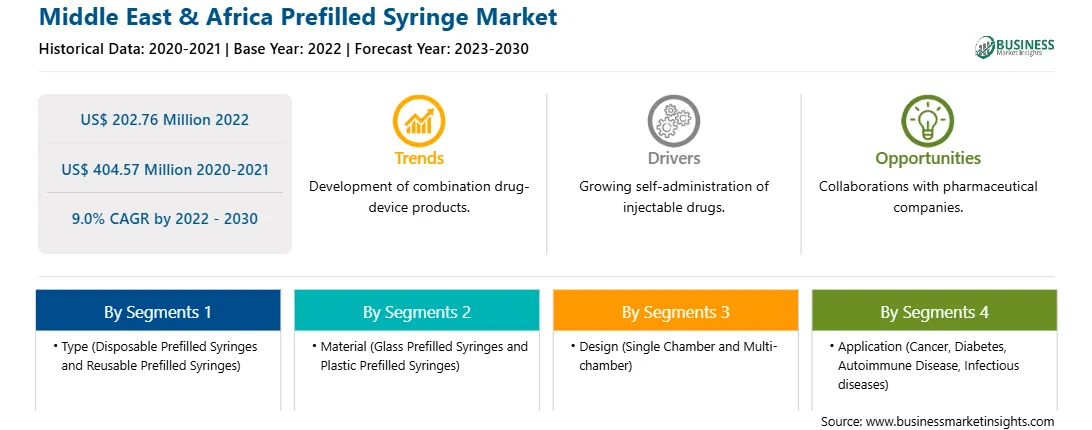

The Middle East & Africa prefilled syringe market was valued at US$ 202.76 million in 2022 and is expected to reach US$ 404.57 million by 2030; it is estimated to grow at a CAGR of 9.0% from 2022 to 2030.

Over a period of time, various aspects of the healthcare industry have been developed to simplify the working process of healthcare professionals and enhance the quality of care by ensuring the safety of patients and healthcare providers. The prefilled syringes have undergone several innovation updates and developments to provide comfort and safety along with a reduction in biomedical waste. Some of the innovations made by manufacturers in prefilled syringes are mentioned below:

• West Pharmaceutical Services provides line extensions that include insert needle syringes and more needle sizes with product volume options. In the past three to five years, there have been more approvals in the larger 2.5-ml format. The larger volume reduces the amount of syringes needed per dose and enhances efficiency and comfort. There is a growing trend of finer needles too; smaller, thinner needles mean less pain.

• Prefilled syringes provide sustainability benefits by reducing multi-dose vials and related production and handling, along with product waste associated with leftover products. There is a lot of room for improvement as the current systems create a lot of waste, owing to which attempts are being made to reduce scrap rates and reuse the tubs that hold nested containers through the fill-finish process.

• Suppliers are looking for designs to prevent needlestick injuries, protect product quality by minimizing particulates, and eliminate product interaction with tungsten or silicone residues. Gerresheimer Biological Solutions provides metal-free syringes manufactured from tungsten-sensitive products. With this patented technology, the pin meant for conical shaping is made of a ceramic rather than tungsten or other metal.

• Silicone oil is commonly used to enhance syringe performance, but it can cause aggregation and particulate issues for sensitive biologicals. The ophthalmologists and regulatory bodies are urging them to move away from siliconized formats. Some patients experience reactions to silicone, and over time, with repeated injections, the material can become accumulated. One silicone-free option is paired with ImproJect plungers from W.L. Gore & Associates and SCHOTT BioPure silicone-free syringes from SCHOTT. This system opens the door for many sensitive products to enter the prefilled syringe format. Thorough attention to syringe geometry and dimensions of the syriQ BioPure syringes helps ensure a constant gliding force and injection duration over the shelf-life of the product and upholds container closure integrity without the use of silicone. Minimal cannula adhesive and ultra-low tungsten residuals reduce the extractible profile and the potential for container and drug interactions.

COVID-19 has increased the development of prefilled syringes, particularly with regard to low-temperature storage. As of now, all COVID-19 vaccines are available in vials, but in the next two to four years, it is expected to be available in novel type of syringe that handles −80ºC.

Therefore, increasing innovations in the prefilled syringes are expected to promote the growth of the prefilled syringes market in the near future

The Middle East & Africa prefilled syringes market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The market growth in this region is attributed to the increasing incidence of diabetes, infertility, and other chronic diseases, which triggered several companies to focus on product development, i.e., prefilled syringes.

Israel, Iran, Iraq, Kuwait, Oman, Egypt, and Kenya are a few of the major countries in the Rest of Middle East & Africa. According to the National Library of Medicine (NLM), ~415,800 adults in Israel had diabetes in 2022, which is 8.1% of the adult population. According to the Health Research Policy and Systems in 2020, the prevalence of infertility in Iran ranges from 10.3% to 24.9%. Moreover, an increase in product launches in prefilled syringe format for the treatment of chronic disorders is expected to promote the market growth. For instance, in February 2023, Teva Neuroscience, Inc. Israel, started the marketing of COPAXONE for treating multiple sclerosis by using prefilled syringe. Thus, the growing number of diabetes, infertility cases and other chronic disorders, along with frequent product launches, are the factors bolstering the growth of the prefilled syringe market in the Rest of Middle East & Africa.

The Middle East & Africa prefilled syringe market is segmented based on type, material, design, application, distribution channel, and country.

Based on type, the Middle East & Africa prefilled syringe market is bifurcated into disposable prefilled syringes and reusable prefilled syringes. The disposable prefilled syringes segment held a larger Middle East & Africa prefilled syringe market share in 2022.

Based on material, the Middle East & Africa prefilled syringe market is bifurcated into glass prefilled syringes and plastic prefilled syringes. The glass prefilled syringes segment held a larger Middle East & Africa prefilled syringe share in 2022.

Based on designs, the Middle East & Africa prefilled syringe market is bifurcated into single chamber and multi chamber. The single chamber segment held a larger Middle East & Africa prefilled syringe share in 2022.

In terms of application, the Middle East & Africa prefilled syringe market is segmented into cancer, diabetes, autoimmune disease, infectious diseases, and others. The others segment held the largest Middle East & Africa prefilled syringe share in 2022.

By distribution channel, the Middle East & Africa prefilled syringe market is segmented into hospital pharmacy, retail pharmacy, and online channel. The hospital pharmacy segment held the largest Middle East & Africa prefilled syringe market share in 2022.

Based on country, the Middle East & Africa prefilled syringe market is categorized into the UAE, South Africa, Saudi Arabia, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa prefilled syringe market in 2022.

B Braun SE, Shandong Weigao Group Medical Polymer Co Ltd, Schott AG, Nipro Corp, Becton Dickinson and Co, Baxter International Inc, Terumo Corp, and Ypsomed Holding AG are some of the leading companies operating in the Middle East & Africa prefilled syringe market.

Strategic insights for the Middle East & Africa Prefilled Syringe provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 202.76 Million |

| Market Size by 2030 | US$ 404.57 Million |

| Global CAGR (2022 - 2030) | 9.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Prefilled Syringe refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. B Braun SE

2. Shandong Weigao Group Medical Polymer Co Ltd

3. Schott AG

4. Nipro Corp

5. Becton Dickinson and Co

6. Baxter International Inc

7. Terumo Corp

8. Ypsomed Holding AG

The Middle East & Africa Prefilled Syringe Market is valued at US$ 202.76 Million in 2022, it is projected to reach US$ 404.57 Million by 2030.

As per our report Middle East & Africa Prefilled Syringe Market, the market size is valued at US$ 202.76 Million in 2022, projecting it to reach US$ 404.57 Million by 2030. This translates to a CAGR of approximately 9.0% during the forecast period.

The Middle East & Africa Prefilled Syringe Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Prefilled Syringe Market report:

The Middle East & Africa Prefilled Syringe Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Prefilled Syringe Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Prefilled Syringe Market value chain can benefit from the information contained in a comprehensive market report.