The Middle East & Africa (MEA) region includes countries such as South Africa, Saudi Arabia, the UAE, and the Rest of MEA. In Middle East & Africa region, the rising obesity rates have become a major public health concern, along with subsequent increase in obesity-related co-morbidities. Malnutrition rates are particularly high in the region. The prevalence of overweight and obesity in the Middle East and North Africa ranges from 74% to 86% in women and 69% to 77% in men, according to the WHO Regional Office for the Eastern Mediterranean. The various types of dietary risks raise the chances of getting a disease. Hence, nowadays, many people from the region are focusing on following healthy eating patterns. In the Middle East & Africa region, there is a growing preference for low calorie sugar substitutes as an alternative to sugar. The consumers are becoming more aware of the health benefits of soluble dietary fibers and their significance in preventing various kinds of diseases. The various programs are widely implemented in countries from the MEA region to promote healthy diets. Countries such as Egypt and Jordan are leading the charge in prioritizing the improvement and growth of school meals programs. All these factors are creating the demand for soluble dietary fibers. Additionally, the growing demand for soluble dietary fibers from food & beverages, pharmaceutical, and animal nutrition industries further contributes to the market growth.

In the MEA region, Turkey, South Africa, Iraq, and Israel are among the major countries with high number of COVID-19 confirmed cases and deaths. According to the International Finance Corporation, the COVID-19 pandemic has a severe impact on the economy of the Middle East & Africa which has led to decline in oil production, tourism, and remittances. The quarantine measures implemented for sanitary purposes in the region have led to standstill of several activities across diverse economic sectors. The MEA region comprises many growing economies, which are prospective markets for soluble dietary fibers vendors. The pandemic has significantly slowed down the growth of soluble dietary fibers market in the region due to volatility associated with the prices of raw materials such as fruits and vegetables, whole grains, and legumes. However, the shift in consumer dietary patterns is expected to promote the demand for soluble dietary fibers in the regional market.

Strategic insights for the Middle East and Africa Soluble Dietary Fibers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

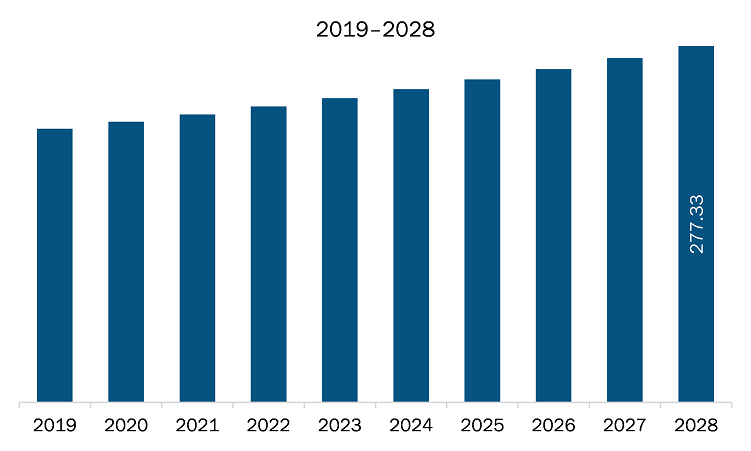

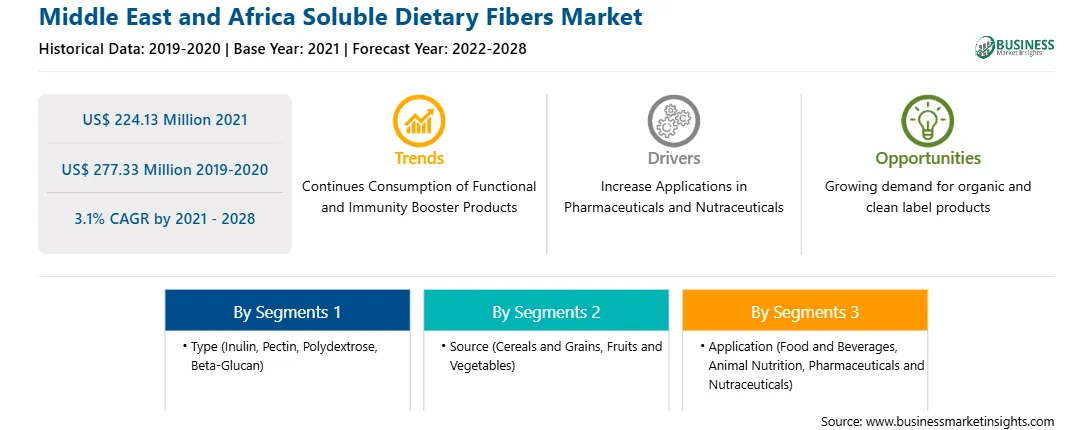

| Market size in 2021 | US$ 224.13 Million |

| Market Size by 2028 | US$ 277.33 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Soluble Dietary Fibers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The soluble dietary fibers market in Middle East & Africa is expected to grow from US$ 224.13 million in 2021 to US$ 277.33 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028. Soluble dietary fibers are used as an additive to foods, and they also promote the colonic health, along with bifidobacterial or lactobacillus stimulation in the gut, coronary artery health, lowers cholesterol, and glucose metabolism. Moreover, soluble dietary fibers contribute to weight management and reduce the risk of cardiovascular diseases. Water-soluble dietary fiber is considered as one of the significant forms of dietary fibers. It is composed of inulin, beta-glucan, polydextrose, pectin, fructooligosaccharides, galactooligosaccharides, and corn fiber, which helps promote the nutritional profile of the food and beverage product added. For instance, Roquette is involved in offering non-viscous soluble fiber under its brand “NUTRIOSE” for food, pharmaceutical and nutraceutical industries. NUTRIOSE is produced from cereals such as wheat and corn and provides efficient digestive tolerance. Similarly, Steadfast Nutrition, which is a premium sports and wellness nutrition company, is involved in offering soluble dietary fiber based dietary supplement powder under the brand, Tri Fiber. The presence of soluble dietary fiber helps maintain a healthy intestine, along with balanced blood glucose levels and serum lipids. Moreover, the product helps to manage the appetite hormones, enhances the bowel movement, and manages triglycerides levels in the body to improve the lipid profile by exercising a control over cholesterol levels. The improved effects of resistant maltodextrin are identified by Foods for Specified Health Use (FOSHU). The product can be consumed by office goers, weight watchers, athletes & fitness enthusiasts, and patients. Similarly, Benefiber and Metamucil are over the counter (OTC) soluble fiber supplements. Benefiber is approved by the Food and Drug Administration (FDA) as a dietary fiber supplement, and it is composed of wheat dextrin as an active ingredient. It helps to absorb water in the intestinal tract along with stimulating peristalsis or the repetitive contraction and relaxation of intestinal muscle. Metamucil is prepared from psyllium husks, obtained from seeds of an Indian herb, Plantago ovata. The growing focus on health, along with increasing consciousness toward health benefits offered soluble dietary fibers and increasing instances of chronic diseases, has motivated the manufacturers to produce nutraceutical and pharmaceutical products based upon soluble dietary fibers, which is expected to propel the demand for soluble dietary fibers market.

In terms of type, the inulin segment accounted for the largest share of the Middle East & Africa soluble dietary fibers market in 2020. In terms of source, the cereals and grains segment accounted for the largest share. Further In term of application, the food and beverages held a larger market share of the soluble dietary fibers market in 2020.

A few major primary and secondary sources referred to for preparing this report on the soluble dietary fibers market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Nexira, Tate & Lyle PLC, ADM, and IFF Nutrition & Biosciences among others.

The Middle East and Africa Soluble Dietary Fibers Market is valued at US$ 224.13 Million in 2021, it is projected to reach US$ 277.33 Million by 2028.

As per our report Middle East and Africa Soluble Dietary Fibers Market, the market size is valued at US$ 224.13 Million in 2021, projecting it to reach US$ 277.33 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The Middle East and Africa Soluble Dietary Fibers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Soluble Dietary Fibers Market report:

The Middle East and Africa Soluble Dietary Fibers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Soluble Dietary Fibers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Soluble Dietary Fibers Market value chain can benefit from the information contained in a comprehensive market report.