Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market

No. of Pages: 122 | Report Code: TIPRE00027253 | Category: Life Sciences

No. of Pages: 122 | Report Code: TIPRE00027253 | Category: Life Sciences

Market Introduction

The pharmaceutical fill and finish outsourcing are more inclined towards contract manufacturing. There are several types of contract manufacturing for pharmaceuticals as well as for biotechnology products that involve partial contract manufacturing and complete manufacturing of pharmaceuticals and biotechnology products.

Moreover, the increase in demand for biopharmaceutical drugs, growing clinical developments, and development of biologics and biosimilars is driving the market’s growth. However, complex processes and high cost of production critically impacts the growth of the market.

With the onset of pandemic, the demand for contract manufacturers accelerated. For instance, GCC companies are looking to compete in contract manufacturing. For example, with around 30 pharmaceutical companies, the GCC pharmaceutical industry is still evolving and is currently dominated by Saudi Arabia accounting to 65% of the GCC pharmaceutical market share. Furthermore, Ahramonline report states that, the Egyptian Drug Authority (EDA) has activated a package of incentive measures for contract manufacturing pharmaceuticals and medical supplies for opening new markets and increase the export value of Egyptian pharmaceutical products and increase incentive for pharmaceutical investment. Moreover, four pharmaceutical companies have applied for contract manufacturing in 2019 and 2020, and 57 products have been approved for export to Sudan, Saudi Arabia, Cyprus, and Yemen.

Market Overview and Dynamics

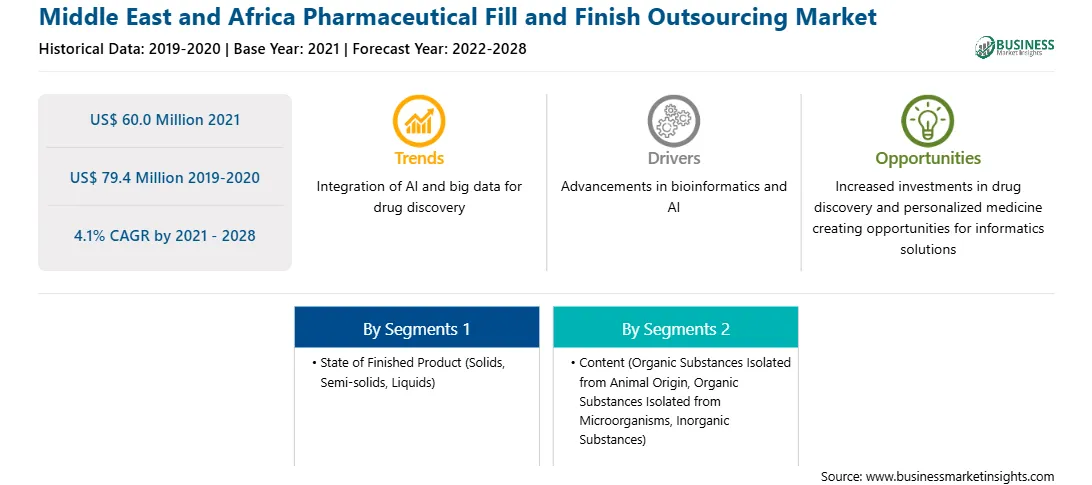

The Middle East & Africa pharmaceutical fill and finish outsourcing market is expected to reach US$ 79.4 million by 2028 from US$ 60.0 million in 2021. The market is estimated to grow at a CAGR of 4.1% from 2021–2028. Pharmaceutical drug manufacturers collaborate with contract service providers to leverage their experience and expertise in the latest fill finish technologies. Currently, over 115 companies are actively providing services for the fill finish of biologics. Many service providers have also acquired other players in the recent past to enhance their service offerings. For instance, Sanofi has outsourced the manufacturing of its biologics to Boehringer Ingelheim. Moreover, AbbVie operations have successfully developed and delivered drug products for more than 130 years; over 14 million small-volume parenteral (SVPs) are filled annually across AbbVie’s network, and the filled products are distributed over 175 countries.

Key Market Segments

In terms of state of finished products, the liquid segment accounted for the largest share of the Middle East & Africa pharmaceutical fill and finish outsourcing market in 2020. In terms of content, the organic substances isolated from microorganism’s segment accounted for the largest share of the Middle East & Africa pharmaceutical fill and finish outsourcing market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the pharmaceutical fill and finish outsourcing market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott, TEVA PHARMACEUTICAL INDUSTRIES LTD, Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd, Piramal Enterprises Ltd., Cytovance Biologics, Thermo Fisher Scientific Inc. (Patheon N.V), and Boehringer Ingelheim International GmbH.

Reasons to Buy Report

MIDDLE EAST & AFRICA PHARMACEUTICAL FILL AND FINISH OUTSOURCING MARKET SEGMENTATION

By State of Finished Product

• Solids

• Semi-Liquid

• Liquid

By Content

• Organic Substances Isolated from Animal Origin

• Organic Substances Isolated from Microorganisms

By Country

Companies Mentioned

Strategic insights for the Middle East and Africa Pharmaceutical Fill and Finish Outsourcing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 60.0 Million |

| Market Size by 2028 | US$ 79.4 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By State of Finished Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Pharmaceutical Fill and Finish Outsourcing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market is valued at US$ 60.0 Million in 2021, it is projected to reach US$ 79.4 Million by 2028.

As per our report Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market, the market size is valued at US$ 60.0 Million in 2021, projecting it to reach US$ 79.4 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market report:

The Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Pharmaceutical Fill and Finish Outsourcing Market value chain can benefit from the information contained in a comprehensive market report.