Middle East & Africa Trade Credit Insurance Market

No. of Pages: 104 | Report Code: BMIRE00031130 | Category: Banking, Financial Services, and Insurance

No. of Pages: 104 | Report Code: BMIRE00031130 | Category: Banking, Financial Services, and Insurance

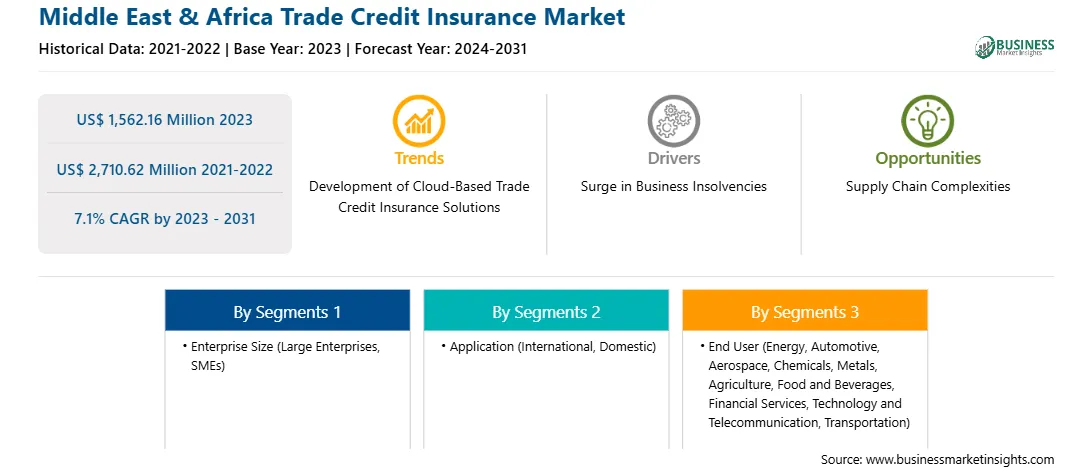

The Middle East & Africa trade credit insurance market was valued at US$ 1,562.16 million in 2023 and is expected to reach US$ 2,710.62 million by 2031; it is estimated to register a CAGR of 7.1% from 2023 to 2031.

Companies and associations in the trade credit insurance market are organizing various conferences and webinars to create awareness related to the impact of AI use on trade credit insurance. For instance, the International Credit Insurance & Surety Association (ICISA) organized the third edition of the ICISA Trade Credit Insurance Week from October 7 to 10, 2024. This global virtual event emphasized the crucial role that Trade Credit Insurance (TCI) plays in supporting businesses, especially SMEs, in today's rapidly evolving economic landscape. Several market players, policymakers, media, practitioners, other trade associations, and users participate in the webinar to create awareness regarding the impact of AI use on trade credit insurance. For example, Tinubu Square SA’s CEO and co-founder, Olivier Placca, participated in the ICISA Trade Credit Insurance Week 2023 webinar to address the usage and advantages of AI-based trade credit insurance solutions. This webinar mainly focuses on the transformative potential of AI-driven solutions in the market. Further, AI has the potential and capability to revolutionize the field of trade credit insurance underwriting. AI-based solutions ensure compliance with regulatory standards and generate relevant data to support users in optimizing processes with enhanced efficiency. Also, the ICISA Trade Credit Insurance Week 2023 webinar explored key topics such as advancing underwriting practices, harnessing data for informed decisions, enhancing operational efficiency, and navigating regulatory changes to create awareness about the positive impact of AI on the adoption of trade credit insurance worldwide. Hence, significant initiatives to promote AI use in trade credit insurance solutions are expected to create various opportunities in the trade credit insurance market during the forecast period.

The trade credit insurance market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The increasing cases of business insolvencies in the Middle East & Africa fuel the demand for trade credit insurance to protect themselves against financial risks. For instance, according to Allianz Trade, the insolvency rate in the region has increased by 44%, with countries such as Turkey and Poland observing growth of over 50% and 18%, respectively, in 2023. Trade credit insurance supports businesses in proper financing, improving cash flow and sales, identifying potential losses, and protecting them against financial risks. Thus, the growing cases of business insolvencies and rising awareness related to the significant benefits offered by trade credit insurance fuels the market growth.

Strategic insights for the Middle East & Africa Trade Credit Insurance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Trade Credit Insurance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Trade Credit Insurance Strategic Insights

Middle East & Africa Trade Credit Insurance Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,562.16 Million

Market Size by 2031

US$ 2,710.62 Million

Global CAGR (2023 - 2031)

7.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Enterprise Size

By Application

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Trade Credit Insurance Regional Insights

The Middle East & Africa trade credit insurance market is categorized into enterprise size, application, end user, and country.

Based on enterprise size, the Middle East & Africa trade credit insurance market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

In terms of application, the Middle East & Africa trade credit insurance market is bifurcated into international and domestic. The international segment held a larger market share in 2023.

By application, the Middle East & Africa trade credit insurance market is segmented into energy, automotive, aerospace, chemicals, metals, agriculture, food and beverages, financial services, technology and telecommunication, transportation, and others. The energy segment held the largest market share in 2023.

By country, the Middle East & Africa trade credit insurance market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa trade credit insurance market share in 2023.

Allianz Trade, American International Group Inc, Aon Plc, Atradius NV, Chubb Ltd, COFACE SA, QBE Insurance Group Ltd, and Zurich Insurance Group AG are some of the leading companies operating in the trade credit insurance market.

The Middle East & Africa Trade Credit Insurance Market is valued at US$ 1,562.16 Million in 2023, it is projected to reach US$ 2,710.62 Million by 2031.

As per our report Middle East & Africa Trade Credit Insurance Market, the market size is valued at US$ 1,562.16 Million in 2023, projecting it to reach US$ 2,710.62 Million by 2031. This translates to a CAGR of approximately 7.1% during the forecast period.

The Middle East & Africa Trade Credit Insurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Trade Credit Insurance Market report:

The Middle East & Africa Trade Credit Insurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Trade Credit Insurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Trade Credit Insurance Market value chain can benefit from the information contained in a comprehensive market report.