A set-top box (STB), also referred to colloquially as a cable box, is an information system that typically includes a TV tuner input and shows the output of a TV set and an external signal source, converting the source signal into material in a format that can then be shown on a TV screen or other display device. They are found in, among other applications of, cable television, satellite television, and over-the-air television networks. A device that connects to your TV makes it possible for you to use a telephone line or cable to access the Internet and exchange electronic mail on your TV. The set-top box market in the Middle East is presently seeing moderate growth. To receive and decode digital television signals, a set-top box is connected to a communication source, such as a phone or an integrated telecommunications digital network. It can be accessed using various TV distribution channels, including terrestrial, cable, Internet and satellite. It supports video conferencing, home networking, telephony with Internet protocol, video-on-demand, and other multimedia facilities on the Internet. At present, due to rapid urbanization and increase in disposable incomes of individuals, set-up box is gaining momentum across the Middle East. Thus, the above-mentioned factors are influencing the adoption of the STBs across the region.

Furthermore, in case of COVID-19, Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are the main countries facing the economic effects of coronavirus in the MEA region. It is becoming clear with the COVID-19 pandemic spreading through the above-mentioned countries that few can avoid its effects, posing major challenges for all sectors. The outbreak has led to more people staying indoors across the region, thereby, have impacted the high adoption of home broadband for watching videos on-demand over local set-top box connection. For instance, 67 percent of UAE adults make more video calls during lockdown to communicate with friends and loved ones, 78 percent use social media more frequently, and 74 percent watch more TV and movies online. Although this is unsurprising considering the limitations placed in place during the lockdown on social events, the increased use of internet-reliant entertainment brings more demand on home broadband. Moreover, the restriction on outdoor activities has also impacted the telecast of new content on television, thereby decreasing the demand for satellite set-top box. Thus, the above-mentioned factors are expected to have adverse impact on the set-top box market owing to the outbreak of the pandemic.

Strategic insights for the Middle East & Africa Set Top Box (STB) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

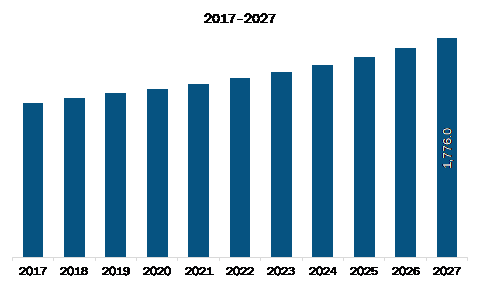

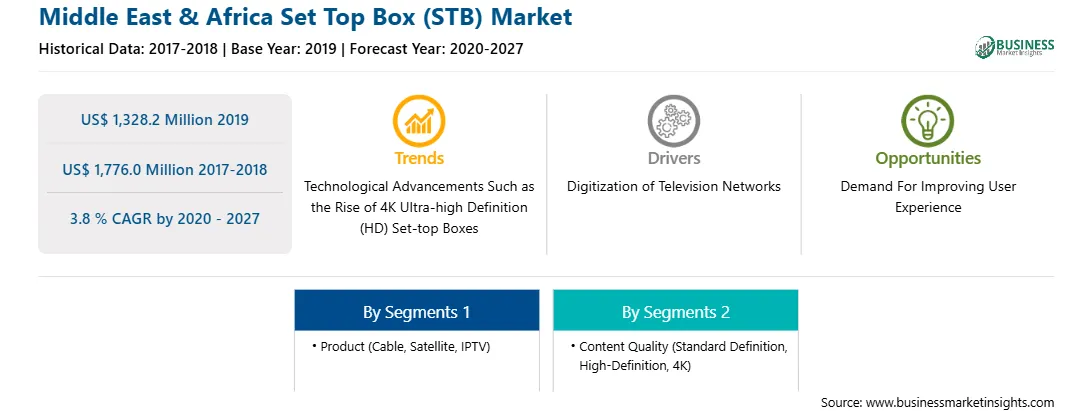

| Market size in 2019 | US$ 1,328.2 Million |

| Market Size by 2027 | US$ 1,776.0 Million |

| Global CAGR (2020 - 2027) | 3.8 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Set Top Box (STB) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA set top box (STB) market is expected to grow from US$ 1,328.2 million in 2019 to US$ 1,776.0 million by 2027; it is estimated to grow at a CAGR of 3.8 % from 2020 to 2027. Authorities steps for mandating digitalization of cable TV is expected to drive the MEA set top box (STB) market. Government regulations mandating the installation of set-top boxes, deployment of free OS-based devices by STB vendors, and analog switch-off transition in emerging countries are the prime factors escalating the demand for STBs. However, several drawbacks are associated with analogue systems; determining the number of households using cable services is difficult, and only local cable operators who also work as bill collection agents are aware of the actual figure. The broadcasters, first, transmit the signals via satellite. The multi-system operators then download these signals into their devices. Multi-system providers are now transmitting these signals to local cable operators, and cable operators are eventually responsible for transferring these signals directly to consumers’ home via a variety of channels using co-axial cables. The inability of governments to monitor the exact number of home consumers using cable TVs is the most significant drawback faced by current analog signals, but, in this case, digitization enables them to know the exact amount of cable consumption. Thus, the stringent government regulations across emerging MEA countries for the digitalization of cable TVs are fueling the growth of the MEA set-top box market.

In terms of product, the cable segment accounted for the largest share of the MEA set top box (STB) market in 2019. In terms of content quality, the standard definition (SD) segment held a larger market share of the MEA set top box (STB) market in 2019.

A few major primary and secondary sources referred to for preparing this report on the MEA set top box (STB) market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Advanced Digital Broadcast SA; Altech UEC; CommScope; COSHIP; Huawei Technologies Co., Ltd; Humax; Kaonmedia Co., Ltd.; Sagemcom; Skyworth Group Co., Ltd.

The Middle East & Africa Set Top Box (STB) Market is valued at US$ 1,328.2 Million in 2019, it is projected to reach US$ 1,776.0 Million by 2027.

As per our report Middle East & Africa Set Top Box (STB) Market, the market size is valued at US$ 1,328.2 Million in 2019, projecting it to reach US$ 1,776.0 Million by 2027. This translates to a CAGR of approximately 3.8 % during the forecast period.

The Middle East & Africa Set Top Box (STB) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Set Top Box (STB) Market report:

The Middle East & Africa Set Top Box (STB) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Set Top Box (STB) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Set Top Box (STB) Market value chain can benefit from the information contained in a comprehensive market report.