Middle East & Africa Trade Surveillance Systems Market

No. of Pages: 113 | Report Code: TIPRE00024731 | Category: Technology, Media and Telecommunications

No. of Pages: 113 | Report Code: TIPRE00024731 | Category: Technology, Media and Telecommunications

The Middle East & Africa trade surveillance market is segmented into Saudi Arabia, the UAE, South Africa, and Rest of MEA. With the rise in digitalization across the region and adoption of advanced and automated solutions across all industries, the demand for automated solutions across the financial market has surged over the years. The UAE Securities and Commodities Jurisdiction (SCA), which has the authority to impose regulations and norms for the Dubai Financial Market (DFM). DFM collaborates with the SCA to protect investors and provide the best trading platform including initiatives such as Margin Trading and Delivery v Payment (DVP) methods. Similarly, the Saudi government's financial regulating authority for Saudi Arabia's capital markets is the Capital Market Authority of Saudi Arabia (CMA). Setting and enforcing financial laws and regulations as well as promoting capital markets are among its tasks, which also include regulating the Tadawul, Saudi Arabia's stock exchange. The rise in governing bodies across the region and their constantly changing stringent rules and regulation with respect to security trading are expected to boost the growth of the Middle East & Africa trade surveillance market during the forecast period.

Turkey, the UAE, Morocco, Saudi Arabia, Kuwait, and Egypt are the main countries facing the impact of COVID-19 in the Middle East and Africa. Saudi Arabia's economy shrank by 7% in the second quarter, indicating how hard the latest coronavirus struck both the oil and non-oil industries, and unemployment reached a new high of 15.4%. The sudden spread of the pandemic resulted to a standstill in the economy and declined the technological investments of the companies across the region, thereby negatively impacting the adoption of trade surveillance systems. Financial markets, especially stock, bond, and commodity (including crude oil and gold) markets, have been severely impacted by the COVID-19 pandemics across the region. The failure to negotiate an OPEC+ agreement resulted in a collapse in crude oil prices and a stock market crash in March 2020, because of a reported Russia–Saudi Arabia oil price war. This negatively impacted the trading market thereby having adverse impact on trade surveillance systems market of the region. However, with the stability in the economy by the second quarter of 2020 and rising demand for cloud solutions across security trading firms to implement efficient remote working culture is creating demand for integration platform solutions to properly monitor the trading activities thereby contributing to the growth of the market over the long run across the region.

Strategic insights for the Middle East & Africa Trade Surveillance Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

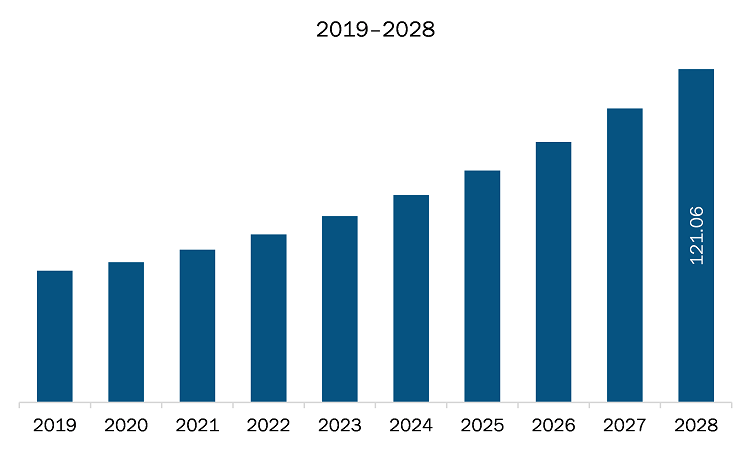

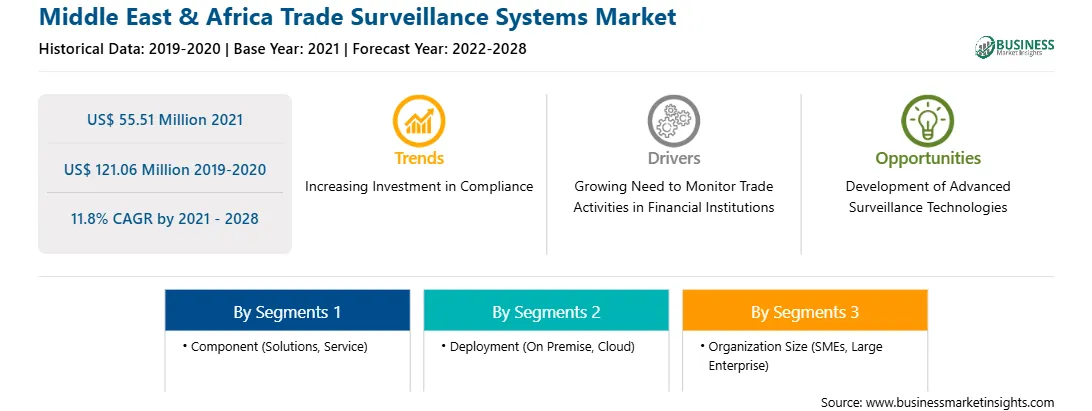

| Market size in 2021 | US$ 55.51 Million |

| Market Size by 2028 | US$ 121.06 Million |

| Global CAGR (2021 - 2028) | 11.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Trade Surveillance Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The trade surveillance systems market in Middle East & Africa is expected to grow from US$ 55.51 million in 2021 to US$ 121.06 million by 2028; it is estimated to grow at a CAGR of 11.8% from 2021 to 2028. Cloud-based trading operations are evolving rapidly because of the convenience of digitalization and quick accessibility. The growing number of cloud-based trading activities increases the requirement for trading surveillance. Cloud-based trade surveillance solutions are gaining more traction than on-premise trade surveillance systems because of its several advantages like scalability. Cloud-based platforms or solutions provide highly scalable performance and a stable environment for the development of trade surveillance solutions. Furthermore, Artificial Technology (AI) technology is used to forecast trends in the acquired data, providing for a standardized and efficient means of monitoring and surveillance of trade activities, as well as ensuring industry compliance. In addition, trade surveillance system providers are introducing new products or updating existing ones to adapt and supply cloud-based solutions. For instance, INTL FCStone, US security and commodities dealer, used Eventus Systems' new trade surveillance technology platform to monitor its global future activity in June 2019. Also, in the same year INTL FCStone announced its expansion operations and replaced its outsourced system with the cloud version of Eventus Systems' Validus market surveillance platform for increased cost efficiency and capabilities as a part of its recently announced expansion ambitions.

In terms of component, the solution segment accounted for the largest share of the Middle East & Africa trade surveillance systems market in 2020. Further, in terms of solution, the risk and compliance segment held a larger market share of the trade surveillance systems market in 2020. Similarly, in term of services, the professional services segment held a larger market share of the trade surveillance systems market in 2020. In terms of deployment, on the on premise segment held a larger market share of the trade surveillance systems market in 2020. In term of organization size, large enterprises segment held a larger market share of the trade surveillance systems market in 2020

A few major primary and secondary sources referred to for preparing this report on the trade surveillance systems market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ACA Group; SIA S.P.A.; CRISIL Limited; FIS Global; Nasdaq Inc; and Software AG among others.

The Middle East & Africa Trade Surveillance Systems Market is valued at US$ 55.51 Million in 2021, it is projected to reach US$ 121.06 Million by 2028.

As per our report Middle East & Africa Trade Surveillance Systems Market, the market size is valued at US$ 55.51 Million in 2021, projecting it to reach US$ 121.06 Million by 2028. This translates to a CAGR of approximately 11.8% during the forecast period.

The Middle East & Africa Trade Surveillance Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Trade Surveillance Systems Market report:

The Middle East & Africa Trade Surveillance Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Trade Surveillance Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Trade Surveillance Systems Market value chain can benefit from the information contained in a comprehensive market report.