Increasing Number of Mergers and Acquisitions to Fuel Middle East & Africa Overactive Bladder Treatment Market in Coming Years

Through mergers and acquisitions (M&A), companies can gain a competitive edge by entering new markets and acquiring new technologies. The ongoing mergers and acquisitions in the overactive bladder treatment market are creating growth opportunities for various companies. In July 2021, Uro Medical strengthened its urology portfolio with the acquisition of Micron Medical, which offers wirelessly powered, injectable, microtechnology neurostimulators focused on treating overactive bladder. These neurostimulators, which can be easily incorporated into patients’ daily lives, offer a convenient, safe, minimally invasive, and cost-effective urological treatment option. In February 2021, Axonics Modulation Technologies, Inc.—a medical technology company—acquired Contura Ltd. and its proprietary product, Bulkamid, which is a urethral bulking agent for women with stress urinary incontinence (SUI). Axonics produces and markets novel implantable sacral neuromodulation (SNM) devices for the treatment of urinary and bowel dysfunction. The acquisition of Contura Ltd. provides an opportunity to expand its SNM business across the world and serve the large, highly underpenetrated SUI market. The company plans to offer urogynecologists and urologists a complete suite of clinically differentiated incontinence solutions to treat their patients. Thus, increasing number of mergers and acquisitions is propelling Middle East & Africa overactive bladder treatment market growth.

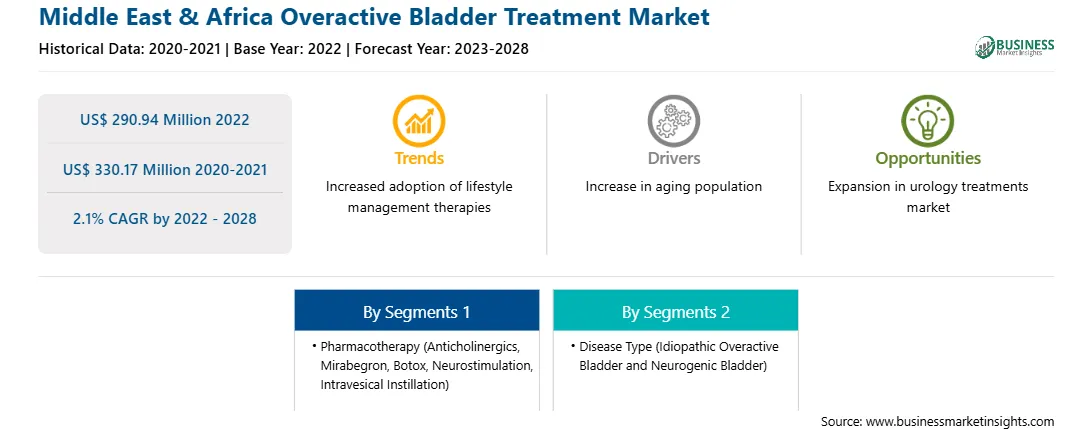

Middle East & Africa Overactive Bladder Treatment Market Overview

The Middle East & Africa overactive bladder treatment market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. The market growth is attributed to the increasing prevalence of chronic diseases and growing medical research studies across the region. Urinary incontinence is a clinical condition that is observed more among women in Saudi Arabia. According to The Cureus Journal of Medical Science published in the National Library of Medicine, in 2022, the prevalence of urinary continence in Jeddah and Riyadh, Saudi Arabia, was estimated to be 41.4% and 29%, respectively. A few factors such as age, obesity, medical comorbidities, hysterectomy, and multiparity contribute to the occurrence of urinary incontinence condition. Further, multiple pregnancy cases and rise in the geriatric population are also a few factors contributing to the growth of the overactive bladder treatment market. Also, the rise in the prevalence of chronic diseases and the high demand for rapid diagnosis, effective treatment options, and preventive measures are boosting the market growth in Saudi Arabia. The Saudi Arabia Ministry of Health provides primary health services through 2,259 centers to ~13,455 people. The primary health center settings are the first in line that deals with emerging complaints such as urological-related problems. It helps assess knowledge and practice patterns regarding common urological problems observed by primary health centers physicians. Thus, aforementioned factors are anticipated to fuel the growth of the overactive bladder treatment market in the coming years.

Strategic insights for the Middle East & Africa Overactive Bladder Treatment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 290.94 Million |

| Market Size by 2028 | US$ 330.17 Million |

| Global CAGR (2022 - 2028) | 2.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Pharmacotherapy

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Overactive Bladder Treatment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Overactive Bladder Treatment Market Segmentation

The Middle East & Africa overactive bladder treatment market is segmented on the basis of pharmacotherapy, disease type, and country.

Based on pharmacotherapy, the Middle East & Africa overactive bladder treatment market is segmented into anticholinergics, mirabegron, botox, neurostimulation, and intravesical instillation. The mirabegron segment registered the largest share of the market in 2022.

Based on disease type, the Middle East & Africa overactive bladder treatment market is bifurcated into idiopathic overactive bladder and neurogenic bladder. The idiopathic overactive bladder segment held a larger share of the market in 2022.

Based on country, the Middle East & Africa overactive bladder treatment market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the market in 2022.

AbbVie Inc; Alembic Pharmaceuticals Limited; Astellas Pharma Inc; Endo Pharmaceuticals Inc.; Hisamitsu Pharmaceutical Co., Inc.; Medtronic Plc; Pfizer Inc; and Teva Pharmaceutical Industries Ltd are the leading companies operating in the Middle East & Africa overactive bladder treatment market.

The Middle East & Africa Overactive Bladder Treatment Market is valued at US$ 290.94 Million in 2022, it is projected to reach US$ 330.17 Million by 2028.

As per our report Middle East & Africa Overactive Bladder Treatment Market, the market size is valued at US$ 290.94 Million in 2022, projecting it to reach US$ 330.17 Million by 2028. This translates to a CAGR of approximately 2.1% during the forecast period.

The Middle East & Africa Overactive Bladder Treatment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Overactive Bladder Treatment Market report:

The Middle East & Africa Overactive Bladder Treatment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Overactive Bladder Treatment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Overactive Bladder Treatment Market value chain can benefit from the information contained in a comprehensive market report.