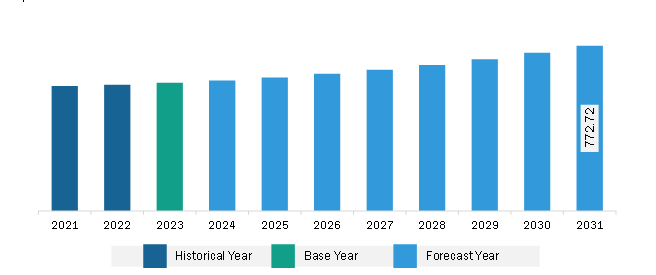

The Middle East & Africa sealants market was valued at US$ 599.30 million in 2023 and is anticipated to reach US$ 772.72 million by 2031; it is estimated to record a CAGR of 3.2% from 2023 to 2031.

Development of Renewable Sealants Bolsters Middle East & Africa Sealants Market

Renewable materials are environmentally friendly and are the subject of extensive research in various fields. Renewable materials exhibit sustainability, thereby driving their use in commercial applications. The easy availability of natural raw materials for the production of eco-friendly polymers is an added factor fueling its supply and demand. Further, due to rising concerns and awareness about the social and environmental impacts of synthesized chemicals, customers are shifting toward the utilization of renewable sealants. As a part of FOSROC Inc’s sustainability pledge for 2023, the company announced the shift of its sealant product range offered in plastic cartridges to foil packs.

Stringent government regulations pertaining to the utilization of toxic chemicals across the world have encouraged many market players to develop nontoxic alternatives and green products, aiding global sustainability goals. The rising demand for renewable materials has prompted manufacturers to develop renewable sealants for various applications. In 2020, WACKER Chemie AG introduced biomethanol-based silicone sealing compounds under the brand name—ELASTOSIL eco. The nonrenewable raw materials required for production are replaced by sustainable biomass, thereby making this product the first generation of sealant manufactured without petrochemical compounds. In 2022, Dow announced the launch of a recyclable silicone self-sealing tire solution. The company aims to meet the self-sealing tire manufacturers’ demands for high performance and sustainability through its new SiLASTIC SST-2650 self-sealing silicone. The global transition towards sustainability and circular economy, leading to research and development for novel sustainable sealants, can be one of the significant trends. Thus, the replacement of petroleum-derived polymers with renewable materials, otherwise sourced from natural sources, is expected to become a significant trend in the Middle East & Africa sealants market during the forecast period.

Middle East & Africa Sealants Market Overview

Saudi Arabia takes various supportive measures for the development of the residential and commercial construction sector. In 2017, Sakani (a Vision 2030 program) was developed by the Ministry of Housing and the Real Estate Development Fund to facilitate home ownership in the Kingdom of Saudi Arabia by creating new housing stock, allocating plots and homes to nationals, and financing their purchase. The program was initiated with the aim of reaching 70% home ownership by 2030. The Sakani program benefitted 70,000 families in the first quarter of 2021, surpassing its target of serving 51,000 families that year. Therefore, various government measures supporting the development of the residential construction industry are propelling residential construction activities, further creating demand for sealants. Thus, the progressive building and construction sector propels the Middle East & Africa sealants market in the country.

Middle East & Africa Sealants Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Middle East & Africa Sealants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Sealants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Sealants Strategic Insights

Middle East & Africa Sealants Report Scope

Report Attribute

Details

Market size in 2023

US$ 599.30 Million

Market Size by 2031

US$ 772.72 Million

Global CAGR (2023 - 2031)

3.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Application

By End-Use Industry

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Sealants Regional Insights

Middle East & Africa Sealants Market Segmentation

The Middle East & Africa sealants market is categorized into type, application, end-use industry, and country.

Based on type, the Middle East & Africa sealants market is segmented into silicone sealants, polyurethane sealants, acrylic sealants, polysulfide sealants, butyl sealants, hybrid sealant, and others. The silicone sealants segment held the largest market share in 2023. Furthermore, hybrid sealant is divided into silane modified polymer sealants, polyurethane modified acrylic sealants, and others.

In terms of application, the Middle East & Africa sealants market is categorized into waterproofing, insulation, bonding and sealing, soundproofing, and others.

Based on end-use industry, the Middle East & Africa sealants market is segmented into building & construction, automotive, electronics, healthcare, aerospace & defense, marine, energy & power, and others.

By country, the Middle East & Africa sealants market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa sealants market share in 2023.

3M Co, ACTEGA DS GmbH, Arkema SA, BASF SE, Dow Inc, HB Fuller Co, Henkel AG & Co KGaA, Momentive Performance Materials Inc, RPM International Inc, and Sika AG are some of the leading companies operating in the Middle East & Africa sealants market.

The Middle East & Africa Sealants Market is valued at US$ 599.30 Million in 2023, it is projected to reach US$ 772.72 Million by 2031.

As per our report Middle East & Africa Sealants Market, the market size is valued at US$ 599.30 Million in 2023, projecting it to reach US$ 772.72 Million by 2031. This translates to a CAGR of approximately 3.2% during the forecast period.

The Middle East & Africa Sealants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Sealants Market report:

The Middle East & Africa Sealants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Sealants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Sealants Market value chain can benefit from the information contained in a comprehensive market report.