The soil fertility testing market in the Middle East and Africa is further segmented into South Africa, Saudi Arabia, the UAE, and Rest of the Middle East and Africa. This region has difficult environment for agriculture due to the scarcity of land and water resources. Moreover, rain-fed as well as irrigated lands are suffering from soil degradation due to unfavorable farming practices. According to the FAO, the one-third of the total land area in Middle East and Africa is available for agriculture, and only 5% of it is arable. Thus, the soil that is currently being used for farming is severely degraded, which is resulting in decrease in productivity to ~30–35%. According to the FAO, wind and water erosion is the major causes of soil degradation in the region, causing the deterioration of soil fertility; loss of soil cover; and mismanagement as well as overuse of herbicides, pesticides, and chemical fertilizers. In the 21st Summit of African Leaders, in 2013, the member states were urged to place land degradation as the focus of the debate. During the post-2015 development agenda, they were urged to recognize it as one of the sustainable development goals. The soil fertility testing market in the Middle East and Africa is in a nascent stage and is likely to undergo development in the coming years, as these tests can provide the famers in the region with information helpful for improving the yield output. The information would assist farmers in making accurate decisions regarding the quantity and type of fertilizer required to improve the soil fertility, which would keep a check on soil degradation.

Turkey has the highest number of COVID-19 cases in the Middle East & Africa region, followed by South Africa, Saudi Arabia and the UAE, among others. The UAE was the first country in the Middle East & Africa to report a confirmed case of COVID-19. Due to the lockdown in Middle East & African countries, various companies remain closed which led to the reduction in the sale of various products, thereby negatively impacting the market for soil fertility testing in the region..

Strategic insights for the Middle East and Africa Soil Fertility Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

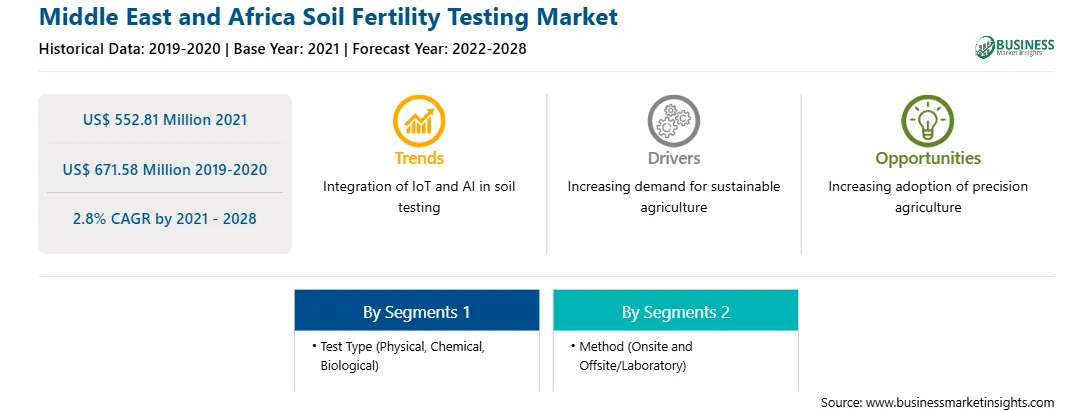

| Market size in 2021 | US$ 552.81 Million |

| Market Size by 2028 | US$ 671.58 Million |

| Global CAGR (2021 - 2028) | 2.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Soil Fertility Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The soil fertility testing market in Middle East & Africa is expected to grow from US$ 552.81 million in 2021 to US$ 671.58 million by 2028; it is estimated to grow at a CAGR of 2.8% from 2021 to 2028. Improving and strengthening agricultural practices through increased investments and supportive government measures are mainstream in developing regions. The rising need of ensuring food security to support the demands of increasing population has propelled the adoption of soil fertility testing solutions and services in developing regions. For instance, the agrarian facilities in Africa are still in a developing phase, wherein crops are generally deprived of certain nutrients. Moreover, the continent has low access to soil fertility testing equipment and chemical fertilizers, which can be associated with their high costs. However, significant government investments in the agricultural sector, coupled with an increasing base of manufacturers in the region, are expected to boost the demand for soil fertility testing in the region. Further, rapid pace of urbanization, along with the growing concerns related to food security, has propelled the utilization of soil fertility testing to boost productivity in Asia Middle East & Africa. In addition, the positive government approach towards boosting the production and application of such techniques to maximize agricultural produce in the region has further accelerated the market growth. For instance, the International Atomic Energy Agency (IAEA) assists its Member States in developing and implementing nuclear-based technologies for increasing soil fertility practices, thereby boosting crop intensification and natural resource conservation.

In terms of test type, the chemical segment accounted for the largest share of the Middle East & Africa soil fertility testing market in 2020. Further In term of method, the offsite/laboratory segment held a larger market share of the soil fertility testing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the soil fertility testing market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are SGS SA; Eurofins Scientific; ALS; Agrocares; Crop Nutrition Laboratory Services Ltd.; Activation Laboratories Ltd. among others.

The Middle East and Africa Soil Fertility Testing Market is valued at US$ 552.81 Million in 2021, it is projected to reach US$ 671.58 Million by 2028.

As per our report Middle East and Africa Soil Fertility Testing Market, the market size is valued at US$ 552.81 Million in 2021, projecting it to reach US$ 671.58 Million by 2028. This translates to a CAGR of approximately 2.8% during the forecast period.

The Middle East and Africa Soil Fertility Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Soil Fertility Testing Market report:

The Middle East and Africa Soil Fertility Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Soil Fertility Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Soil Fertility Testing Market value chain can benefit from the information contained in a comprehensive market report.