Middle East & Africa Ophthalmology Devices Market

No. of Pages: 109 | Report Code: BMIRE00030917 | Category: Life Sciences

No. of Pages: 109 | Report Code: BMIRE00030917 | Category: Life Sciences

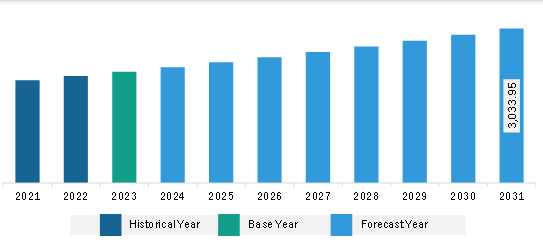

The Middle East & Africa ophthalmology devices market was valued at US$ 2,186.05 million in 2023 and is expected to reach US$ 3,033.95 million by 2031; it is estimated to register at a CAGR of 4.2% from 2023 to 2031.

Ophthalmic devices are designed for surgical, diagnostic, and vision correction purposes. These devices have gained substantial importance over the years due to the high incidence of cataracts, glaucoma, and other vision-related issues. According to Eurostat, Cataracts are the leading cause of avoidable blindness, accounting for 20 million cases of blindness and 65.2 million cases of progressive visual loss globally. As people age, its prevalence rises; it reaches 92% at age 80 and beyond, from 4% at age 55 to 64. Cataract surgery is the most popular and successful procedure in all medicine. Every year, more than 30 million people have this procedure. Furthermore, according to the most recent Global Burden of Disease Study (GBD), there will be 43.3 million blind people, 295 million people with moderate to severe visual impairment, and 258 million people with mild visual impairment globally in 2020. It is predicted that between 2020 and 2050, the number of persons with visual impairment and blindness will increase by 90% and 50%, respectively.

The Middle East and Africa's population is aging, and sight loss is more common as people age. Furthermore, the prevalence of important underlying causes of vision loss, such as diabetes and obesity, is rising. This indicates that the number of individuals with vision impairment is probably going to rise significantly over the next 25 years. Hence, the rising burden of ophthalmic diseases such as cataracts among adult and older populations propels the need for vision care devices (contact lenses, spectacle lenses, etc.), diagnostics and monitoring devices (ophthalmic ultrasound imaging systems, fundus cameras, and so on), and surgical devices (refractive surgical devices, ophthalmic microscopes, etc.). The demand for quality eye care products is increasing with a rise in the prevalence of ophthalmic diseases across the region.

The Middle East & Africa ophthalmology devices market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. The market growth in this region is attributed to the growing prevalence of eye diseases and various initiatives taken by governments to boost infrastructure in the respective countries. According to a recent report by the Gulf Cooperation Council (GCC), GCC countries made the world's most prominent investments in healthcare infrastructure during 2010-2020.

It is observed that aging population in Saudi Arabia is also expected to increase the demand for ophthalmic devices as they are more susceptible to developing age-related eye diseases such as cataracts, glaucoma, diabetic retinopathy, age-related macular degeneration, and presbyopia. Further, according to the United Nations Population Fund, in 2022, 72% of the population in Saudi Arabia is aged 15-64 years, while the remaining 4% are aged 65 and above.

Therefore, an upsurge in eye diseases and an aging population is expected to support the ophthalmology devices market growth in Saudi Arabia in the coming years.

Strategic insights for the Middle East & Africa Ophthalmology Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,186.05 Million |

| Market Size by 2031 | US$ 3,033.95 Million |

| Global CAGR (2023 - 2031) | 4.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Ophthalmology Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the Middle East & Africa Ophthalmology Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Ophthalmology Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Ophthalmology Devices Strategic Insights

Middle East & Africa Ophthalmology Devices Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,186.05 Million

Market Size by 2031

US$ 3,033.95 Million

Global CAGR (2023 - 2031)

4.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Ophthalmology Devices Regional Insights

The Middle East & Africa ophthalmology devices market is segmented based on product, application, end user, and country.

Based on product, the North America ophthalmology devices market is segmented into vision care products, surgical devices, and diagnostics and monitoring devices. The vision care products segment held the largest share in 2023.

In terms of application, the North America ophthalmology devices market is segmented into cataract, glaucoma, refractory disorders, vitreoretinal disorders, and other applications. The glaucoma segment held the largest share in 2023.

By end user, the North America ophthalmology devices market is segmented into hospital and eye clinics, academic and research laboratories, and other end users. The hospital and eye clinics segment held the largest share in 2023.

Based on country, the Middle East & Africa ophthalmology devices market is categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa ophthalmology devices market in 2023.

Key players operating in the Middle East & Africa ophthalmology devices market are Johnson & Johnson Vision Care Inc, Alcon AG, Carl Zeiss Meditec, Bausch & Lomb Inc, Essilor Intonational SAS, Nidek Co Ltd, Topcon Corp, and Hoya Corp are some of the leading companies operating in the Middle East & Africa ophthalmology devices market.

The Middle East & Africa Ophthalmology Devices Market is valued at US$ 2,186.05 Million in 2023, it is projected to reach US$ 3,033.95 Million by 2031.

As per our report Middle East & Africa Ophthalmology Devices Market, the market size is valued at US$ 2,186.05 Million in 2023, projecting it to reach US$ 3,033.95 Million by 2031. This translates to a CAGR of approximately 4.2% during the forecast period.

The Middle East & Africa Ophthalmology Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Ophthalmology Devices Market report:

The Middle East & Africa Ophthalmology Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Ophthalmology Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Ophthalmology Devices Market value chain can benefit from the information contained in a comprehensive market report.