There was an increase in the number of home bakers across the region due to the COVID-19 pandemic. National Online Survey conducted by Packaged Facts in November–December 2020 stated that 84% of the respondents reported baking at home in 2020, which resulted in a growing number of bakers. Also, King Arthur Baking Company considers home baking an enduring consumer trend to progress over the years rather than a fad. Along with this, Google data suggested that the interest in do-it-yourself (DIY) baking was on the rise in 2020, and by April 2020, the searches for “yeast” (in English and its foreign translations) bubbled up by 300% compared with the first week of March. The food processor is mostly used to chop, slice, grate, and mix large quantities of ingredients, and all of these functions are useful in the home baking process. The processors with a powerful motor and a generous bowl capacity are used to knead dense pastry dough, and knife blades mix cake batter quickly and evenly. In addition, food processors are used for chopping nuts in large quantities and making whipped cream without any worktop mess. Thus, the growing number of home bakers across the region demands food processors for different baking applications, which fuels the growth of the residential food processors market.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is driving the growth of the Middle East & Africa residential food processors market at a substantial CAGR.

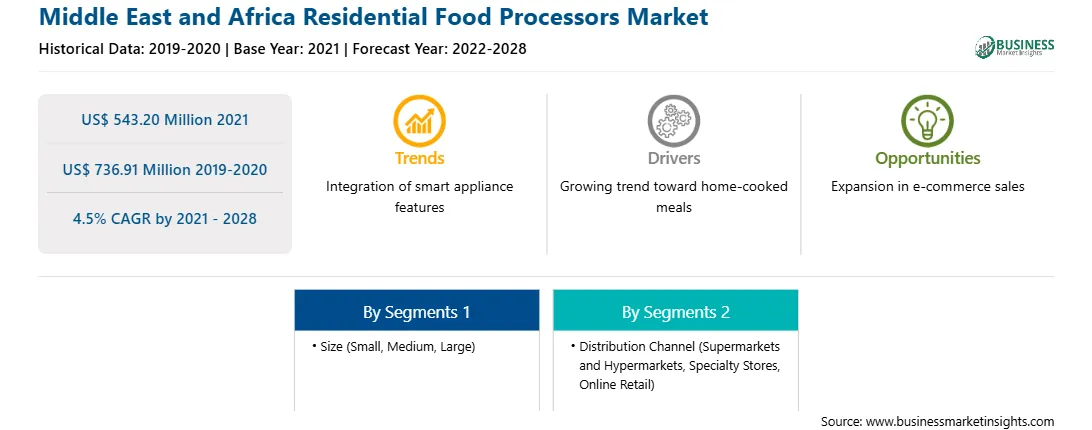

The Middle East & Africa residential food processors market is segmented on the basis of size, distribution channel, and country. Based on size, the market is segmented into small, medium, and large. In 2020, the medium segment held the largest market share; however, the small segment is expected to register the highest CAGR during the forecast period. Based on distribution channel, the Middle East & Africa residential food processors market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. In 2020, the specialty stores treatment segment held the largest market share; however, the supermarkets and hypermarkets segment is expected to register the highest CAGR during the forecast period. Further, based on country, the Middle East & Africa residential food processors market is segmented into South Africa, Saudi Arabia, Egypt, the UAE, and the Rest of the MEA. In 2020, the Rest of the MEA held the largest market share; however, the UAE is expected to grow at the fastest CAGR during the forecast period.

Koninklijke Philips N.V.; Whirlpool Corporation; Breville Group Limited; De’Longhi Appliances S.r.l.; Robert Bosch GmbH; MAGIMIX; Groupe SEB; and Spectrum Brands, Inc. are among the leading companies in the Middle East & Africa residential food processors market.

Strategic insights for the Middle East and Africa Residential Food Processors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 543.20 Million |

| Market Size by 2028 | US$ 736.91 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Size

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Residential Food Processors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa Residential Food Processors Market is valued at US$ 543.20 Million in 2021, it is projected to reach US$ 736.91 Million by 2028.

As per our report Middle East and Africa Residential Food Processors Market, the market size is valued at US$ 543.20 Million in 2021, projecting it to reach US$ 736.91 Million by 2028. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East and Africa Residential Food Processors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Residential Food Processors Market report:

The Middle East and Africa Residential Food Processors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Residential Food Processors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Residential Food Processors Market value chain can benefit from the information contained in a comprehensive market report.