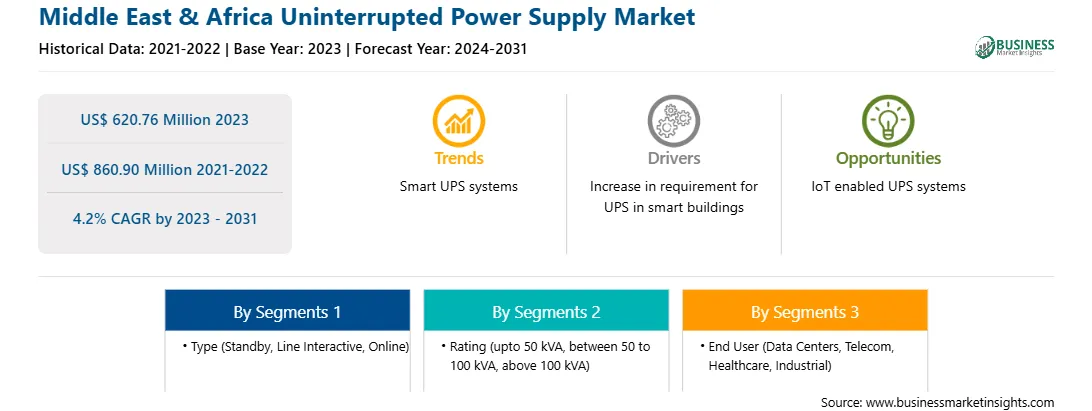

The Middle East & Africa uninterrupted power supply market was valued at US$ 620.76 million in 2023 and is expected to reach US$ 860.90 million by 2031; it is estimated to register a CAGR of 4.2% from 2023 to 2031.

The principal advantages of an uninterruptible power supply in a data center are that it supplements primary power source failures and protects sensitive technology from dangerous electrical surges. Uninterruptible power supply (UPS) solutions such as smart capabilities can enable networked monitoring, centralized management, and optimized power demands. A standard UPS protects downtime throughout a data center's power infrastructure. Compared to legacy and standard units, smart UPS systems feature functions that simplify UPS management and reduce the mean time to recovery. A smart UPS can deliver real-time status updates, providing better insights into device health and performance. If a battery needs to be replaced, the system sends a notification. Smart UPS systems also enable more precise charge control and frequency and voltage regulation. This type of sophisticated battery management increases battery life and performance and reduces overall energy expenditures. You will not have to worry about overcharged batteries, and your equipment should receive a balanced degree of power protection, as well as evenly matched, conditioned, and controlled current without any oversight. Many major market players are introducing smart UPS systems in the market to capture the potential demand. For instance, in June 2022, Schneider Electric introduced the APC Smart-UPS Modular Ultra, the most sustainable uninterruptible power supply (UPS). This UPS offers customers more scalable power in the lowest footprint, freeing up space for essential IT or other equipment while increasing its time and minimizing the total cost of ownership. Schneider Electric's APC Smart-UPS Modular Ultra reinvents the single-phase modular UPS category to address changing customer demands for dispersed edge computing and hybrid IT environments.

The MEA uninterrupted power supply market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The market growth in the MEA is attributed to the growing industrial sector and rising urbanization. Owing to these factors, many manufacturers of UPS are increasing their presence in the Middle East & Africa. For instance, in 2024, Vertiv, a global provider of critical digital infrastructure and continuity solutions, announced the introduction of the Vertiv Liebert GXT5 Lithium-ion double-conversion online UPS system for 5 kVA–10 kVA Global Voltage (GV) (200V–240V; Default 230V) applications. The company will enhance its distribution in the Middle East & Africa to cater to the demand for UPS from the growing sectors in the region.

Strategic insights for the Middle East & Africa Uninterrupted Power Supply provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Uninterrupted Power Supply refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Uninterrupted Power Supply Strategic Insights

Middle East & Africa Uninterrupted Power Supply Report Scope

Report Attribute

Details

Market size in 2023

US$ 620.76 Million

Market Size by 2031

US$ 860.90 Million

Global CAGR (2023 - 2031)

4.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Rating

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Uninterrupted Power Supply Regional Insights

The Middle East & Africa uninterrupted power supply market is categorized into type, rating, end user, and country.

Based on type, the Middle East & Africa uninterrupted power supply market is segmented into standby, line interactive, and online. The online segment held the largest market share in 2023.

In terms of rating, the Middle East & Africa uninterrupted power supply market is categorized into upto 50 kVA, between 50 to 100 kVA, and above 100 kVA. The above 100 kVA segment held the largest market share in 2023.

By end user, the Middle East & Africa uninterrupted power supply market is segmented into data centers, telecom, healthcare, industrial, and others. The data centers segment held the largest market share in 2023.

Based on country, the Middle East & Africa uninterrupted power supply market is segmented into KSA, the UAE, South Africa, and the Rest of Middle East & Africa. KSA dominated the Middle East & Africa uninterrupted power supply market share in 2023.

Schneider Electric SE, ABB Ltd, Toshiba Corp, Cyber Power Systems (USA) Inc, Eaton Corp Plc, Emerson Electric Co, Delta Electronics Inc, Legrand SA, Mitsubishi Electric Corp, and Kehua Data Co Ltd. are some of the leading companies operating in the Middle East & Africa uninterrupted power supply market.

The Middle East & Africa Uninterrupted Power Supply Market is valued at US$ 620.76 Million in 2023, it is projected to reach US$ 860.90 Million by 2031.

As per our report Middle East & Africa Uninterrupted Power Supply Market, the market size is valued at US$ 620.76 Million in 2023, projecting it to reach US$ 860.90 Million by 2031. This translates to a CAGR of approximately 4.2% during the forecast period.

The Middle East & Africa Uninterrupted Power Supply Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Uninterrupted Power Supply Market report:

The Middle East & Africa Uninterrupted Power Supply Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Uninterrupted Power Supply Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Uninterrupted Power Supply Market value chain can benefit from the information contained in a comprehensive market report.