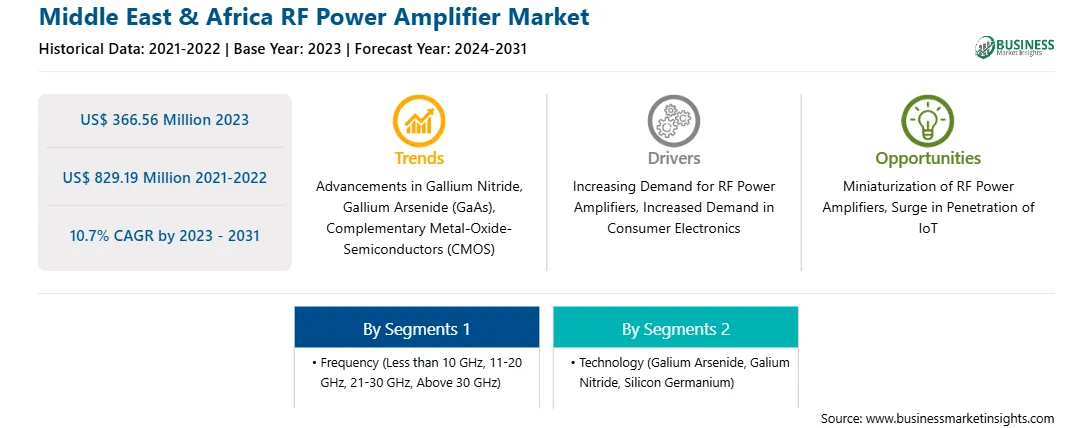

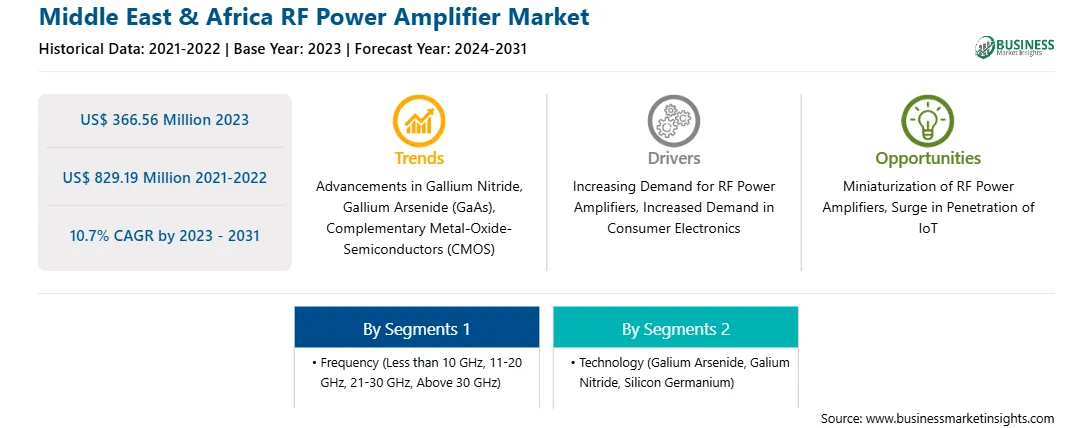

The Middle East & Africa RF power amplifier market was valued at US$ 366.56 million in 2023 and is anticipated to reach US$ 829.19 million by 2031; it is estimated to register a CAGR of 10.7% from 2023 to 2031.

GaAs, gallium nitride (GAN), and complementary metal-oxide-semiconductor (CMOS) components offer energy-efficient and compact solutions for RF power amplifiers, making them highly suitable for various applications. Gallium nitride (GAN) is well-suited for high-power and high-temperature microwave applications due to its high breakdown voltages, high electron mobility, and saturation velocity. It is ideal for RF power amplifiers used in high-speed wireless data transmission, power grids, and microwave ovens. GAN-based RF transistors are known for their ability to maintain performance at higher temperatures compared to silicon transistors, which enhances their reliability and efficiency. Gallium arsenide (GaAs) is another compound semiconductor that is widely used in RF power amplifiers. GaAs power amplifiers are commonly used in cell phones and cover various frequency ranges. They offer high power levels and are designed for maximum power-added efficiencies. Complementary metal-oxide-semiconductor (CMOS) technology is also emerging as a promising option for RF power amplifiers. CMOS-based RF power amplifiers offer advantages such as low power consumption, small form factor, and integration with other CMOS components. These characteristics make CMOS-based RF power amplifiers suitable for applications where power efficiency and compactness are crucial. The adoption of GaAs, GAN, and CMOS components in RF power amplifiers is driven by the need for energy-efficient and compact solutions. Companies are collaborating for the development of these technologies; for instance, in May 2022, STMicroelectronics and MACOM Technology Solutions Holdings Inc. achieved a significant milestone by successfully creating prototypes of radio-frequency gallium-nitride-on silicon (RF GAN-on-Si) technology. These emerging technologies are expected to continue driving the growth of the RF power amplifier market, enabling advancements in wireless communication, data centers, and other industries.

The MEA RF power amplifier market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. Governments of the MEA countries are indulging in the deployment of wireless networks such as Wi-Fi 6E to enable advanced technologies. For example, in February 2022, Saudi Arabia's Communications and Information Technology Commission (CITC) issued its "WLAN Regulations," thereby strengthening the country's global and regional dominance in the field of Wi-Fi and license-exempt technologies, activating its latest generation of high-speed telecommunication technologies, and enabling the use of emerging and future technologies. The WLAN Regulations lay out a regulatory policy for the use of WLAN applications in the country and make new spectrum accessible in the 6 GHz and 60 GHz bands to encourage the continued usage of WLAN applications. RF power amplifiers play a significant role in amplifying and adapting signals.

Strategic insights for the Middle East & Africa RF Power Amplifier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 366.56 Million |

| Market Size by 2031 | US$ 829.19 Million |

| Global CAGR (2023 - 2031) | 10.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Frequency

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa RF Power Amplifier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the Middle East & Africa RF Power Amplifier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa RF Power Amplifier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa RF Power Amplifier Strategic Insights

Middle East & Africa RF Power Amplifier Report Scope

Report Attribute

Details

Market size in 2023

US$ 366.56 Million

Market Size by 2031

US$ 829.19 Million

Global CAGR (2023 - 2031)

10.7%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Frequency

By Technology

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa RF Power Amplifier Regional Insights

The Middle East & Africa RF power amplifier market is categorized into frequency, technology, application and country.

Based on frequency, the Middle East & Africa RF power amplifier market is segmented into less than 10 GHz, 11-20 GHz, 21-30 GHz, and above 30 GHz. The less than 10 GHz segment held the largest market share in 2023.

In terms of technology, the Middle East & Africa RF power amplifier market is segmented into galium arsenide, galium nitride, silicon germanium, and others. The galium arsenide segment held the largest market share in 2023.

By application, the Middle East & Africa RF power amplifier market is segmented into consumer electronics, aerospace and defense, automotive, medical, and others. The consumer electronics segment held the largest market share in 2023.

By country, the Middle East & Africa RF power amplifier market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa RF power amplifier market share in 2023.

Qorvo Inc, NXP Semiconductors NV, Qualcomm Inc, Infineon Technologies AG, Broadcom Inc, Mitsubishi Electric Corp, STMicroelectronics NV, and Analog Devices Inc. are some of the leading companies operating in the Middle East & Africa RF power amplifier market.

The Middle East & Africa RF Power Amplifier Market is valued at US$ 366.56 Million in 2023, it is projected to reach US$ 829.19 Million by 2031.

As per our report Middle East & Africa RF Power Amplifier Market, the market size is valued at US$ 366.56 Million in 2023, projecting it to reach US$ 829.19 Million by 2031. This translates to a CAGR of approximately 10.7% during the forecast period.

The Middle East & Africa RF Power Amplifier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa RF Power Amplifier Market report:

The Middle East & Africa RF Power Amplifier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa RF Power Amplifier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa RF Power Amplifier Market value chain can benefit from the information contained in a comprehensive market report.