Middle East & Africa Radiation-Hardened Electronics Market

No. of Pages: 132 | Report Code: BMIRE00025601 | Category: Electronics and Semiconductor

No. of Pages: 132 | Report Code: BMIRE00025601 | Category: Electronics and Semiconductor

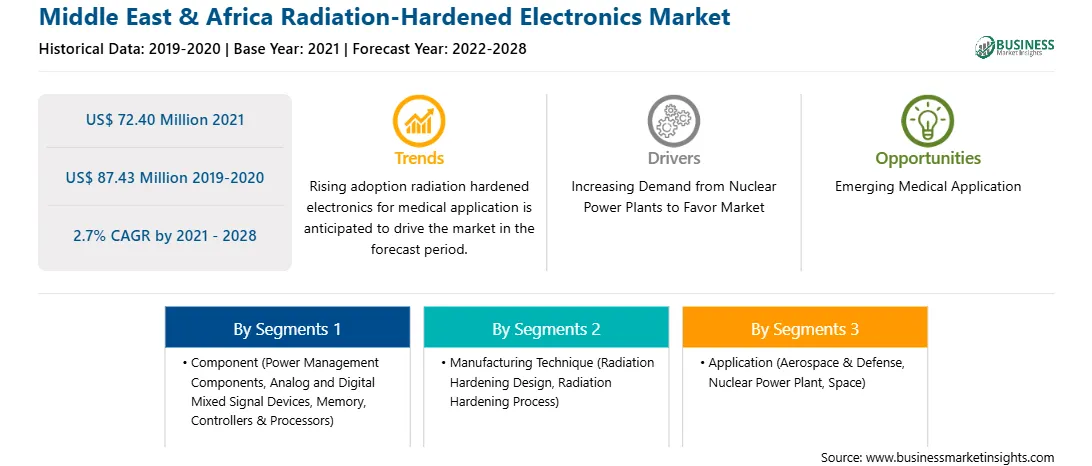

The MEA radiation-hardened electronics market is expected to grow from US$ 72.40 million in 2021 to US$ 87.43 million by 2028; it is estimated to grow at a CAGR of 2.7% from 2021 to 2028.

The increase in demand for radiation-hardened electronics by the end-use industries has influenced manufacturers to invest in product development. Major players operating in the market include BAE Systems; Microchip Technology Inc.; Texas Instruments Incorporated; Renesas Electronics Corporation; and Xilinx, Inc. Some of the recent product developments across the region have taken place in recent years. For instance, in October 2021, VORAGO Technologies announced Arm Cortex-M4 VA41628 and VA41629, two new radiation-hardened microcontrollers designed to give flexibility in space-based missions for the aerospace & defense sector. Consumers of the product will be able to upgrade from previous generations of rad-hard arm microcontrollers with functional compatibility and a more powerful entry-level M4 core and scale up to more highly integrated M4 core options with code compatibility owing to the new product additions to VORAGO's M4 family. Further, Renesas Electronics Corporation introduced a new radiation-hardened 16-channel current driver with an integrated 4-bit decoder in May 2019 to help satellite command and telemetry systems reduce their size, weight, and power (SWaP). The ISL72814SEH combines the decoder, input level shifter, and 16 current driver arrays in a single monolithic IC. For medium earth orbit (MEO), geosynchronous earth orbit (GEO), highly elliptical orbit (HEO), and deep space mission profiles, the device allows satellite designers to considerably boost system capacity while reducing solution footprint by 50%. The rise in investment in product development by the radiation-hardened electronic manufacturers is expected to contribute to the growth of the radiation-hardened electronics market over the forecast period.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA radiation-hardened electronics market. The MEA radiation-hardened electronics market is expected to grow at a good CAGR during the forecast period.

MEA Radiation-Hardened Electronics Market Segmentation

The MEA radiation-hardened electronics market is segmented based on component, manufacturing technique, application, and country. Based on component, the market is segmented into power management components, analog and digital mixed signal devices, memory, and controllers & processors. The power management component segment dominated the market in 2021 and is expected to be the fastest-growing segment during the forecast period. Based on manufacturing technique, the market is segmented into radiation hardening by design (RHBD) and radiation hardening by process (RHBP). The radiation hardening by design (RHBD) segment dominated the market in 2021. It is anticipated to be the fastest-growing segment during the forecast period. Based on application, the market is segmented into aerospace & defense, nuclear power plant, space, and others. The space segment dominated the market in 2021, and the others segment is expected to be the fastest-growing segment during the forecast period. Based on country, the MEA radiation-hardened electronics market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA.

BAE Systems; Data Device Corporation; Honeywell International Inc.; Infineon Technologies AG; Microchip Technology Inc.; Renesas Electronics Corporation; STMicroelectronics; Texas Instruments Incorporated; VORAGO Technologies; and Xilinx, Inc. (AMD) are among the leading companies in the MEA radiation-hardened electronics market.

Strategic insights for the Middle East & Africa Radiation-Hardened Electronics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 72.40 Million |

| Market Size by 2028 | US$ 87.43 Million |

| Global CAGR (2021 - 2028) | 2.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Radiation-Hardened Electronics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa Radiation-Hardened Electronics Market is valued at US$ 72.40 Million in 2021, it is projected to reach US$ 87.43 Million by 2028.

As per our report Middle East & Africa Radiation-Hardened Electronics Market, the market size is valued at US$ 72.40 Million in 2021, projecting it to reach US$ 87.43 Million by 2028. This translates to a CAGR of approximately 2.7% during the forecast period.

The Middle East & Africa Radiation-Hardened Electronics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Radiation-Hardened Electronics Market report:

The Middle East & Africa Radiation-Hardened Electronics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Radiation-Hardened Electronics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Radiation-Hardened Electronics Market value chain can benefit from the information contained in a comprehensive market report.