The slewing bearing market in the Middle East and Africa (MEA) is further segmented into Turkey, South Africa, and Rest of the MEA. The region has a large number of oil & gas refineries, and the ever-growing oil demand boosts the demands for tools used at the oil & gas exploration and extraction sites. This is the key factor contributing to the slewing bearings market growth in the MEA. The slewing bearings are also used predominantly in the renewable energy sector. The investments of Middle East in renewables reached USD 11 billion in 2016 from USD 1.2 billion in 2008, with a nine-fold increase. Several countries in the region have now become world leaders in terms of the development of renewable energy. The region attained world-record solar prices in recent auctions with 17.8 USD/MWh for the Sakaka project in Saudi Arabia, and 24.2 and 29.9 USD/MWh in Abu Dhabi and Dubai, respectively. Collins Aerospace is extending its footprint in the MEA, with increasing investments and forging new ties in the region; the MEA is one of the fastest growing markets for the aerospace and defense industry players. Also, mining sector in the region is growing rapidly with the surge in foreign investments. The proliferation of these sectors is boosting the demand for slewing bearings. Thus, despite the limited presence of major players, the MEA has huge market potential for the future growth of the market. The COVID-19 pandemic impacted the economy of the region due to disrupted manufacturing and other activities in 2020; however, it is likely to recover quickly with the gradual resumption of activities in different industries in 2021. High investments in various sectors would support the region in mitigating the ill-effects of this pandemic.

The Middle East and Africa slewing bearings market is majorly impacted due to the COVID-19 pandemic as country borders were closed and the supply chain of several industrial equipment and components was disturbed. This has led to the decline in revenue among the slewing bearings manufacturers and distributors offering their products to manufacturing, oil & gas, and aerospace & defense industries. However, with the ease in restrictions, the manufacturing of slewing bearing gained traction and witnessed a steady adoption rate in the Q1 of 2021.

Strategic insights for the Middle East & Africa Slewing Bearing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

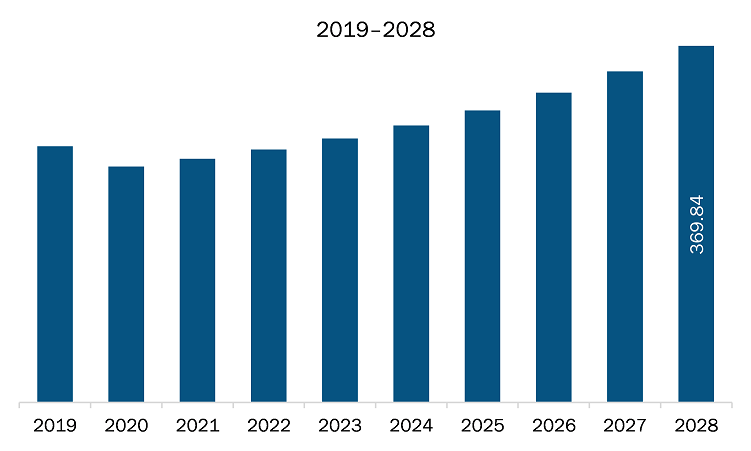

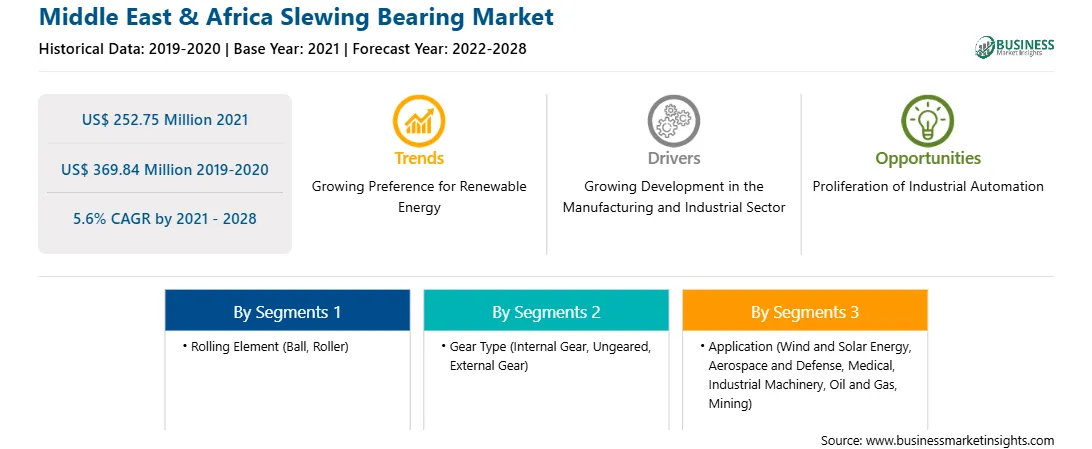

| Market size in 2021 | US$ 252.75 Million |

| Market Size by 2028 | US$ 369.84 Million |

| Global CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Rolling Element

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Slewing Bearing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The slewing bearing market in Middle East and Africa is expected to grow from US$ 252.75 million in 2021 to US$ 369.84 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028. Growing defense budgets owing to the increasing concerns about national security, governments are allocating greater funds to strong-arm their defense forces. Higher military budget allocations enable the military forces to focus on the development of robust arms and ammunition, indigenous technologies, communication system, and various other technologies. Currently, communication and combat system modernization practices are peaking among most military forces, as a significant percentage of defense budget is spent on procuring advanced weapons and electronic equipment such as combat tanks, missile systems, and communication systems. The slewing bearings are widely used turrets of combat tanks, missile launchers, precision radar antennas, communication antennae, and gun mounts. Thus, increasing defense budgets in different countries are driving the slewing bearing market growth.

Based on gear type, the market is segmented into external, internal, and ungeared. The internal gear segment held the largest share of Middle East and Africa slewing bearing market throughout the forecast period. Based on rolling element, the slewing bearing market is segmented into ball and roller. The ball segment held a larger market share throughout the forecast period. Based on application, the slewing bearing market is segmented into wind and solar energy, aerospace & defense, medical, industrial machinery, oil & gas, mining, and others. The industrial machinery segment accounted for a major share of the Middle East and Africa slewing bearing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the slewing bearing market in Middle East and Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are IMO Group, Italcuscinetti S.p.A. a Socio Unico, Liebherr, Schaeffler Technologies AG & Co. KG, SKF, thyssenkrupp rothe erde Germany GmbH, THE TIMKEN COMPANY, and Emerson Bearing Company among others.

The Middle East & Africa Slewing Bearing Market is valued at US$ 252.75 Million in 2021, it is projected to reach US$ 369.84 Million by 2028.

As per our report Middle East & Africa Slewing Bearing Market, the market size is valued at US$ 252.75 Million in 2021, projecting it to reach US$ 369.84 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Middle East & Africa Slewing Bearing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Slewing Bearing Market report:

The Middle East & Africa Slewing Bearing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Slewing Bearing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Slewing Bearing Market value chain can benefit from the information contained in a comprehensive market report.