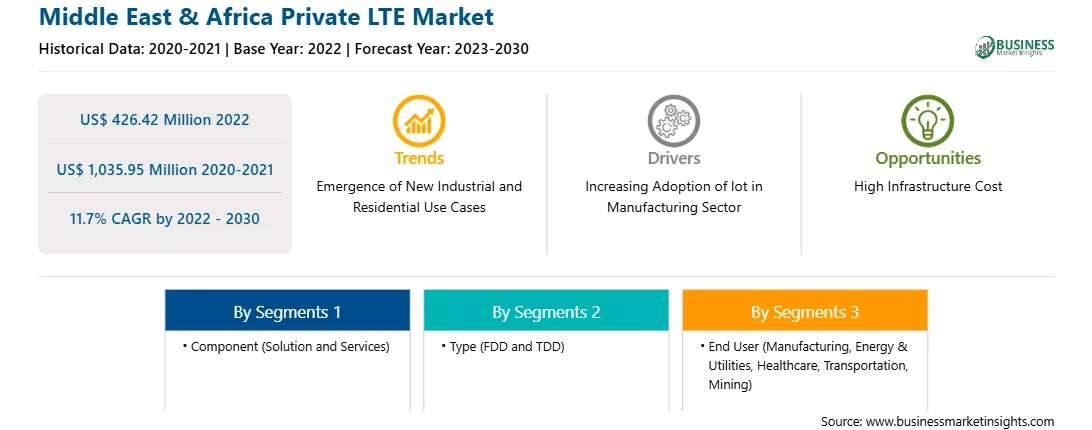

The Middle East & Africa private LTE market was valued at US$ 426.42 million in 2022 and is expected to reach US$ 1,035.95 million by 2030; it is estimated to grow at a CAGR of 11.7% from 2022 to 2030.

Emergence of New Industrial and Residential Use Cases Bolsters Middle East & Africa Private LTE Market.

The advent of private LTE has brought many new use cases for industrial and residential uses that are anticipated to be enabled by evolving networks over the years. Fixed Wireless Access (FWA) for residential use and distributed cloud for industries could be examples of this kind. A market competing with fixed broadband access is driving a need for higher bandwidth. The objective is to provide fiber-like speeds that meet the demand for residential streaming services, such as TV and video. Typical data speed demand ranges from 100 to 4,000 Mbps. However, there is a limited business case to provide fixed broadband alternatives. Specific data speed demand ranges from 50 to 200 Mbps.

Networks are evolving to handle utilize cases with different demands on integrity, mobility, data rates, latency, scalability, security, reliability, and availability. Such requests can be met by distributed cloud architecture, which enables application deployment at distributed, central, and edge sites to meet specific use case requirements. Compared to what is possible from major sites, providing services closer to the user reduces the network transport delay and enables faster time to action, content, and control. Executing workloads closer to the network edge also reduces the need for backhaul bandwidth and capacity, and the distribution of workloads and storage over multiple sites increases availability. Overall, the emergence of these new use cases is making private LTE a more attractive option for a wider range of industries and individuals. As the technology matures and becomes more cost-effective, more innovative applications are expected to emerge, further fueling the growth of the Middle East & Africa private LTE market.

The private LTE market in the Middle East & Africa consists of Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. The Gulf countries are economically developed, whereas several African countries are yet to match up to the economic conditions of these countries. The high economy of the Middle Eastern countries is set to favor higher infrastructural investments by the Middle East & Africa Government for developing the telecommunication sector.

Moreover, the pharmaceutical industry in the UAE is experiencing growth owing to the government support through incentive schemes for a brand-friendly environment, growing healthcare needs, and increasing domestic production. Several new pharmaceutical plants are being launched in the country. For instance, in October 2023, Himalaya Wellness Company LLC expanded in UAE with groundbreaking of US$ 54.44 million Herbal Pharmaceutical Factory at Dubai Industrial City. Additionally, other Middle East countries, such as Oman and Israel, are also expected to witness the growth of its manufacturing sector. The Oman government is supporting the manufacturing industry by introducing several incentives as well as promoting FDIs. Further, it has created special economic zones to enhance manufacturing growth. The growth of the manufacturing industry in the region is anticipated to further propel the market demand for the implementation of private LTE in the MEA region.

Moreover, the implementation of private LTE is increasing in the MEA. For instance, in November 2023, Ooredoo, a Qatari mobile provider, implemented a Nokia private LTE network for the oil & gas industry, including both offshore and onshore operations. Thus, considering the above parameters, the Middle East & Africa private LTE market is boosting in Middle East & Africa.

Strategic insights for the Middle East & Africa Private LTE provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Private LTE refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Private LTE Strategic Insights

Middle East & Africa Private LTE Report Scope

Report Attribute

Details

Market size in 2022

US$ 426.42 Million

Market Size by 2030

US$ 1,035.95 Million

Global CAGR (2022 - 2030)

11.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Type

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Private LTE Regional Insights

The Middle East & Africa private LTE market is segmented based on component, type, end user, and country. Based on component, the Middle East & Africa private LTE market is segmented into solution and services. The services is further bifurcated into professional and managed services. The solution segment held a larger market share in 2022.

Based on type, the Middle East & Africa private LTE market is bifurcated into FDD and TDD. The FDD held a larger market share in 2022.

Based on end user, the Middle East & Africa private LTE market is segmented into manufacturing, energy & utilities, healthcare, transportation, mining, and others. The manufacturing held the largest market share in 2022.

Based on country, the Middle East & Africa private LTE market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa private LTE market share in 2022.

Cisco Systems Inc, Telefonaktiebolaget LM Ericsson, Huawei Investment & Holding Co Ltd, Samsung Group, Verizon Communications Inc, Star Solutions, and Kyndryl Holdings Inc are some of the leading companies operating in the Middle East & Africa private LTE market.

The Middle East & Africa Private LTE Market is valued at US$ 426.42 Million in 2022, it is projected to reach US$ 1,035.95 Million by 2030.

As per our report Middle East & Africa Private LTE Market, the market size is valued at US$ 426.42 Million in 2022, projecting it to reach US$ 1,035.95 Million by 2030. This translates to a CAGR of approximately 11.7% during the forecast period.

The Middle East & Africa Private LTE Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Private LTE Market report:

The Middle East & Africa Private LTE Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Private LTE Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Private LTE Market value chain can benefit from the information contained in a comprehensive market report.