Middle East & Africa Type-C Tanks Market Forecast to 2030 - Regional Analysis - by Tank Type (Cylindrical, Bi-lobe, and Tri-lobe), Application (Cargo Tanks and Fuel Tanks), and End User (LNG, LPG, LH2, and Ethanol)

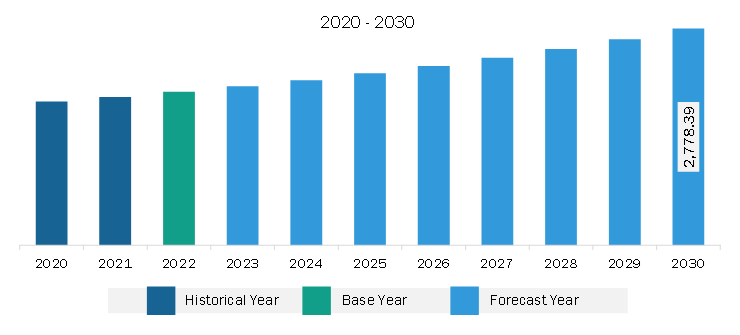

The Middle East & Africa Type-C tanks market was valued at US$ 1,966.47 million in 2022 and is expected to reach US$ 2,778.39 million by 2030; it is estimated to register at a CAGR of 4.4% from 2022 to 2030.

Growing Application of Liquified Natural Gas as a Marine Fuel Bolsters Middle East & Africa Type-C Tanks Market

Liquified Natural Gas (LNG) is a potential alternative marine fuel as it is less expensive than diesel and is also environmentally friendly. The cruise and shipping industries are highly accepting LNG as a marine fuel as natural gas burns more cleanly, requires less maintenance, and helps engines to operate better and longer. The increasing demand for energy is also boosting the need for liquefied gas carriers, barges, or bunkers. These include liquefied petroleum gas (LPG), liquefied ethane gas (LEG), and liquefied natural gas (LNG) vessels. As mentioned in the international code for the construction and equipment of ships carrying liquefied gases in bulk and the international code of safety for ships using gases or other low-flashpoint fuels, there are various categories of cargo containment systems, including independent type tanks Type A, Type B, and Type-C and membrane type systems. Type-C cargo tanks are also known as "pressure vessels." They are primarily designed and developed to meet the requirements of identified pressure vessel standards such as The American Society of Mechanical Engineers, Boiler and Pressure Vessel Code (ASME BPVC), which are supplemented by additional class society requirements and statutory regulations.

The adoption of the "Initial International Maritime Organization (IMO) Strategy on Reduction of Greenhouse Gas (GHG) Emissions from Ships" by IMO Resolution MEPC.304(72) in April 2018 shows IMO's commitment to support the Paris Agreement. The IMO strategy incorporates initial targets to lower the average carbon dioxide (CO2) emissions (as compared to 2008 levels) in the transportation sector by at least ~40% by 2030 and ~70% by 2050. LNG as a fuel is one of the viable alternatives to support IMO's 2030 CO2 reduction targets. The growing advent of LNG as a marine fuel boosts the usage of Type-C tanks in vessels, thereby driving the market.

Middle East & Africa Type-C tanks market Overview

According to IEA, the Middle East & Africa generates ~95% of its electricity from oil and gas. More than 290 billion cubic meters of gas, or more than one-third of the region's gas production, and 1.75 million barrels of oil per day are consumed by thermal plants in the region. The oil and gas producer economies of the Middle East & Africa rely heavily on fossil fuels, which raises the carbon intensity of their electricity generation by approximately a fifth compared to the global average. As a result, this region is expected to offer promising opportunities for opting for CCUS-EOR projects to achieve carbon neutrality. In May 2023, the Abu Dhabi National Oil Company (ADNOC) granted three contracts totaling US$ 4 billion to reduce carbon emissions and reach a production capacity of 5 million barrels per day by 2030. The contracts can cover ADNOC's onshore and offshore operations for five years with a two-year extension option. Thus, the growing adoption of carbon-neutral oil and gas production is expected to offer lucrative growth opportunities to the type-C tank market during the forecast period.

Middle East & Africa Type-C Tanks Market Revenue and Forecast to 2030 (US$ Million)

Middle East & Africa Type-C Tanks Market Segmentation

The Middle East & Africa Type-C tanks market is segmented based on tank type, application, end user, and country.

Based on tank type, the Middle East & Africa Type-C tanks market is segmented into cylindrical, bi-lobe, and tri-lobe. The cylindrical segment held the largest share in 2022.

In terms of application, the Middle East & Africa Type-C tanks market is bifurcated into cargo tanks and fuel tanks. The fuel tanks segment held a larger share in 2022.

By end user, the Middle East & Africa Type-C tanks market is segmented into LNG, LPG, LH2, and ethanol. The LNG segment held the largest share in 2022.

Based on country, the Middle East & Africa Type-C tanks market is categorized into South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa Type-C tanks market in 2022.

CRYOCAN Co, Linde Plc, IHI Corp, McDermott International Ltd, China Intonational Marine Containers (Group) Co Ltd, Furuise Europe Co SL, China Shipbuilding Trading Co Ltd, MAN Energy Solutions SE, Mitsubishi Heavy Industries Ltd, Broadview Energy Solutions BV, Transworld Equipment Corp, ISISAN AS, Wartsila Corp, Gloryholder Liquefied Gas Machinery Co Ltd, and TaylorWharton America Inc are some of the leading companies operating in the Middle East & Africa Type-C tanks market.

TABLE OF CONTENTS

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Middle East & Africa Type-C Tanks Market Landscape

4.1 Overview

4.2 Ecosystem Analysis

4.2.1 Raw Material Suppliers:

4.2.2 Type-C Tank Manufacturers:

4.2.3 End-users:

4.2.4 List of Type-C Tank Providers

5. Middle East & Africa Type-C Tanks Market - Key Market Dynamics

5.1 Middle East & Africa Type-C Tanks Market - Key Market Dynamics

5.2 Market Drivers

5.2.1 Growing Application of Liquified Natural Gas as a Marine Fuel

5.2.2 Structural Efficiency to Support Pressure Vessel Requirement

5.3 Market Restraints

5.3.1 High Cost of Type-C Tanks

5.4 Market Opportunities

5.4.1 Increasing Focus on Clean Energy

5.4.2 Growing Demand for Small-Scale Liquefied Gas

5.5 Future Trends

5.5.1 Rising Demand for Natural Gas from Several Industries

5.6 Impact of Drivers and Restraints:

6. Type-C Tanks Market - Middle East & Africa Market Analysis

6.1 Middle East & Africa Type-C Tanks Market Revenue (US$ Million), 2022-2030

6.2 Middle East & Africa Type-C Tanks Market Forecast Analysis

7. Middle East & Africa Type-C Tanks Market Analysis - by Tank Type

7.1 Cylindrical

7.1.1 Overview

7.1.2 Cylindrical: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

7.2 Bi-lobe

7.2.1 Overview

7.2.2 Bi-lobe: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

7.3 Tri-lobe

7.3.1 Overview

7.3.2 Tri-lobe: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

8. Middle East & Africa Type-C Tanks Market Analysis - by Application

8.1 Cargo Tanks

8.1.1 Overview

8.1.2 Cargo Tanks: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

8.2 Fuel Tanks

8.2.1 Overview

8.2.2 Fuel Tanks: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

9. Middle East & Africa Type-C Tanks Market Analysis - by End User

9.1 LNG

9.1.1 Overview

9.1.2 LNG: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

9.2 LPG

9.2.1 Overview

9.2.2 LPG: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

9.3 LH2

9.3.1 Overview

9.3.2 LH2: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

9.4 Ethanol

9.4.1 Overview

9.4.2 Ethanol: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

10. Middle East & Africa Type-C Tanks Market -Country Analysis

10.1 Middle East & Africa

10.1.1 Middle East & Africa: Type-C Tanks Market - Revenue and Forecast Analysis - by Country

10.1.1.1 Middle East & Africa: Type-C Tanks Market - Revenue and Forecast Analysis - by Country

10.1.1.2 Saudi Arabia: Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

10.1.1.2.1 Saudi Arabia: Type-C Tanks Market Breakdown, by Tank Type

10.1.1.2.2 Saudi Arabia: Type-C Tanks Market Breakdown, by Application

10.1.1.2.3 Saudi Arabia: Type-C Tanks Market Breakdown, by End User

10.1.1.3 United Arab Emirates: Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

10.1.1.3.1 United Arab Emirates: Type-C Tanks Market Breakdown, by Tank Type

10.1.1.3.2 United Arab Emirates: Type-C Tanks Market Breakdown, by Application

10.1.1.3.3 United Arab Emirates: Type-C Tanks Market Breakdown, by End User

10.1.1.4 South Africa: Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

10.1.1.4.1 South Africa: Type-C Tanks Market Breakdown, by Tank Type

10.1.1.4.2 South Africa: Type-C Tanks Market Breakdown, by Application

10.1.1.4.3 South Africa: Type-C Tanks Market Breakdown, by End User

10.1.1.5 Rest of Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

10.1.1.5.1 Rest of Middle East & Africa: Type-C Tanks Market Breakdown, by Tank Type

10.1.1.5.2 Rest of Middle East & Africa: Type-C Tanks Market Breakdown, by Application

10.1.1.5.3 Rest of Middle East & Africa: Type-C Tanks Market Breakdown, by End User

11. Competitive Landscape

11.1 Heat Map Analysis

11.2 Company Positioning & Concentration

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Product Development

12.4 Mergers & Acquisitions

13. Company Profiles

13.1 CRYOCAN Co

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Linde Plc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 IHI Corp

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 McDermott International Ltd

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 SWOT Analysis

13.4.5 Key Developments

13.5 China International Marine Containers (Group) Co Ltd

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Furuise Europe Co SL

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 China Shipbuilding Trading Co Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 MAN Energy Solutions SE

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Mitsubishi Heavy Industries Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Broadview Energy Solutions BV

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 Transworld Equipment Corp

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

13.12 ISISAN AS

13.12.1 Key Facts

13.12.2 Business Description

13.12.3 Products and Services

13.12.4 Financial Overview

13.12.5 SWOT Analysis

13.12.6 Key Developments

13.13 Wartsila Corp

13.13.1 Key Facts

13.13.2 Business Description

13.13.3 Products and Services

13.13.4 Financial Overview

13.13.5 SWOT Analysis

13.13.6 Key Developments

13.14 Gloryholder Liquefied Gas Machinery Co Ltd

13.14.1 Key Facts

13.14.2 Business Description

13.14.3 Products and Services

13.14.4 Financial Overview

13.14.5 SWOT Analysis

13.14.6 Key Developments

13.15 Taylor Wharton America Inc

13.15.1 Key Facts

13.15.2 Business Description

13.15.3 Products and Services

13.15.4 Financial Overview

13.15.5 SWOT Analysis

13.15.6 Key Developments

14. Appendix

14.1 About The Insight Partners

List of Tables

Table 1. Middle East & Africa Type-C Tanks Market Segmentation

Table 2. List of Vendors in Value Chain

Table 3. Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Table 4. Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million) - by Tank Type

Table 5. Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million) - by Application

Table 6. Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million) - by End User

Table 7. Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Country

Table 8. Saudi Arabia: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Tank Type

Table 9. Saudi Arabia: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Application

Table 10. Saudi Arabia: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by End User

Table 11. United Arab Emirates: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Tank Type

Table 12. United Arab Emirates: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Application

Table 13. United Arab Emirates: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by End User

Table 14. South Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Tank Type

Table 15. South Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Application

Table 16. South Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by End User

Table 17. Rest of Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Tank Type

Table 18. Rest of Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by Application

Table 19. Rest of Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million) - by End User

List of Figures

Figure 1. Middle East & Africa Type-C Tanks Market Segmentation, by Country

Figure 2. Impact Analysis of Drivers and Restraints

Figure 3. Middle East & Africa Type-C Tanks Market Revenue (US$ Million), 2022-2030

Figure 4. Middle East & Africa Type-C Tanks Market Share (%) - by Tank Type (2022 and 2030)

Figure 5. Cylindrical: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 6. Bi-lobe: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 7. Tri-lobe: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 8. Middle East & Africa Type-C Tanks Market Share (%) - by Application (2022 and 2030)

Figure 9. Cargo Tanks: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 10. Fuel Tanks: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 11. Middle East & Africa Type-C Tanks Market Share (%) - by End User (2022 and 2030)

Figure 12. LNG: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 13. LPG: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 14. LH2: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 15. Ethanol: Middle East & Africa Type-C Tanks Market - Revenue and Forecast to 2030 (US$ Million)

Figure 16. Middle East & Africa Type-C Tanks Market- Country, 2022 (US$ Million)

Figure 17. Middle East & Africa: Type-C Tanks Market Breakdown, by Key Countries, 2022 and 2030 (%)

Figure 18. Saudi Arabia: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million)

Figure 19. United Arab Emirates: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million)

Figure 20. South Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million)

Figure 21. Rest of Middle East & Africa: Type-C Tanks Market - Revenue and Forecast to 2030(US$ Million)

Figure 22. Company Positioning & Concentration

1. CRYOCAN Co

2. Linde Plc

3. IHI Corp

4. McDermott International Ltd

5. China Intonational Marine Containers (Group) Co Ltd

6. Furuise Europe Co SL

7. China Shipbuilding Trading Co Ltd

8. MAN Energy Solutions SE

9. Mitsubishi Heavy Industries Ltd

10. Broadview Energy Solutions BV

11. Transworld Equipment Corp

12. ISISAN AS

13. Wartsila Corp

14. Gloryholder Liquefied Gas Machinery Co Ltd

15. TaylorWharton America Inc

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa type-C tanks market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Middle East & Africa type-C tanks market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.