The MEA Pharmaceutical Isolator market is analyzed based on Saudi Arabia, UAE, South Africa, and the rest of MEA. In the current market scenario, the Middle East region is experiencing increasing pharmaceutical companies and manufacturing process. Saudi Arabia is leading the market. Saudi Arabia is one of the critical countries in the Middle Eastern region that has significant scope for biopharmaceutical contract manufacturing. The healthcare system in the country is developing at a rapid pace as well as an increasing number of sponsors are developing medical and research teams in the country. A sharp increase in the state health budget is also expected to create increasing demand for biopharmaceutical contract manufacturing in the country. Additionally, the country has a large number of clinical trials in progress. Moreover, Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), the listed Saudi Arabia-based company engaged in the production and marketing of medicines and medical appliances, has acquired a 48% stake in EirGen Pharma Limited, the Ireland-based pharmaceutical company, for a consideration of US$24 million. Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) has recently acquired an advanced integrated system for contamination control from Fedegari of Italy. Several players have expanded their business in the market by acquisitions, mergers, partnerships, and other strategic alliances. For instance, in May 2017, the latest manufacturing facility built by a Middle East partnership in King Abdullah Economic City, Jeddah. The project is the first Emirati-Saudi investment partnership in the pharmaceutical industry. This is helpful for drug discovery, and thus the healthcare policies favoring private sectors are expected to drive the growth of the pharmaceutical isolators market in the region.

In case of COVID-19, MEA is highly affected especially South Africa. The coronavirus pandemic has become the largest challenge to this region, as they are low-cost regions. For instance, due to the high uncertainty of the spread of COVID-19, the impact on Africa is expected to be severe, given the continent’s exposure to China. These regions are widely dependent on the import of pharmaceutical and biopharmaceutical equipment. The lockdown situation in many countries has resulted in no trade in foreign countries. Thus, the countries in the MEA have started producing API in their domestic market. However, the cost of production was a challenge for several countries. The Saudi government policies are favored of domestic pharmaceutical manufacturers including not any import duties on raw materials & intermediate products and interest-free funding support the growth of the pharmaceutical market in this region. Similarly, increasing incidence of COVID-19 create huge demand for aseptic processing of pharmaceutical products. This scenario is expected to offer several growth opportunities for pharmaceutical isolator market. In South Africa, adoption of aseptic processing during pandemic has significantly witnessed high growth, which is expected to increase the demand for pharmaceutical isolator market. For instance, Esco Technologies Pty Ltd has offered Esco Class II Biological Safety Cabinets to various laboratories and testing facilities in South Africa. Biosafety cabinets pose great importance in handling biohazards in COVID-19 testing facilities. All these factors will positively impact the pharmaceutical isolator market.

Strategic insights for the Middle East and Africa Pharmaceutical Isolator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

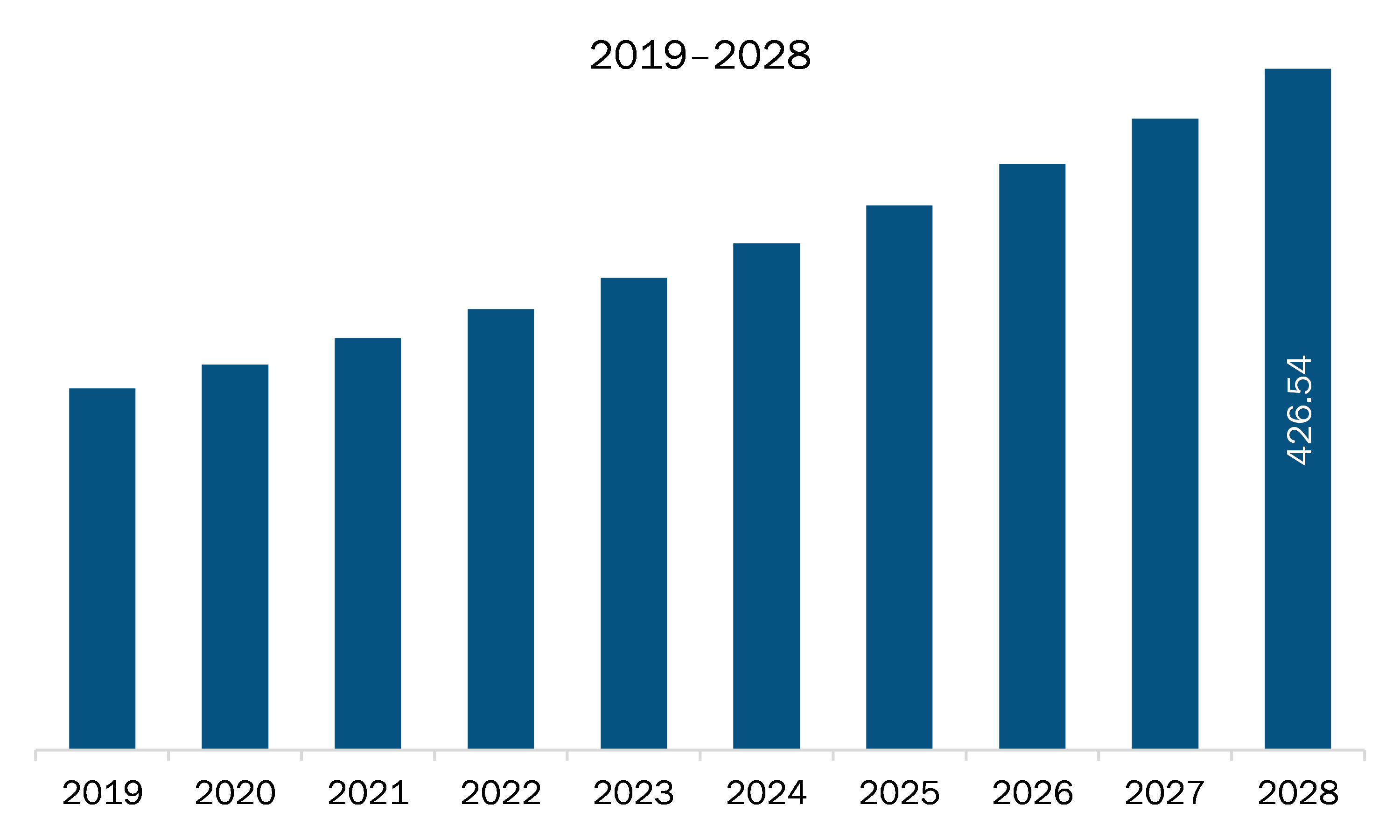

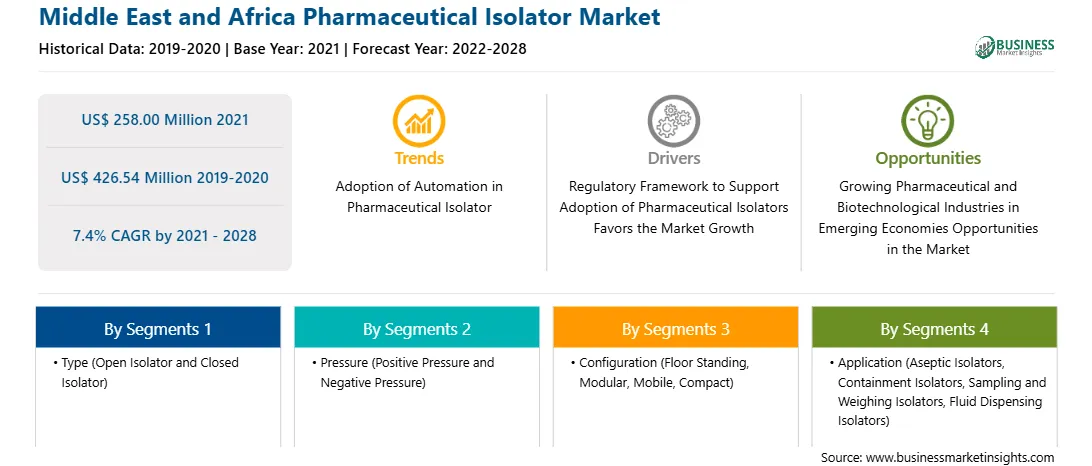

| Market size in 2021 | US$ 258.00 Million |

| Market Size by 2028 | US$ 426.54 Million |

| Global CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Pharmaceutical Isolator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA pharmaceutical isolator market is expected to grow from US$ 258.00 million in 2021 to US$ 426.54 million by 2028; it is estimated to grow at a CAGR of 7.4% from 2021 to 2028. A pharmaceutical isolator offers a superior sterile environment than conventional clean rooms. Positive or negative pressures inside the chamber prevent contamination due to operator interference. It ensures long-lasting sterility in accordance with pharmaceutical regulations related to the manufacturing of sterile medicine products. Moreover, most of the experts agree that regulatory agencies are no longer impeding progress when it comes to technologies such as pharmaceutical isolators. The guidelines set by the agencies have an important role in the adoption of isolators in comparison to cleanrooms. Administration mentions isolators 55 times in its latest guideline of manufacturing in an aseptic environment. A well-designed positive pressure isolator, supported by adequate procedures for its maintenance, monitoring, and controls, offers significant advantages over traditional aseptic processing, including fewer opportunities for microbial contamination during processing. Isolators have become a core component of the pharmaceutical industry, as the cost of noncompliance with the regulatory guidelines is much high. Pharmaceutical isolators are critical for a range of processes to ensure aseptic conditions and containment. Stringent aseptic conditions are essential to maintain quality control and meet the administration current good manufacturing practice guidelines and other regulatory demands. WHO good manufacturing practices guidelines for sterile pharmaceutical products, section 8 of Annex 6 also mention the use of isolator technology to minimize human interventions in processing areas. All these regulatory guidelines fuel the adoption of pharmaceutical isolators in the MEA market.

In terms of type, the open isolator segment accounted for the largest share of the MEA pharmaceutical isolator market in 2020. In terms of pressure, the positive pressure segment held a larger market share of the MEA pharmaceutical isolator market in 2020. In terms of configuration, the floor standing segment held a larger market share of the MEA pharmaceutical isolator market in 2020. In terms of application, the aseptic isolators segment held a larger market share of the MEA pharmaceutical isolator market in 2020. Further, the pharmaceutical and biotechnology companies segment held a larger share of the MEA pharmaceutical isolator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA pharmaceutical isolator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Azbil Telstar, Bioquell (Ecolab Solution), Comecer, Fedegari Autoclavi S.p.A., Getinge AB, Hosokawa Micron Group, and Nuaire Inc.

The Middle East and Africa Pharmaceutical Isolator Market is valued at US$ 258.00 Million in 2021, it is projected to reach US$ 426.54 Million by 2028.

As per our report Middle East and Africa Pharmaceutical Isolator Market, the market size is valued at US$ 258.00 Million in 2021, projecting it to reach US$ 426.54 Million by 2028. This translates to a CAGR of approximately 7.4% during the forecast period.

The Middle East and Africa Pharmaceutical Isolator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Pharmaceutical Isolator Market report:

The Middle East and Africa Pharmaceutical Isolator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Pharmaceutical Isolator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Pharmaceutical Isolator Market value chain can benefit from the information contained in a comprehensive market report.