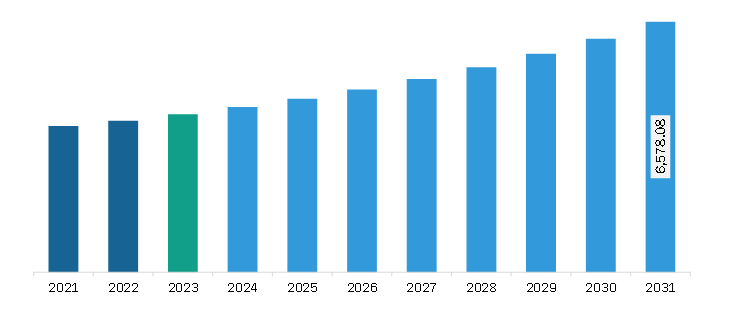

The Middle East & Africa plastic pipes market was valued at US$ 4,140.64 million in 2023 and is projected to reach US$ 6,578.08 million by 2031; it is anticipated to register a CAGR of 6.0% from 2023 to 2031.

Use of Sustainable Materials in Plastic Pipe Manufacturing Bolster Middle East & Africa Plastic Pipes Market

Sustainable and eco-friendly materials are the subject of extensive research in various fields, fueled by their increasing utilization in commercial applications. The easy availability of natural raw materials for the production of eco-friendly polymers is an added factor boosting their supply and demand. Further, due to the rising concerns and awareness about the social and environmental impacts of synthesized chemicals, customers are shifting toward the utilization of sustainably manufactured plastic pipes. Stringent government regulations on the use of toxic chemicals across the globe have encouraged many market players to develop nontoxic alternatives and green products, aiding global sustainability goals. The global transition toward sustainability and circular economy leads to increased research and development activities associated with plastic pipes.

In response to growing environmental concerns, PVC pipe manufacturers are exploring innovative formulations integrating bio-based plasticizers and stabilizers, such as Bio-PVC, aiming to decrease reliance on conventional additives. For instance, in June 2024, Hanwha designed a bio-attributed PVC by integrating biomaterials into its PVC production. This development highlights the commitment of market players to reduce ecological impact and foster an eco-friendly and socially responsible approach to PVC pipe production. In addition, the key market players are adopting closed-loop recycling technologies to recycle PVC and PE. This strategic closed-loop recycling technology addresses environmental concerns associated with plastic disposal and determines a commitment to circular economy principles. Thus, the use of sustainable materials in plastic pipe manufacturing is expected to become a significant trend in the plastic pipes market during the forecast period.

Middle East & Africa Plastic Pipes Market Overview

Egypt, Nigeria, Oman, Qatar, Kuwait, Iran, Turkey, and Kenya are among the major economies contributing to the plastic pipes market in the Rest of Middle East & Africa. These countries are focused on making significant investments in the construction industry, which fuels plastic pipes market growth in the Rest of Middle East & Africa. For example, as per the Ministry of Foreign Affairs, in 2022, Kuwait invested in various projects worth more than US$ 60 billion in line with its Vision Kuwait 2035 strategy. Also, an additional investment of US$ 100 billion is expected to be made over the coming years. Thus, the development of construction industry in the rest of Middle East & Africa is expected to drive the market growth.

Middle East & Africa Plastic Pipes Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Middle East & Africa Plastic Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Plastic Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Plastic Pipes Strategic Insights

Middle East & Africa Plastic Pipes Report Scope

Report Attribute

Details

Market size in 2023

US$ 4,140.64 Million

Market Size by 2031

US$ 6,578.08 Million

Global CAGR (2023 - 2031)

6.0%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Material Type

By Application

By End-Use Industry

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Plastic Pipes Regional Insights

Middle East & Africa Plastic Pipes Market Segmentation

The Middle East & Africa plastic pipes market is categorized into type, material type, application, end-use industry, and country.

Based on type, the Middle East & Africa plastic pipes market is bifurcated into corrugated and smooth wall. The smooth wall segment held a larger market share in 2023.

By material type, the Middle East & Africa plastic pipes market is divided into polyvinyl chloride, high-density polyethylene, polypropylene, and others. The polyvinyl chloride segment held the largest market share in 2023.

In the terms of application, the Middle East & Africa plastic pipes market is segmented into water supply, sewage and drainage, irrigation, gas distribution, and others. The water supply segment held the largest market share in 2023.

Based on end-use industry, the Middle East & Africa plastic pipes market is segmented into construction and infrastructure, water and wastewater management, oil and gas, and others. The construction and infrastructure segment held the largest market share in 2023.

By country, the Middle East & Africa plastic pipes market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa plastic pipes market share in 2023.

Advanced Drainage Systems Inc, Aliaxis Holdings SA, Genuit Group Plc, Georg Fischer Ltd, and Reboca are some of the leading companies operating in the Middle East & Africa plastic pipes market.

The Middle East & Africa Plastic Pipes Market is valued at US$ 4,140.64 Million in 2023, it is projected to reach US$ 6,578.08 Million by 2031.

As per our report Middle East & Africa Plastic Pipes Market, the market size is valued at US$ 4,140.64 Million in 2023, projecting it to reach US$ 6,578.08 Million by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The Middle East & Africa Plastic Pipes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Plastic Pipes Market report:

The Middle East & Africa Plastic Pipes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Plastic Pipes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Plastic Pipes Market value chain can benefit from the information contained in a comprehensive market report.