Various market players are incorporating artificial intelligence (AI), machine learning (ML), and other similar technologies in their smart locks. AI- and ML-integrated door locks ensure better home security by keeping track of who opens and closes the doors. Further, these locks provide greater control over who can lock and unlock particular doors. They also allow users to automatically lock or unlock doors as they leave or approach their homes. The AI- or ML-integrated locks may also help recognize break-in or lock-tampering attempts. In December 2022, Viomi launched the Viomi AI Smart Door Lock Super 2E. This fully automatic smart door lock supports six unlocking methods: fingerprint, password, virtual password, temporary password, door card, and key. It features AI self-learning technology, which becomes more sensitive with use. In February 2023, Xiaomi introduced its new Xiaomi Smart Door Lock M20 series. This new model, Smart Guardian Can See, is equipped with an integrated peephole camera and a display screen that provide users with a comprehensive view of a front door in real time. In addition, the model is further incorporated with a doorbell function making it more convenient for users. Thus, the introduction of smart locks enabled with new technologies to enhance security will further fuel the growth of the Middle East & Africa smart door lock market during the forecast period.

The Middle East & Africa (MEA) smart door lock market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Favourable initiatives of the government toward energy efficiency, rising adoption of Internet of Things (IoT), and the building of smart cities are propelling the demand for smart home solutions, including smart locks. As security is considered an integral part of an infrastructure, deployment of various smart security solutions, such as wireless locks, fingerprint locks, iris detection systems, etc., has increased across the MEA. Also, increasing technological advancements are helping users to monitor their day-to-day activities through smartphones, tablets, and other Bluetooth-enabled devices from anywhere and anytime. Growing awareness and acceptance of advanced security solutions across the MEA countries has increased the adoption of smart door locks, which provides real-time security to the owners. Also, the rising penetration of smartphones, smart wearables, tablets, and other connected devices is propelling the demand for smart door locks across the region, as these devices help users monitor if someone checks in or leaves the property. In addition, rising demand for households with the growing population and increasing spending power of consumers are bolstering the demand for smart home solutions such as smart door locks. Market players are developing innovative solutions for the regional market to fulfill the demand for smart door locks. In August 2021, Etisalat announced that they have partnered with Yale Middle East to bring to its customers a wide range of smart door-locking solutions. Under this partnership, Etisalat will provide free-of-cost installation and configuration services for the smart locks by Yale. Thus, all the above factors are fueling the growth of the MEA smart door lock market.

Strategic insights for the Middle East & Africa Smart Door Lock provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Smart Door Lock refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Smart Door Lock Strategic Insights

Middle East & Africa Smart Door Lock Report Scope

Report Attribute

Details

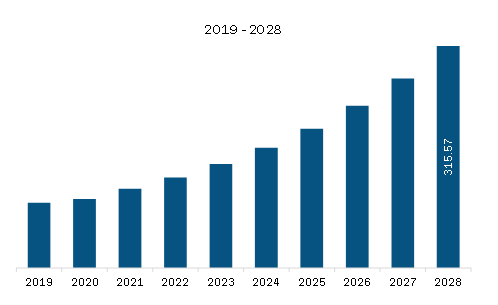

Market size in 2023

US$ 147.36 Million

Market Size by 2028

US$ 315.57 Million

Global CAGR (2023 - 2028)

16.5%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Product

By Technology

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Smart Door Lock Regional Insights

Middle East & Africa Smart Door Lock Market Segmentation

The Middle East & Africa smart door lock market is segmented into product, technology, end user, and country.

Based on product, the Middle East & Africa smart door lock market is segmented into fingerprint locks, remote locks, and electronic cipher locks. In 2023, the electronic cipher locks segment registered a largest share in the Middle East & Africa smart door lock market.

Based on technology, the Middle East & Africa smart door lock market is segmented into wi-fi, Bluetooth, Z wave, and others. In 2023, Bluetooth segment registered a largest share in the Middle East & Africa smart door lock market.

Based on end user, the Middle East & Africa smart door lock market is bifurcated into commercial and residential. In 2023, the commercial segment registered a larger share in the Middle East & Africa smart door lock market.

Based on country, the Middle East & Africa smart door lock market is segmented into South Africa, Saudi Arabia, the UAE, and Rest of Middle East & Africa. In 2023, the UAE segment registered a largest share in the Middle East & Africa smart door lock market.

ADEL Marketing (M) Sdn Bhd, Allegion Plc, Assa Abloy AB, Honeywell International Inc, Master Lock Company LLC, and Spectrum Brands Holdings Inc are the leading companies operating in the Middle East & Africa smart door lock market.

1. ADEL Marketing (M) Sdn Bhd

2. Allegion Plc

3. Assa Abloy AB

4. Honeywell International Inc

5. Master Lock Company LLC

6. Spectrum Brands Holdings Inc

The Middle East & Africa Smart Door Lock Market is valued at US$ 147.36 Million in 2023, it is projected to reach US$ 315.57 Million by 2028.

As per our report Middle East & Africa Smart Door Lock Market, the market size is valued at US$ 147.36 Million in 2023, projecting it to reach US$ 315.57 Million by 2028. This translates to a CAGR of approximately 16.5% during the forecast period.

The Middle East & Africa Smart Door Lock Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Smart Door Lock Market report:

The Middle East & Africa Smart Door Lock Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Smart Door Lock Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Smart Door Lock Market value chain can benefit from the information contained in a comprehensive market report.