The tert butanol market in Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East and Africa. Strong economic growth in countries across the region is creating a platform for the growth and expansion of the market in the region. In comparison to other regions, coating consumption in the Middle East & Africa is low. However, as economies from the region continue to evolve, sales of coatings have increased substantially. Saudi Arabia is one of the major markets for paint and coatings in the region. Paint & coatings demand in the UAE has been steadily increasing due to the growing construction sector and rising demand from industrial segments. The automotive industry in South Africa is the most important manufacturing industry in the region. Moreover, growing demand for fragrance products drives the growth of the tert butanol market. A few players operating in the Middle East & Africa tert butanol market are Evonik Industries AG; LyondellBasell Industries Holdings B.V.; and Tokyo Chemical Industry Co., Ltd. With the growth of various end-use industries such as paint and coatings and many others in the region, the demand for tert butanol is expected to grow during the forecast period.

In the MEA region, the worse-affected countries Turkey, South Africa, Iraq, Israel, and others are among the major countries with high number of COVID-19 confirmed cases and deaths. According to International Finance Corporation, the COVID-19 pandemic has a severe impact upon the economy of the Middle East & Africa which has led to decline in oil production, tourism, and remittances. The MEA region comprises many growing economies, which are prospective markets for tert butanol vendors. The pandemic has significantly slowed down the growth of tert butanol market in the region.

Strategic insights for the Middle East and Africa Tert Butanol provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

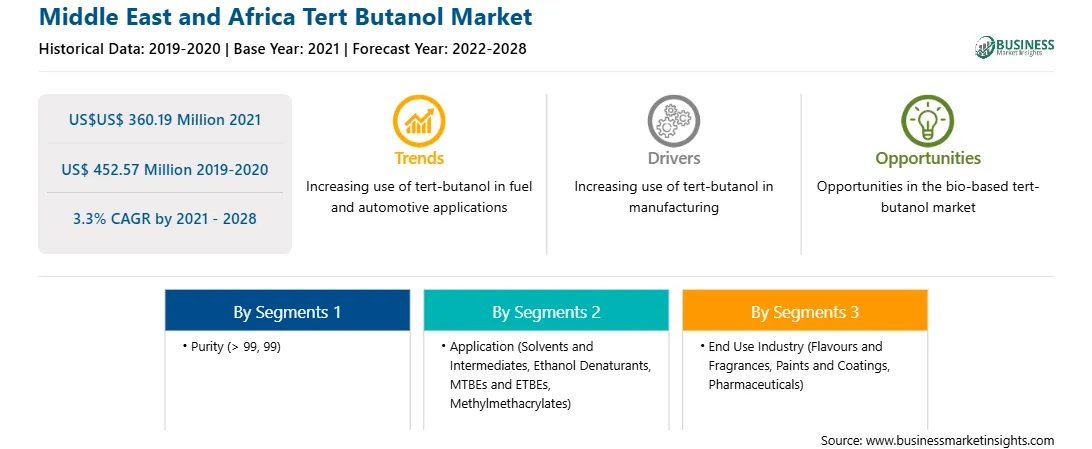

| Market size in 2021 | US$US$ 360.19 Million |

| Market Size by 2028 | US$ 452.57 Million |

| Global CAGR (2021 - 2028) | 3.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Purity

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Tert Butanol refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

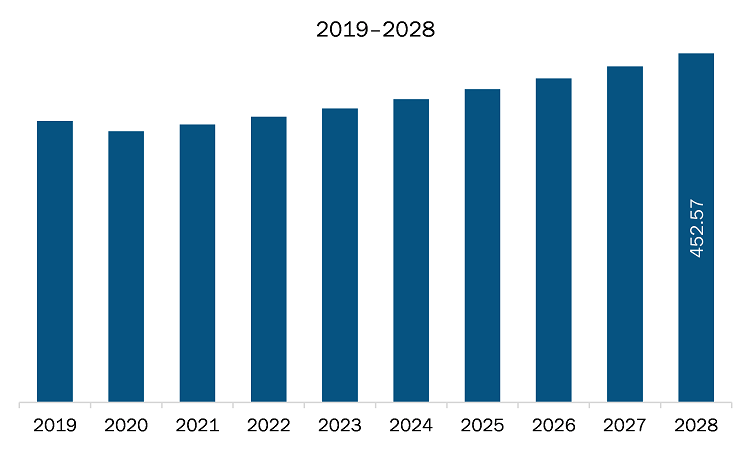

The tert butanol market in Middle East & Africa is expected to grow from US$ 452.57 million by 2028 from US$ 360.19 million in 2021. The market is estimated to grow at a CAGR of 3.3% from 2021 to 2028. Organic solvents such as tert-butyl alcohol provide many benefits for freeze-dried formulations. These include increasing the solubility of hydrophobic drugs, reducing drying time, improving product stability, and improving reconstitution characteristics. Tert-butanol has a high freezing point (24 ° C), crystallizes primarily at room temperature, and will sublimate during the freezing process. TBA completely crystallizes during the freezing stage and exhibits long, needle-shaped ice crystals. It also produces a lower cake resistance during the drying stage and has a larger surface area. Tert-butanol is gradually becoming the tender freeze-drying agent in the biomedical industry. The evolving nature of the pharmaceutical industry and increasing research activities have necessitated the preservation of vaccines, blood samples, purified proteins, and many other biological materials. Tert-butanol is a solvent with high vapor pressure, low toxicity, and low melting point, and it is the best freeze-drying agent. Manufacturers are capitalizing on this trend by strengthening ties and partnerships with raw material suppliers and pharmaceutical industry service providers to capitalize on the industry's market potential. They place considerable emphasis on the development of high purity tert butanol that is optimal for pharmaceutical applications. Tert butanol is used as a freeze-drying agent in the manufacture of pharmaceutical compounds. Freeze-drying or lyophilization is used to remove ice or other frozen solvents from the material. They are used to store vaccines, blood samples, purified proteins, and other biological materials. The growing demand for lyophilized agents in the biotech and biomedical industries to preserve vaccines, blood samples, purified proteins, and other biological materials is expected to present a lucrative opportunity for tert butanol manufacturers. Thus, increasing demand for freeze-drying agents in the pharmaceutical industry is expected to propel the tert butanol market growth.

In terms of purity, the ≥99 accounted for the largest share of the Middle East & Africa tert butanol market in 2020. In term of end use, paints and coatings held a larger market share of the tert butanol market in 2020. Further, in term of application, the solvents and intermediates held a larger market share of the tert butanol market in 2020

A few major primary and secondary sources referred to for preparing this report on tert butanol market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are The Sherwin-Williams Company; Kobra Paint - Spray Art Technologies; Montana Colors S.L.; Nippon Paint Holdings Co., Ltd; PPG Industries Inc.; Rust Oleum; Masterchem Industries LLC; Plutonium Paint; and AVT Paints Pty Ltd among others.

The Middle East and Africa Tert Butanol Market is valued at US$US$ 360.19 Million in 2021, it is projected to reach US$ 452.57 Million by 2028.

As per our report Middle East and Africa Tert Butanol Market, the market size is valued at US$US$ 360.19 Million in 2021, projecting it to reach US$ 452.57 Million by 2028. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East and Africa Tert Butanol Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Tert Butanol Market report:

The Middle East and Africa Tert Butanol Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Tert Butanol Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Tert Butanol Market value chain can benefit from the information contained in a comprehensive market report.