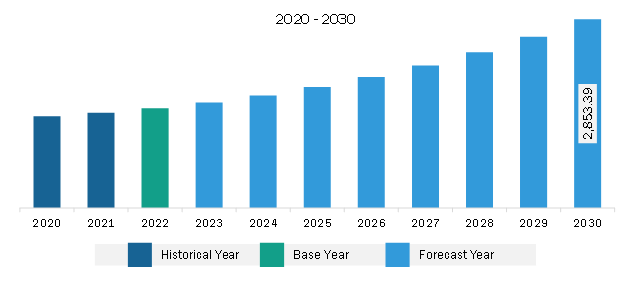

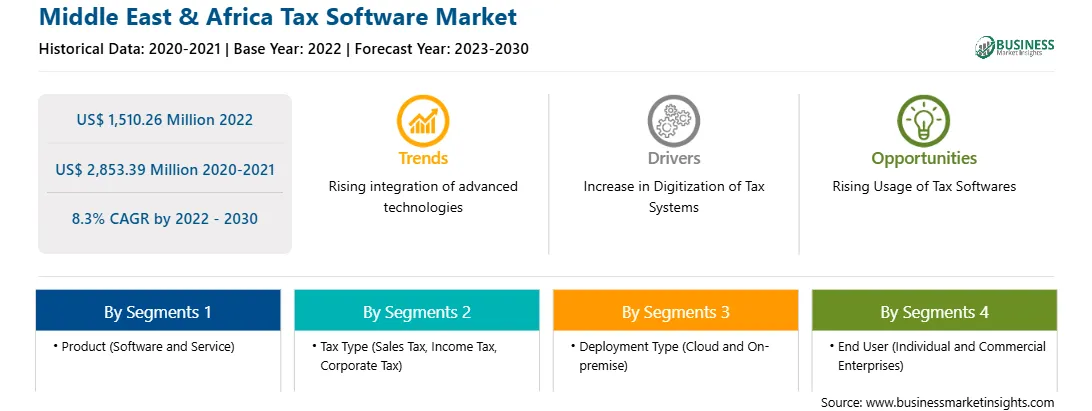

The Middle East & Africa tax software market is expected to grow from US$ 1,510.26 million in 2022 to US$ 2,853.39 million by 2030. It is estimated to grow at a CAGR of 8.3% from 2022 to 2030.

The ongoing digital revolution presents enormous scope for businesses-digital services and automation help to modify business models and traditional processes for improving operational efficiencies and revenues. Digital transformation or automation in businesses is characterized by the integration of digital technology in various business processes, organizational activities, and business models. The digitalization of tax systems aids in enhanced operational efficiencies, end-to-end business process optimization, and cost and human error reduction. Citizens mostly find the process of paying taxes challenging and time-consuming. The tax administration authorities are increasingly undertaking digital transformation and automation of their systems, as monitor tax compliance and collecting sufficient revenue is necessary to finance public goods and services. Digitalized tax systems have the potential to bring successful and sustainable tax reforms, ensure proper taxation, and address compliance-related challenges. Further, the COVID-19 pandemic, which led to a rise in the use of digital commerce, made digital transformation especially urgent for tax administrations. Companies are increasingly embracing tax digitalization to comply with new electronic reporting requirements and enhance the accuracy and efficiency of tax functions. The relevant investments by these companies in tax software technologies continue to rise to improve the ability to gather more tax information and gain more insights into the tax and financial positions of taxpayers. In May 2023, the Federal Tax Authority (FTA) opened the EmaraTax digital tax services platform for Public Joint Stock Companies and PriVATe Companies for registration for Corporate Tax. Further, in 2019, the General Authority of Zakat and Tax (GAZT) in Saudi Arabia has awarded a five-year contract to De La Rue, the leading global provider of security solutions, to install and run a digital tax stamp system for all tobacco and soft drink products sold in the country. Tax software quickly analyzes a client's overall financial situation and suggests insurance or investment products. It also provides services such as auditing, bookkeeping, and comprehensive financial plan preparation. The tax preparation process has become faster and more efficient as vast information is now available in digital format, which helps tax preparers directly import their client data from personal finance software in a single click. This has eliminated the need for manual entries. Sage Group plc, Xero Limited, SAP SE, and CloudTax are among the key tax software vendors operating worldwide. Further, mobile apps are available now for taxpayers, which help them effortlessly e-file their taxes. Thus, the continuous digitization of the tax system propels the growth of the tax software market.

The Middle East & Africa tax software market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The region has experienced a rapid penetration of internet connectivity over the years. Government bodies have launched various initiatives to promote the adoption of digital technologies across all industry sectors to increase efficiency and strengthen their position in the global market. For instance, in March 2021, the Saudi Arabian government launched the Digital Government Authority (DGA) to oversee the national digital strategy nationwide. In addition, the region comprises several growing economies, such as the UAE, Saudi Arabia, Oman, Kuwait, and Qatar, which are becoming potential markets for digitalization. Thus, the rise in digitalization is likely to propel the tax software market in the region.

The region's personal income taxes (PITs) have a very low contribution to the GDP, owing to which the government is planning to improve the PIT regimes in the country. According to the International Monetary Fund (IMF) report on personal income tax (PIT) in the Middle East & North Africa in February 2023, the MENA region was experiencing several developments to improve the prospect that countries could successfully adopt a PIT or strengthen existing ones. Most MENA countries have VATs that raised tax administration capacity and efficiency over the past three decades (and more recently in GCC members), which is expected to be transferable to PIT regimes. In addition, the changes in technology and digitalization, business systems, and payment methods can enhance the information available to tax authorities, a key factor for the successful implementation of the PIT regime. Moreover, the countries in the region are widely adopting advanced software solutions to help individuals and businesses experience hassle-free tax filing. For example, in May 2023, Zoho launched new corporate tax features in Zoho Books, an FTA-accredited cloud accounting software to allow companies, solopreneurs, and freelancers to automate Corporate Tax compliance, which allows better visibility into their tax filings. In addition, in June 2021, Sovos, a global tax software provider, announced the availability of Sovos Advanced Periodic Reporting platform. This platform brings hundreds of customers on next-generation architecture designed for performance, scalability, enhanced functionality, and expanded global coverage. Building on over a decade, this SaaS-based indirect tax solution automates, centralizes, and streamlines indirect tax compliance processes for firms operating in the Middle East, Africa, Europe, Latin America, and Asia. Thus, such practices to improve tax prospects via digitalization and launching new solutions in the market foster tax software market in the Middle East & Africa.

Strategic insights for the Middle East & Africa Tax Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,510.26 Million |

| Market Size by 2030 | US$ 2,853.39 Million |

| Global CAGR (2022 - 2030) | 8.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Tax Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa tax software market is segmented into product, deployment type, tax type, end user, and country.

Based on product, the Middle East & Africa tax software market is bifurcated into software and services. The software segment held a larger share of the Middle East & Africa tax software market in 2022.

In terms of deployment type, the Middle East & Africa tax software market is bifurcated into cloud and on-premise. The cloud segment held a larger share of the Middle East & Africa tax software market in 2022.

Based on tax type, the Middle East & Africa tax software market is segmented into sales tax, income tax, corporate tax, and others. The sales tax segment held the largest share of the Middle East & Africa tax software market in 2022.

Based on end user, the Middle East & Africa tax software market is bifurcated into commercial enterprises and individual. The commercial enterprises segment held a larger share of the Middle East & Africa tax software market in 2022. Further, commercial enterprises segment is categorized into enterprise size (large enterprises, medium enterprises, and small enterprises) and vertical (IT & Telecom, retail, BFSI, government, healthcare, and others).

Based on country, the Middle East & Africa tax software market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa tax software market in 2022.

Sage Group Plc, Thomson Reuters Corp, Xero Ltd, Wolters Kluwer NV, Intuit Inc, and SAP SE are some of the leading companies operating in the Middle East & Africa tax software market.

1. Sage Group Plc

2. Thomson Reuters Corp

3. Xero Ltd

4. Wolters Kluwer NV

5. Intuit Inc

6. SAP SE

The Middle East & Africa Tax Software Market is valued at US$ 1,510.26 Million in 2022, it is projected to reach US$ 2,853.39 Million by 2030.

As per our report Middle East & Africa Tax Software Market, the market size is valued at US$ 1,510.26 Million in 2022, projecting it to reach US$ 2,853.39 Million by 2030. This translates to a CAGR of approximately 8.3% during the forecast period.

The Middle East & Africa Tax Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Tax Software Market report:

The Middle East & Africa Tax Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Tax Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Tax Software Market value chain can benefit from the information contained in a comprehensive market report.