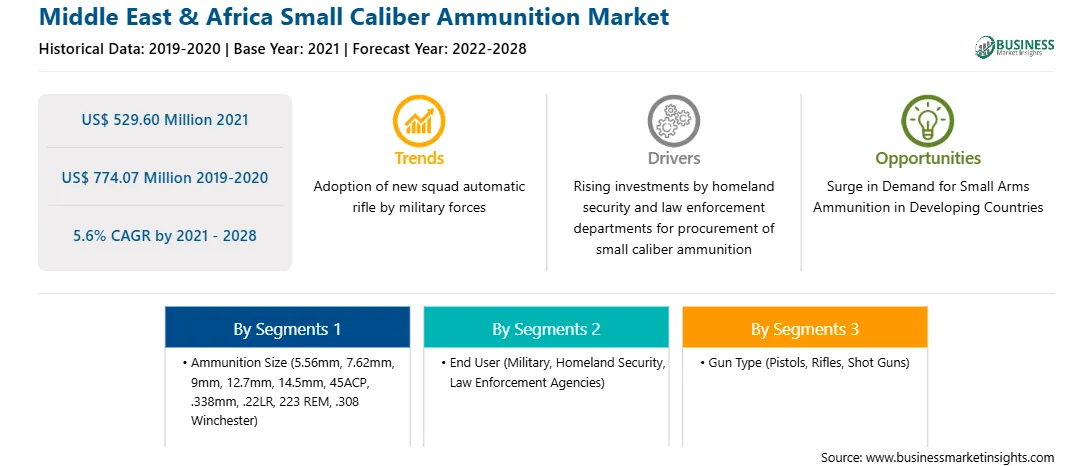

The small caliber ammunition market in the MEA is sub segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA, including Israel, Turkey, Iran, and Qatar. According to Stockholm International Peace Research Institute (SIPRI), Saudi Arabia is the largest military spender in the MEA region, and it invested US$ 61.8 billion in this sector in 2019. Turkey, Israel, Iran, and Algeria are the next prominent military spenders in the region, after Saudi Arabia. The countries are buying artillery and mortar systems to protect their borders from illegal trespassing and various forms of trafficking, driving up ammunition demand in the region. For example, in November 2018, the US State Department approved the sale of 46,000 M831A1 and M865 rounds and 10,000 APFSDS-T rounds to Egypt for a total cost of US$ 201 million. The US State Department approved sale of additional F-16 ammunition to Morocco in September 2019, with an estimated cost of US$ 209 million. The agreement calls for the sale of 5,810 MK 82-1 bomb, 300 MK 84-4 bombs, 105 Joint Direct Attack Munitions (JDAM), BBU-36/BBU-35/B impulse cartridges, and a variety of bomb components, including 180 MXU-651 B/B Air Foil Group (AFG) units and 4,125 MXU-650 C/B AFG units. Escalating adoption of new squad automatic rifle by military forces and mounting demand for small arms ammunition are the major factor driving the growth of the MEA small caliber ammunition market

In case of COVID-19, MEA is highly affected especially South Africa. The MEA small caliber ammunition market is majorly affected by the disruption in the supply chain. Pertaining to the closure of borders of countries, the supply chain of several small caliber ammunition has been disturbed. The demand for advanced military equipment and products, including rifles and pistols, for strengthening the military troops have weakened during the initial months of COVID-19 virus outbreak. This led the ammunition manufacturers to experience disturbed supply chain of raw materials. This has resulted in a loss of business among the local and international small caliber ammunition manufacturers. Further, several international defense forces rely on sourcing small caliber ammunition from the Israeli, Turkish, and South African manufacturers, however, due to disruption in supply chain and international trades during early days of COVID outbreak, the small caliber ammunition manufacturers faced substantial challenges to generate revenues. This factor has been analyzed to understand and depict the impact of COVID-19 on MEA small caliber ammunition market.

Strategic insights for the Middle East & Africa Small Caliber Ammunition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

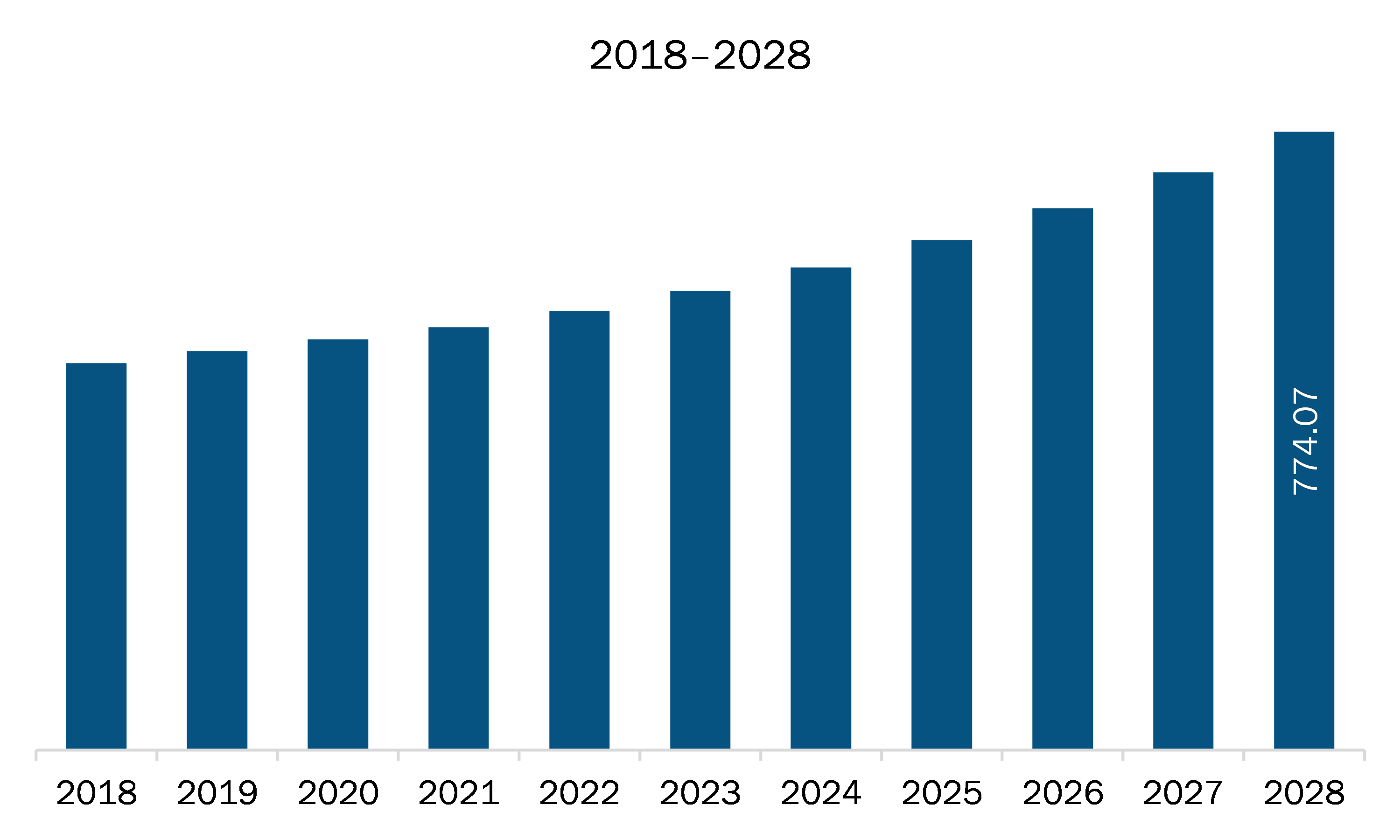

| Market size in 2021 | US$ 529.60 Million |

| Market Size by 2028 | US$ 774.07 Million |

| Global CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Small Caliber Ammunition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA small caliber ammunition market is expected to grow from US$ 529.60 million in 2021 to US$ 774.07 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028. Growing need of modernizing military operations with rapid changes in warfare is expected to fuel the market growth. Rapid changes in modern warfare are urging governments of different countries across MEA region to allocate higher amounts toward respective military forces. The forces are focusing on caliber sizes such as 7.62 mm for attaining greater projectile ranges, as the existing calibers such as 5.56 mm are becoming ineffective in piercing tougher armors. The military budget allocation enables the military forces to engage themselves in the development of robust indigenous technologies alongside procuring advanced weapons, ammunitions, vehicles, and other equipment from domestic and international manufacturers. Moreover, the solider and military vehicle modernization practices help them keep their personnel and vehicles mission ready. The increased military investments are being channelized toward the procurement of newer technologies, including different types of ammunitions, which is boosting the growth of the MEA small caliber ammunitions market. The militaries of almost all major defense spending nations maintain an arsenal consisting of numerous self-propelled and towed howitzers and main battle tanks (MBTs). The armies are involved in regular training exercises with these weapon systems. Therefore, they need to stock significant quantities of tank, artillery, and training ammunition, depending on the number of launch platforms they possess. Small caliber ammunition is a part of artillery ammunition of various defense forces across the MEA region is used in a range of weapon systems. Moreover, military professionals are focusing on calibers like 7.62mm for higher projectiles as the existing widely used calibers like the 5.56 mm are becoming ineffective in piercing the tougher armors. Therefore, the government and military forces are emphasizing on investing on ammunitions which is fostering the MEA small caliber ammunition market.

In terms of ammunition size, the 9mm segment accounted for the largest share of the MEA small caliber ammunition market in 2020. In terms of end user, the military segment held a larger market share of the MEA small caliber ammunition market in 2020. Further, the pistols segment held a larger share of the MEA small caliber ammunition market based on gun type in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA small caliber ammunition market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems Plc, CBC Global Ammunition, Denel PMP, Elbit Systems Ltd., FN HERSTAL, NAMMO AS, and Northrop Grumman Corporation.

The Middle East & Africa Small Caliber Ammunition Market is valued at US$ 529.60 Million in 2021, it is projected to reach US$ 774.07 Million by 2028.

As per our report Middle East & Africa Small Caliber Ammunition Market, the market size is valued at US$ 529.60 Million in 2021, projecting it to reach US$ 774.07 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Middle East & Africa Small Caliber Ammunition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Small Caliber Ammunition Market report:

The Middle East & Africa Small Caliber Ammunition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Small Caliber Ammunition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Small Caliber Ammunition Market value chain can benefit from the information contained in a comprehensive market report.