Middle East and Africa Security Inspection Market

No. of Pages: 96 | Report Code: TIPRE00018166 | Category: Technology, Media and Telecommunications

No. of Pages: 96 | Report Code: TIPRE00018166 | Category: Technology, Media and Telecommunications

The UAE is the most advanced country in this region, and its government is focusing on exploiting several technologically advanced solutions to uplift the country’s overall security. Along with the increasing acceptance toward innovative technologies in this region, the adoption of advanced technological screening solutions in the security inspection industry is also growing, which is encouraging various new players to invest in this market. Since the MEA is characterized by huge refugee populations, the demand for efficient screenings across the country borders is high. In Africa, the market is not as mature as that in the Middle East, as the later, being highly technologically advanced, and implements technologies in the security sector. Moreover, the existence of unskilled laborers, and lack of awareness toward the development and acceptance of technologies are impacting the growth of the security inspection market in this region. However, many government and nongovernment organizations are taking initiatives to educate people, to bring technological advancements towards improving the security of people across the region. Advent of automated security scanner is expected to create a significant demand for security inspection in the coming years, which is further anticipated to drive the MEA security inspection market.

The ongoing COVID-19 pandemic is having a terrible effect on MEA. Iran, Saudi Arabia, Qatar, South Africa, and the UAE are among the countries with high number of COVID-19 confirmed cases and deaths. The economic and industrial growth of these countries has been affected negatively in the past few months. The region comprises several growing economies such as the UAE, which are prospective markets for security inspection market owing to the presence of diverse customer base for electronics and semiconductor industries. The COVID-19 pandemic would have significant effects the economies, but the region is anticipated to be impacted as there is already pressure on economy of various oil-based countries due to falling oil prices. Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are the other countries facing the economic effects due to COVID-19 pandemic. However, the government bodies in the region have recently uplifted the travel restrictions, which enabled transportation but with all safety measures and social distancing norms. Thus, to ensure compliance with social distancing norms and reduce contact within security personnel and passengers, public places such as airports, borders, and railway stations are adopting contactless or automatic security inspection systems. For instance, in October 2020, Vision-Box announced the integration of digital identification platform for Emirates airline in the Dubai International Airport to offer a contactless passenger traveling experience coupled with identification, safety, and security monitoring environment.

Strategic insights for the Middle East and Africa Security Inspection provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

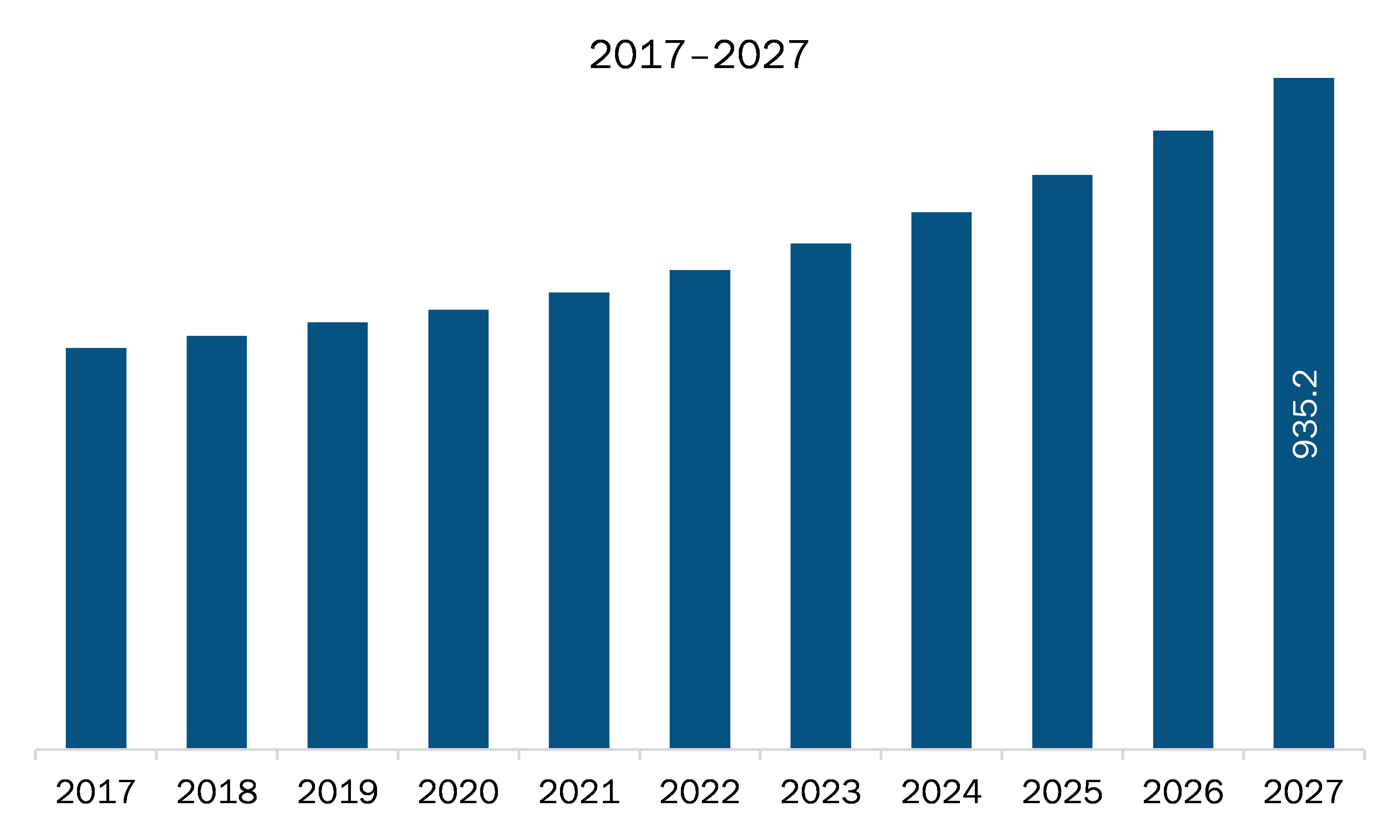

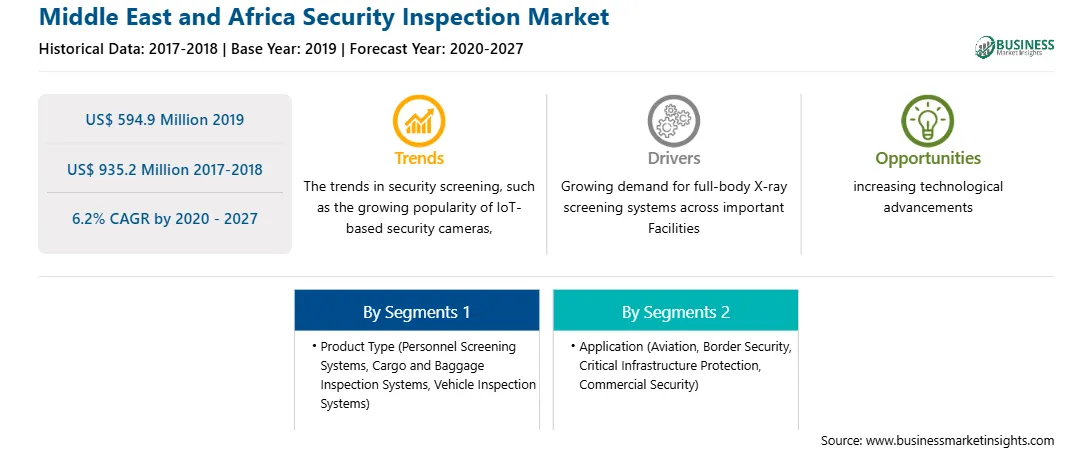

| Market size in 2019 | US$ 594.9 Million |

| Market Size by 2027 | US$ 935.2 Million |

| Global CAGR (2020 - 2027) | 6.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Security Inspection refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The security inspection market in MEA is expected to grow from US$ 594.9 million in 2019 to US$ 935.2 million by 2027; it is estimated to grow at a CAGR of 6.2% from 2020 to 2027. With the rise in terrorism worldwide, security inspection equipment has become necessary across the crowded and government facilities; thus, increasing the demand for efficient and full body scanning systems for screening humans, baggage, and cargoes, among others. X-ray screening helps in scanning objects without human intervention and scans large number of individuals and baggage in less time. Therefore, X-ray screening is being adopted among facilities such as metro stations, railways stations, airports, and sea ports. ADANI offers x-ray screening systems for detecting non-metallic weapons, plastics, liquid explosives, and drugs under clothing. Thus, owing to the demand for efficient scanning, full-body x-ray systems are gaining a significant scope across the MEA security inspection market.

In terms of product type, the personnel screening systems segment accounted for the largest share of the MEA security inspection market in 2019. In terms of application, the aviation segment held a larger market share of the MEA security inspection market in 2019.

A few major primary and secondary sources referred to for preparing this report on the security inspection market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Leidos; Nuctech Company Limited; OSI Systems, Inc.; Smiths Group plc; unival group GmbH.

Some of the leading companies are:

The Middle East and Africa Security Inspection Market is valued at US$ 594.9 Million in 2019, it is projected to reach US$ 935.2 Million by 2027.

As per our report Middle East and Africa Security Inspection Market, the market size is valued at US$ 594.9 Million in 2019, projecting it to reach US$ 935.2 Million by 2027. This translates to a CAGR of approximately 6.2% during the forecast period.

The Middle East and Africa Security Inspection Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Security Inspection Market report:

The Middle East and Africa Security Inspection Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Security Inspection Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Security Inspection Market value chain can benefit from the information contained in a comprehensive market report.