Middle East and Africa Oil Conditioning Monitoring Market

No. of Pages: 104 | Report Code: TIPRE00024220 | Category: Electronics and Semiconductor

No. of Pages: 104 | Report Code: TIPRE00024220 | Category: Electronics and Semiconductor

The Middle East is a home to five of the top ten oil-producing countries, accounting for about 27% of world output. Even though state-owned corporations produce the bulk of the oil, many international oil companies participate in oil production and related activities in the Middle East through joint ventures, production-sharing agreements, and other economic models. The Organization of Petroleum Exporting Countries (OPEC), which coordinates oil extraction quotas and prices among its members, is a home to most of the Middle Eastern oil producers. According to Organization of the Petroleum Exporting Countries, around 41.9% of today's crude oil is produced by OPEC countries, with Saudi Arabia, the group's founding member, generating around 12.2 million barrels per day. Saudi Arabia also boasts the Middle East's biggest crude oil distillation capacity, with over 3 million barrels per day owing to the presence of Saudi Aramco, a state-owned enterprise. Saudi Aramco is one of the world's most valuable businesses as of September 2019. As a result, region's need for oil conditioning monitoring system is strong due to its well-developed oil and gas infrastructure and the presence of large oil suppliers. Furthermore, Saudi Arabia's oil output is anticipated to quadruple in the next decade, resulting in increased drilling operations connected to oil production. This factor would increase the demand for oil conditioning monitoring systems in coming years. Saudi Aramco granted a few new contracts for the development of the Fadhili gas programme as a part of its efforts to increase oil output. The Middle East and Africa's oil conditioning monitoring market is anticipated to grow owing to the growth of such projects

Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are the main MEA countries that are facing the effects of COVID-19 pandemic. The majority of operations in the region have been suspended due to an increase in the number of cases in the region. In order to deal with the pandemic, countries have been compelled to redirect funds to improve their healthcare infrastructure. Although oil prices have rebounded since the production reduction deal went into force in early May, the negative impact on the Middle Eastern oil producers' economies, and the energy industry has not subsided. A complete recovery might take another year or two. As a result of lower oil prices, the economies of Middle Eastern oil producers, notably Gulf Arab producers, would suffer, requiring governments in the area to slash fiscal expenditure and devote cash for rescue packages. The crisis has shown the flaws in our present economic and energy models, requiring changes to handle the post-crisis era. As a result, the demand for monitoring equipment’s in the oil industry is dwindling. As a result, the COVID-19 pandemic is limiting the demand development of oil conditioning monitoring in the Middle East and Africa

Strategic insights for the Middle East and Africa Oil Conditioning Monitoring provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

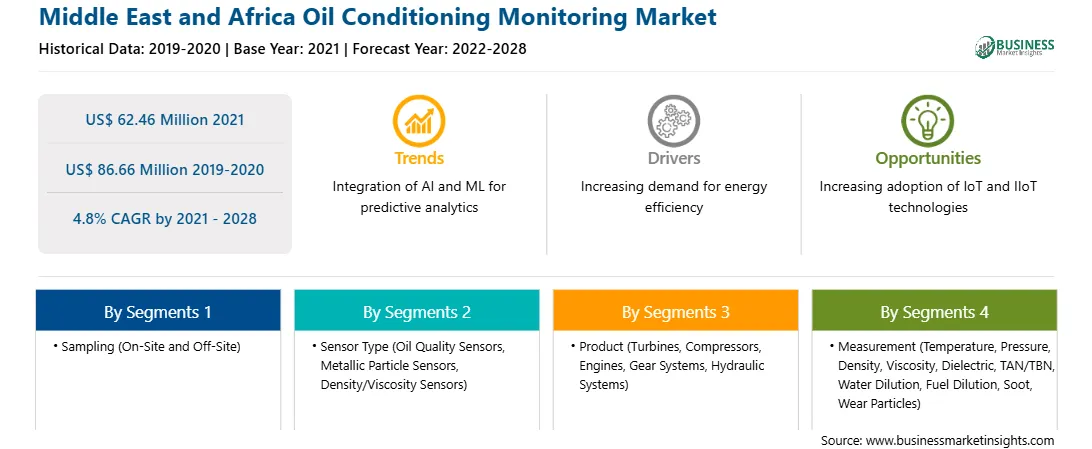

| Market size in 2021 | US$ 62.46 Million |

| Market Size by 2028 | US$ 86.66 Million |

| Global CAGR (2021 - 2028) | 4.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Sampling

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Oil Conditioning Monitoring refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

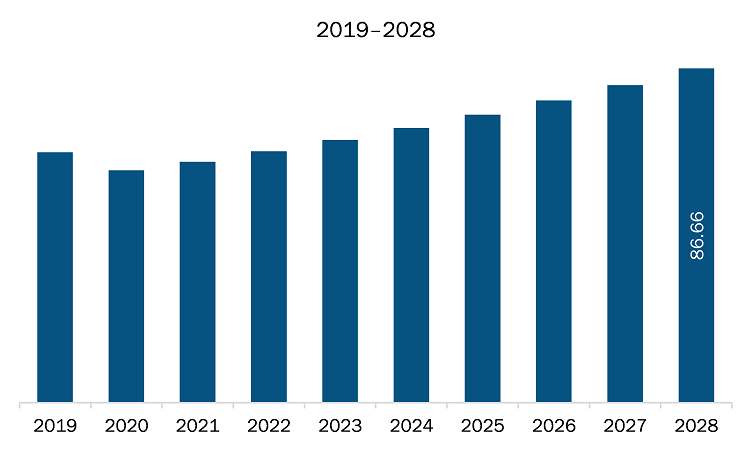

The oil conditioning monitoring market in MEA is expected to grow from US$ 62.46 million in 2021 to US$ 86.66 million by 2028; it is estimated to grow at a CAGR of 4.8% from 2021 to 2028. Growing demand of cost-effective services; Hundreds of oil samples are analyzed every day by specialist service laboratories and large plant operators for a variety of constituents to detect component wear and the presence of foreign materials that may accelerate wear. The study of lubricating oils in use helps in lowering operating costs, reducing downtimes, increasing plant and equipment lives, and making effective maintenance plans. Lubricating oil analysis is also being used to check the condition of engines and other machinery. It is used to lubricate most lubricated mechanical systems, such as engines, gear gearboxes, hydraulics, and the like, and has a wide range of applications in industries such as construction, power production, and transportation, including aircraft, fleet operations, and public transit. In addition, under fault circumstances, many additional changes may occur in oils, such as dilution by fuels or contamination by water or anti-freeze. For example, oxidation can cause changes in lubricant characteristics such as viscosity, resulting in faster wear rates. Because elemental analysis cannot identify all these processes, a combination of physical and chemical measuring techniques is required for complete condition monitoring, although elemental analysis has emerged as the most important instrument for wear detection. As a result, efficient oil monitoring aids in the provision of cost-effective services in a variety of industrial surroundings. This is bolstering the growth of the oil conditioning monitoring market.

Based on sampling, the market is bifurcated into on-site and off-site. In 2020, the off-site segment held the largest share MEA oil conditioning monitoring market. By sensors type, the market is segmented into oil quality sensors, metallic particle sensors, and density/viscosity sensors. In 2020, the oil quality sensors segment held the largest share MEA oil conditioning monitoring market. The oil conditioning monitoring market, based on product, is segmented into turbines, compressors, engines, gear systems, and hydraulic systems. In 2020, the turbines segment held the largest share MEA oil conditioning monitoring market. By measurement, the market is segmented into temperature, pressure, density, viscosity, dielectric, TAN, TBN, water dilution, fuel dilution, soot, and wear particles. In 2020, the viscosity segment held the largest share MEA oil conditioning monitoring market. The oil conditioning monitoring market, based on industry, is segmented into transportation, industrial, oil & gas, energy & power, and mining. In 2020, the transportation segment held the largest share MEA oil conditioning monitoring market.

A few major primary and secondary sources referred to for preparing this report on the oil conditioning monitoring market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CM Technologies GmbH

The Middle East and Africa Oil Conditioning Monitoring Market is valued at US$ 62.46 Million in 2021, it is projected to reach US$ 86.66 Million by 2028.

As per our report Middle East and Africa Oil Conditioning Monitoring Market, the market size is valued at US$ 62.46 Million in 2021, projecting it to reach US$ 86.66 Million by 2028. This translates to a CAGR of approximately 4.8% during the forecast period.

The Middle East and Africa Oil Conditioning Monitoring Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Oil Conditioning Monitoring Market report:

The Middle East and Africa Oil Conditioning Monitoring Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Oil Conditioning Monitoring Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Oil Conditioning Monitoring Market value chain can benefit from the information contained in a comprehensive market report.