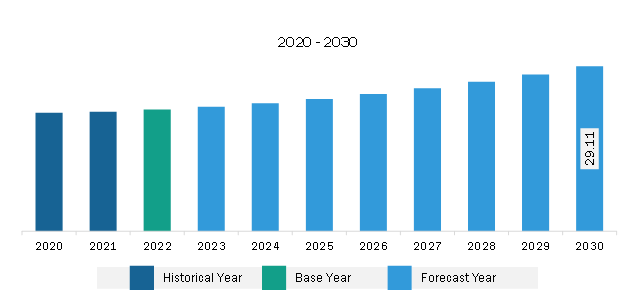

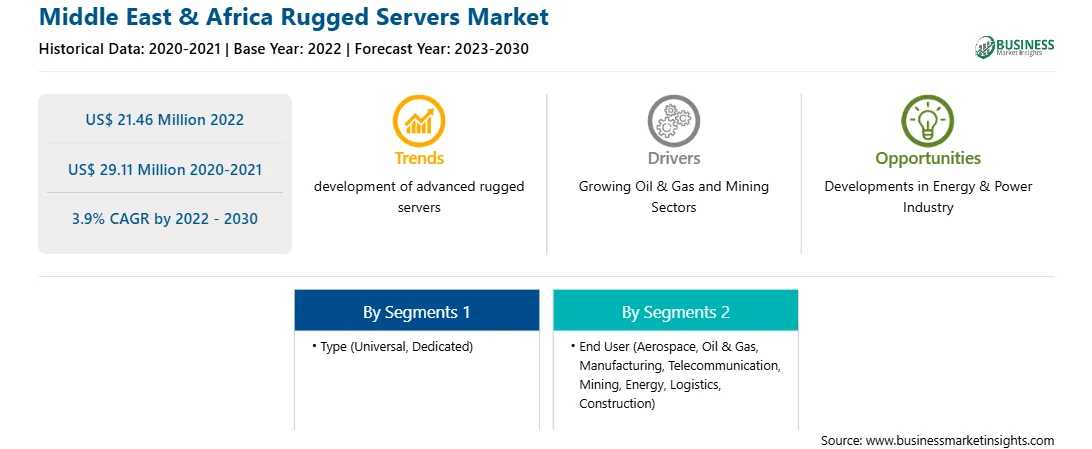

The Middle East & Africa rugged servers market was valued at US$ 21.46 million in 2022 and is expected to reach US$ 29.11 million by 2030; it is estimated to register a CAGR of 3.9% from 2022 to 2030.

Oil & gas and mining sectors have been experiencing significant growth in the US over the years. Oil & gas and mining are the two most attractive sectors from the technology developer's perspective, as these two industries are gaining strong traction for advanced technologies. The adoption of advanced technologies continues to prevail, with increasing attraction toward sophisticated and rugged data centers and servers. As oil & gas and mining sectors encounter harsh environments, which degrade the quality of traditional data centers and servers, the demand for rugged data centers and servers is increasing, fueling market growth. As modern technologies are becoming more connected and reliable, and with the evolution of the Internet of Things (IoT), companies in the oil & gas sector are seeking deployment of solutions beyond data centers, such as cloud-based servers, which are allowing them to gain productivity. This has raised the demand for ruggedized servers among companies in the oil & gas sector because of their smooth operability under harsh environmental conditions. Hence, the continuous growth in the oil & gas and mining sectors and the growing adoption of advanced technology in the above sectors to secure data are boosting the growth of the Middle East & Africa rugged servers market.

Various manufacturers are developing rugged servers for the oil & mining industry, combining operational and information technology. In January 2022, Cisco Systems, Inc. launched a new ruggedized Catalyst switch for industrial edge uses at utilities, railways, oil and gas facilities, and highway traffic flow and safety operations deployment. The new rack-mountable Catalyst Industrial Ethernet 9300 switch was built on Cisco's Catalyst 9000 series switches and used in multiple applications, including smart buildings and other industries. Such product development propels the adoption of rugged server technology in the oil & gas and mining industry.

The Middle East's economy has traditionally depended on energy, oil, and gas resources, driving economic and national prosperity. Energy industries are experiencing significant growth in terms of investments due to the rising need for electricity generation. Investments in renewables increased by 19% in 2021 in the Middle East & Africa to US$ 12.8 billion. The two regions continued to grow for their concentrated solar power sector, which aims to concentrate the sun's energy using reflective devices, including mirror panels, to produce heat, which is used to produce electricity. The Middle East & Africa added probable 5.2 gigawatts of solar power capacity in 2021, up to 3%. Off-grid installations grew rapidly, and rooftop photovoltaics outside of regulatory schemes have progressed in many countries in the Middle East & Africa. As power plants are located in remote locations and harsh environments, the need for reliable computing solutions is increasing in the region. Thus, they need rugged servers to store the data securely. Therefore, with the rising energy sector in the Middle East & Africa, the demand for rugged servers is increasing.

The rising demand for oil and gas worldwide is raising the oil and gas exploration activities in the Middle East & Africa. For example, Petroleum Development Oman (PDO) completed its 1,500th well at the Nimr cluster, a groundbreaking achievement in the Sultanate of Oman. The rugged servers are widely used in the oil & gas industry for various applications, including monitoring and control systems, data acquisition, and communication systems, as they can be used in high temperatures and shock. Therefore, the demand for rugged servers is increasing in the industry.

Strategic insights for the Middle East & Africa Rugged Servers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Rugged Servers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Rugged Servers Strategic Insights

Middle East & Africa Rugged Servers Report Scope

Report Attribute

Details

Market size in 2022

US$ 21.46 Million

Market Size by 2030

US$ 29.11 Million

Global CAGR (2022 - 2030)

3.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Rugged Servers Regional Insights

The Middle East & Africa rugged servers market is categorized into type, end user, and country.

Based on type, the Middle East & Africa rugged servers market is bifurcated into universal and dedicated. The dedicated segment held a larger market share in 2022.

In terms of end-user, the Middle East & Africa rugged servers market is categorized into aerospace, oil & gas, manufacturing, telecommunication, mining, energy, logistics, construction, and others. The oil & gas segment held the largest market share in 2022.

By country, the Middle East & Africa rugged servers market is segmented into South Africa

Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa rugged servers market share in 2022.

Dell Inc, ZMicro Inc, MILTEC RUGGED COMPUTING SOLUTIONS LLC, and HEWLETT PACKARD ENTERPRISE CO are some of the leading companies operating in the Middle East & Africa rugged servers market.

The Middle East & Africa Rugged Servers Market is valued at US$ 21.46 Million in 2022, it is projected to reach US$ 29.11 Million by 2030.

As per our report Middle East & Africa Rugged Servers Market, the market size is valued at US$ 21.46 Million in 2022, projecting it to reach US$ 29.11 Million by 2030. This translates to a CAGR of approximately 3.9% during the forecast period.

The Middle East & Africa Rugged Servers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Rugged Servers Market report:

The Middle East & Africa Rugged Servers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Rugged Servers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Rugged Servers Market value chain can benefit from the information contained in a comprehensive market report.