Middle East & Africa Probiotic Supplements Market

No. of Pages: 113 | Report Code: BMIRE00027944 | Category: Consumer Goods

No. of Pages: 113 | Report Code: BMIRE00027944 | Category: Consumer Goods

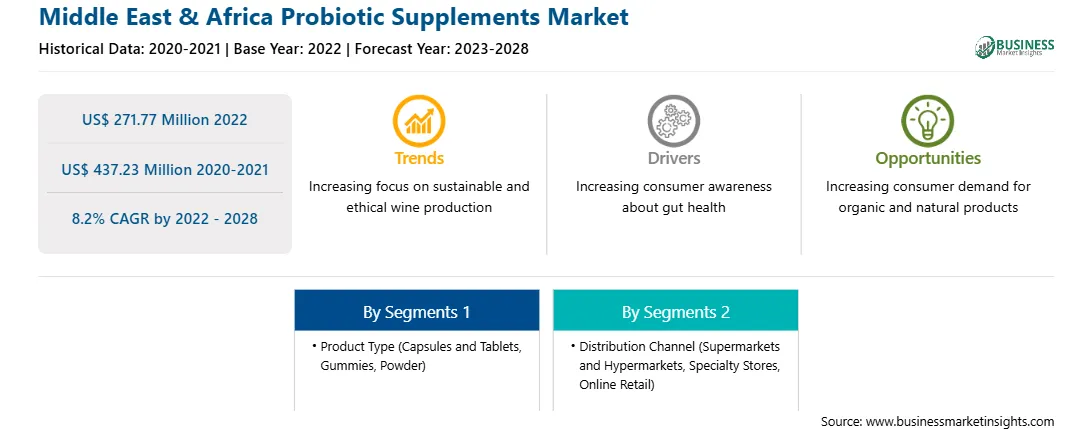

Rising Strategic Development Initiatives is Driving the Middle East & Africa Probiotic Supplements Market

The probiotic supplements market is growing with an upward trend, and manufacturers are making significant investments in research & development, partnerships, and collaborations to launch innovative products to tap into emerging market opportunities. Jarrow Formula launched probiotic gummy supplements in three variations—probiotic duo gummies, probiotic and prebiotic gummies, and probiotic and immune gummies. They are pectin-based, non-GMO (genetically modified organism), gluten-free, and vegetarian. They contain no artificial flavors, sweeteners, colors, or preservatives that address various consumer requirements. Such developments are expected to provide immense growth opportunities to the probiotic supplements market in the coming years. Consumers across the globe are getting familiar with probiotics and their potential benefits, leading to the introduction of innovative probiotic products in various delivery formats, including capsules, powders, liquids, and other forms. For instance, in 2018, Activ Nutritional LLC launched Viactiv Digestive Health Soft Chews with its proprietary, heat-treated, and dried Lactobacillus LB Fermentate, expanding the iconic Viactiv supplement brand into the digestive health category. Further, the manufacturers are expanding their retail network in various countries to widen their customer base and boost revenues. Thus, rising strategic development initiatives is expected to significantly drive the Middle East & Africa probiotic supplements market.

Middle East & Africa Overview

The Middle East & Africa probiotic supplements market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East & Africa is an emerging market in probiotic supplements due to rising health awareness, growing use of self-medication, developing distribution networks, and establishment of new manufacturing units. According to the US Department of Agriculture, a study conducted in Oman has stated that 61.8% of over the counter (OTC) probiotic supplements consisted of multistrain probiotic microorganisms, while 32.1% consisted of dairy-based probiotic supplements. Furthermore, OTC probiotic supplements offer a variety of probiotic microorganisms and higher colony forming unit (CFU) per intake. All these factors are projected to boost the demand for probiotic supplements across the Middle East & Africa.

Strategic insights for the Middle East & Africa Probiotic Supplements provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Probiotic Supplements refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Probiotic Supplements Strategic Insights

Middle East & Africa Probiotic Supplements Report Scope

Report Attribute

Details

Market size in 2022

US$ 271.77 Million

Market Size by 2028

US$ 437.23 Million

Global CAGR (2022 - 2028)

8.2%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Distribution Channel

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Probiotic Supplements Regional Insights

Middle East & Africa Probiotic Supplements Market Segmentation

The Middle East & Africa probiotic supplements market is segmented into product type, distribution channel, and country.

Based on product type, the Middle East & Africa probiotic supplements market is sub segmented into capsules and tablets, gummies, powder, and others. The capsules and tablets segment registered the largest market share in 2022.

Based on distribution channel, the Middle East & Africa probiotic supplements market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held a larger market share in 2022.

Based on country, the Middle East & Africa probiotic supplements market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the market share in 2022.

Bayer AG; BioGaia AB; Church & Dwight Co., Inc.; GNC Holdings, LLC; Nature's Bounty; Nestlé S.A.; NOW Foods; and SFI Health are the leading companies operating in the Middle East & Africa probiotic supplements market.

The Middle East & Africa Probiotic Supplements Market is valued at US$ 271.77 Million in 2022, it is projected to reach US$ 437.23 Million by 2028.

As per our report Middle East & Africa Probiotic Supplements Market, the market size is valued at US$ 271.77 Million in 2022, projecting it to reach US$ 437.23 Million by 2028. This translates to a CAGR of approximately 8.2% during the forecast period.

The Middle East & Africa Probiotic Supplements Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Probiotic Supplements Market report:

The Middle East & Africa Probiotic Supplements Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Probiotic Supplements Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Probiotic Supplements Market value chain can benefit from the information contained in a comprehensive market report.