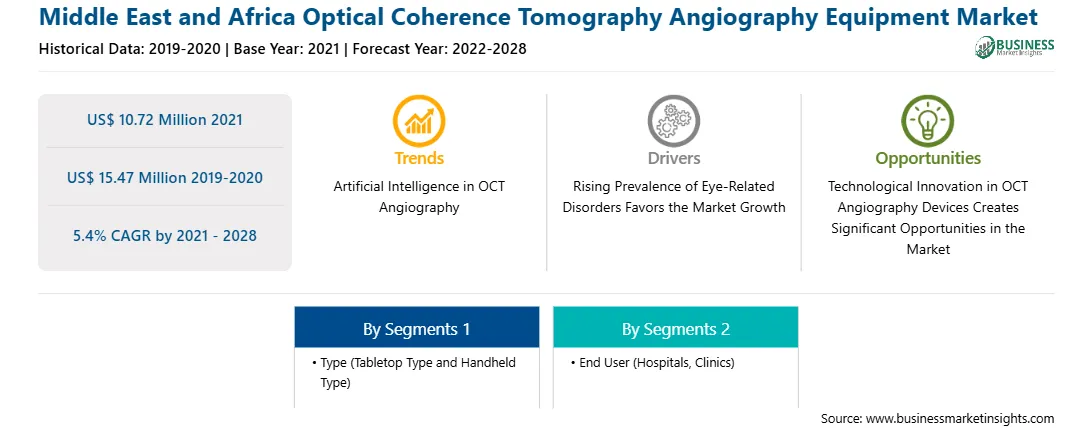

Middle East and Africa Optical Coherence Tomography Angiography Equipment Market

No. of Pages: 95 | Report Code: BMIRE00025215 | Category: Life Sciences

No. of Pages: 95 | Report Code: BMIRE00025215 | Category: Life Sciences

The growth of the market is due to the rising prevalence of eye-related disorders and increasing use of artificial intelligence in optical coherence tomography angiography. However, lack of skilled professionals and system challenges is expected to restrict the market growth during the forecast period.

The increasing prevalence of eye disorders has encouraged the angiography equipment market players to adopt advanced technologies such as artificial intelligence (AI), machine learning (ML), and deep learning (DL) for the development of advanced OCT imaging devices. The integration of ML and DL to OCT angiography yields insights into new pathologic signals that could benefit the clinical management of retinal diseases. DL techniques are increasingly being used for analyzing medical images. Based on the target application, promising AI-based models developed for ophthalmology have incorporated various types of imaging, which help predict diabetic retinopathy, glaucoma diagnosis, and age-related macular degeneration. Studies suggest that the DL-based analysis of OCT angiography images obtained in the preoperative setting can help create promising decisive support systems. Moreover, OCT angiography image-based evaluation by DL algorithms enables effective disease detection, prognosis prediction, and image quality control. As a result, DL technology incorporation could potentially enhance disease evaluation accuracy and clinical workflow efficiency, along with aiding the early diagnosis of DR. DL-based models are trained with different kinds of input from conventional OCT and OCT angiography images. Advancements in DL have also improved the state-of-the-art OCT angiography image analysis, including retinal layers and avascular area segmentation, and image quality assessment. In addition, image quality control is essential for accurate disease evaluation on OCT angiography images.

In 2019, Kauer et al. proposed an automatic quality assessment network based on Computational Neural Network (CNN) to evaluate the quality of OCTA scans, and the DL-based model achieved an accuracy of 99.5% to classify the image as good, bad, upper, and low quality. The DL methods were employed in many clinical applications of classification tasks, such as DR classification and AMD classification. For AMD classification, Thakoor et al. presented an interesting study in 2021 using a custom-made 3D CNN and a stack of 2D images of retinal layers of interest as input. By using a two-class classification method (NV-AMD vs. healthy), the classification accuracy was found to be quite high (93.4%).

Support vector machine (SVM) is the most common machine learning method found for OCT angiography image classification. It is used for single disease detection, such as DR and glaucoma, and also employed for DR staging. The other classifiers included neural networks (NNs) and a gradient boosting tree, i.e., XGBoost. The ML classification methods were used in all clinical applications, including DR classification and staging, glaucoma classification, AMD classification, and sickle cell retinopathy (SCR) classification. For AMD classification, in 2018, Alfahaid et al. used rotation-invariant, uniform local binary pattern texture feature computed on 184 images coupled with a KNN classifier to obtain a maximum accuracy of 100% considering the choriocapillaris layer and an accuracy of 89% for all layers. In 2021, Abdelsalam et al. presented the most promising results for DR classification using multifractal parameter computation with an SVM classifier that showed an accuracy of 98.5%.

Thus, AI highlighted can potentially help interpret challenging cases and ensure the highest possible diagnostic accuracy. Also, the combined use of AI and OCT angiography will significantly improve the early diagnosis of diabetic changes in retinal disorders.

Strategic insights for the Middle East and Africa Optical Coherence Tomography Angiography Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 10.72 Million |

| Market Size by 2028 | US$ 15.47 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Optical Coherence Tomography Angiography Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa optical coherence tomography angiography equipment market, based on type, has been bifurcated into handheld type and tabletop type. The Middle East and Africa optical coherence tomography angiography equipment market, based on end user is segmented into hospitals, clinics, and others. Geographically, the Middle East and Africa optical coherence tomography angiography equipment market is divided into UAE, Saudi Arabia, Saudi Africa and Rest of Middle East and Africa.

Carl Zeiss AG, Canon Inc., Michelson Diagnostics Ltd., Alcon Inc., and Topcon Corporation are among the leading companies operating in the

Middle East and Africa optical coherence tomography angiography equipment market.

The Middle East and Africa Optical Coherence Tomography Angiography Equipment Market is valued at US$ 10.72 Million in 2021, it is projected to reach US$ 15.47 Million by 2028.

As per our report Middle East and Africa Optical Coherence Tomography Angiography Equipment Market, the market size is valued at US$ 10.72 Million in 2021, projecting it to reach US$ 15.47 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The Middle East and Africa Optical Coherence Tomography Angiography Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Optical Coherence Tomography Angiography Equipment Market report:

The Middle East and Africa Optical Coherence Tomography Angiography Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Optical Coherence Tomography Angiography Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Optical Coherence Tomography Angiography Equipment Market value chain can benefit from the information contained in a comprehensive market report.