Middle East & Africa Real-Time Location Systems Market

No. of Pages: 113 | Report Code: TIPRE00025558 | Category: Technology, Media and Telecommunications

No. of Pages: 113 | Report Code: TIPRE00025558 | Category: Technology, Media and Telecommunications

The Middle East & Africa real-time location systems market was valued at US$ 489.76 million in 2022 and is expected to reach US$ 2,665.38 million by 2030; it is estimated to record a CAGR of 23.6% from 2022 to 2030.

In the healthcare sector, RTLS is used to maintain patient safety and provide great experience and satisfaction. The technology can assist in tracking patient flow for throughput management, which can further help to recognize and address bottlenecks. It can also help to find solutions for the problems such as long waiting times; overcrowding in emergency rooms, outpatient clinics, and post-anesthesia care units; delay or rescheduling of surgeries; and shortage of beds for patients. RTLS technology is used in everyday operations or emergencies at hospitals to locate hospital assets such as beds, equipment, wheelchairs, and others quickly and reliably. In emergencies and when the hospital is nearing capacity, RTLS can help notify the availability of a bed when a patient is discharged. Through this, hospitals can achieve up to 50% faster bed turnover times. In addition, the technology can assist in keeping track of medical devices such as IV pumps, ICU ventilators, and defibrillators to ensure their availability when needed, thus can help to save the life of critical patients. Furthermore, by using RTLS, patients or staff members can be tracked. For instance, patients suffering from mental distress who must be watched closely can be easily tracked through RTLS technology if they wander away from their treatment area or into other parts of the facility. The RTLS-embedded solution will send an alert whenever patients cross a virtual boundary into an unauthorized area. It can provide a high level of security to patients and reduce the time of staff members, which should be devoted to directly monitoring these patients. As the RTLS technology can help track assets and patients, its demand is expected to increase in the healthcare sector during the forecast period.

The real-time location system market in the MEA is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. With the rising proliferation of smartphones, coupled with the expansion of internet connectivity across the Middle East, there is a noteworthy increase in online shopping in the region. Additionally, several countries in the MEA have a large internet user base. For instance, according to the Digital 2023: The United Arab Emirates report, in early 2023, there were ~9.38 million internet users in the UAE, indicating a 99.0% internet penetration rate. Similarly, according to the bulletin of the General Authority for Statistics (GASTAT), the rate of internet users in Saudi Arabia jumped to 94.3% in 2022, which is an increase of 1.4% from 2021. The increase in internet users in the region is expected to fuel the growth of the e-commerce industry in the MEA. According to the International Trade Administration, by 2024, the number of Saudi internet users for e-commerce is expected to reach 33.6 million, an increase of 42% from 2019. Similarly, the e-commerce market of the UAE jumped by 53% in 2020, with a record of US$ 3.9 billion in e-commerce sales. Furthermore, other countries in the MEA, such as Bahrain, Kuwait, and Qatar, are adopting the e-retail mode of distribution, which is expected to influence the growth of the MEA real-time location system market in the coming years.

The oil & gas industry in the region is one of the largest industries, producing approximately one-third of the total oil production globally. According to the International Trade Administration, the UAE is among the world's top ten largest oil producers. Nearly 96% of the country’s oil reserves, ~100 billion barrels, are in Abu Dhabi. The country also produces an average of 3.2 million barrels of petroleum and liquids per day. Similarly, Saudi Arabia has ~17% of the world’s proven petroleum reserves, making the country one of the largest petroleum exporters. Also, Saudi Arabia has the second-largest proven oil reserves in the world. Due to the Russia-Ukraine war, many countries have banned business with Russia, which has fueled the growth of the oil & gas industry in the MEA. To cater to this rising demand for oil and gas, various drilling and exploration activities are carried out in the country. These activities need to be monitored properly to stop any mishaps from occurring. The RTLS solutions can help track personnel and assets' location, improving operational efficiency at the oil and gas exploration plants. Hence, growing e-commerce industry and increasing oil and gas exploration activities are expected to propel the growth of the Middle East & Africa real-time location system market during the forecast period.

Strategic insights for the Middle East & Africa Real-Time Location Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Real-Time Location Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Real-Time Location Systems Strategic Insights

Middle East & Africa Real-Time Location Systems Report Scope

Report Attribute

Details

Market size in 2022

US$ 489.76 Million

Market Size by 2030

US$ 2,665.38 Million

Global CAGR (2022 - 2030)

23.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Offering

By Technology

By Industry Vertical

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Real-Time Location Systems Regional Insights

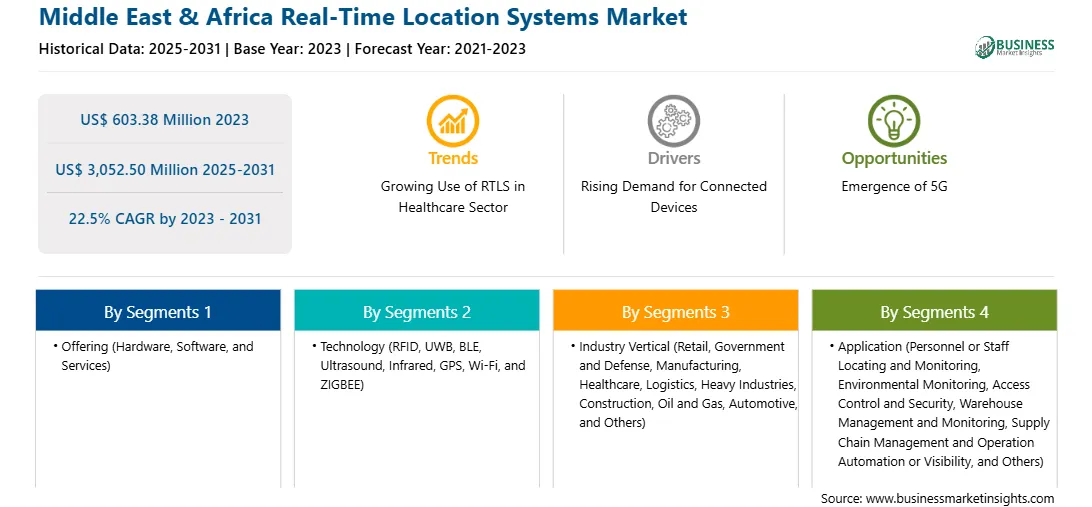

The Middle East & Africa real-time location systems market is categorized into offering, technology, industry vertical, application, and country.

Based on offering, the Middle East & Africa real-time location systems market is categorized into hardware, software, and services. The hardware segment held the largest market share in 2022.

By technology, the Middle East & Africa real-time location systems market is segmented into RFID, UWB, BLE, Ultrasound, Infrared, GPS, Wi-Fi, and ZIGBEE. The BLE segment held the largest market share in 2022.

In terms of industry vertical, the Middle East & Africa real-time location systems market is categorized into retail, government and defense, manufacturing, healthcare, logistics, heavy industries, construction, oil and gas, automotive, and others. The healthcare segment held the largest market share in 2022.

In terms of application, the Middle East & Africa real-time location systems market is segmented into personnel/staff locating and monitoring, environmental monitoring, access control and security, warehouse management and monitoring, supply chain management and operational automation/visibility, and others. The supply chain management and operational automation/visibility management segment held the largest market share in 2022.

By country, the Middle East & Africa real-time location systems market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa real-time location systems market share in 2022.

Aruba Networks, Qorvo Inc, Siemens AG, Zebra Technologies Corp, Sonitor Technologies AS, and Stanley Black & Decker Inc are some of the leading companies operating in the Middle East & Africa real-time location systems market.

The Middle East & Africa Real-Time Location Systems Market is valued at US$ 489.76 Million in 2022, it is projected to reach US$ 2,665.38 Million by 2030.

As per our report Middle East & Africa Real-Time Location Systems Market, the market size is valued at US$ 489.76 Million in 2022, projecting it to reach US$ 2,665.38 Million by 2030. This translates to a CAGR of approximately 23.6% during the forecast period.

The Middle East & Africa Real-Time Location Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Real-Time Location Systems Market report:

The Middle East & Africa Real-Time Location Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Real-Time Location Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Real-Time Location Systems Market value chain can benefit from the information contained in a comprehensive market report.