Advanced materials are crucial for boosting the fuel economy of modern automobiles while ensuring safety and performance. Substituting cast iron and traditional steel components with lightweight materials such as high-strength natural fiber composites reduces the weight of a vehicle body and chassis, thereby reducing the fuel consumption of a vehicle. Moreover, natural fiber composites are suitable for the manufacturing of nonstructural interior components, seat backs, headliners, interior panels, and dashboards.

The utilization of natural fiber-reinforced composites is increasing in automotive applications due to legislation and regulations forcing manufacturers to use sustainable and recycled materials to manufacture fuel-efficient and lightweight vehicles. Moreover, several automotive manufacturers use natural fiber composites for interior and exterior applications. In 2020, Dr. Ing. h.c. F. Porsche AG launched Porsche 718 Cayman GT4 Clubsport MR, featuring a car body kit made of natural fiber composite materials made from farmed flax fibers. This natural fiber composite is used to develop front and rear aprons; front spoilers; front and rear lids; mudguards; and diffusers, including aerodynamic fins. In 2022, Mercedes-Benz Group and its development partners, HWA AG and Bcomp Ltd, developed front bumpers engineered from natural fiber composite for Mercedes-AMG GT4 race cars. In 2022, Bayerische Motoren Werke AG and Bcomp Ltd formed a development alliance to utilize renewable raw materials for vehicle components. Furthermore, Bcomp Ltd developed powerRibs and ampliTex reinforcement solutions made from natural composite materials. These solutions have been used in DTM touring cars from BMW M Motorsport to substitute selected carbon fiber-reinforced plastic components. Therefore, the increasing use of natural fiber composites in the automotive industry drives the market growth. Also, the rising adoption of electric vehicles (EVs) drives the Middle East & Africa natural fiber composites market.

The natural fiber composites market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The construction of commercial infrastructure has upsurged in the region due to the growing tourism industry and the rising immigrant population. The natural fiber composites market in the Middle East & Africa is expected to grow at a significant rate over the coming years due to advancements in construction activities and infrastructure developments funded and supported by government initiatives. In ten years, the UAE government has invested extensively in airport developments and expansion projects, namely US$ 8.1 billion in Al Maktoum International Airport in Dubai, US$ 7.6 billion in the Dubai International Airport Expansion Phase 4, US$ 6.8 billion in Abu Dhabi Airport development and expansion plans, and around US$ 400 million in Sharjah’s International Airport terminal expansion. Thus, the growing construction industry is projected to drive the natural fiber composites market in the Middle East & Africa during the forecast period.

Strategic insights for the Middle East & Africa Natural Fiber Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Natural Fiber Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Natural Fiber Composites Strategic Insights

Middle East & Africa Natural Fiber Composites Report Scope

Report Attribute

Details

Market size in 2022

US$ 136.39 Million

Market Size by 2028

US$ 166.69 Million

Global CAGR (2022 - 2028)

3.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Raw Material

By Technology

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Natural Fiber Composites Regional Insights

Middle East & Africa Natural Fiber Composites Market Segmentation

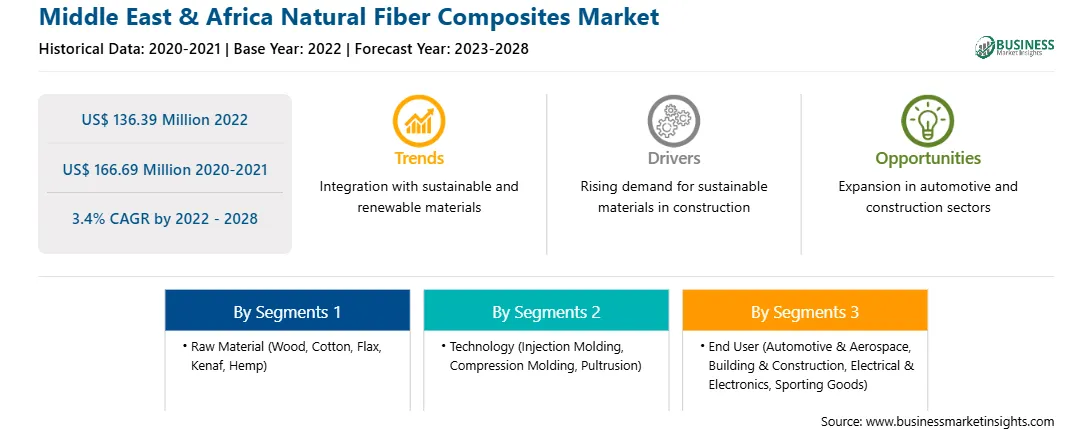

The Middle East & Africa natural fiber composites market is segmented into raw material, technology, end user, and country

Based on raw material, the Middle East & Africa natural fiber composites market is segmented into wood, cotton, flax, kenaf, hemp, and others. The wood segment held the largest share of the Middle East & Africa natural fiber composites market in 2022.

Based on technology, the Middle East & Africa natural fiber composites market is segmented into injection molding, compression molding, pultrusion, and others. The others segment held the largest share of the Middle East & Africa natural fiber composites market in 2022.

Based on end user, the Middle East & Africa natural fiber composites market is segmented into automotive & aerospace, building & construction, electrical & electronics, sporting goods, and others. The automotive & aerospace segment held the largest share of the Middle East & Africa natural fiber composites market in 2022.

Based on country, the Middle East & Africa natural fiber composites market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabi dominated the share of the Middle East & Africa natural fiber composites market in 2022.

Amorim Cork Composites S.A.; Lanxess AG; TECNARO GMBH; and UPM-Kymmene Corp are the leading companies operating in the Middle East & Africa natural fiber composites market.

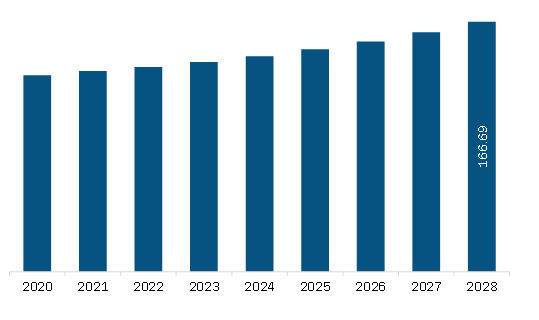

The Middle East & Africa Natural Fiber Composites Market is valued at US$ 136.39 Million in 2022, it is projected to reach US$ 166.69 Million by 2028.

As per our report Middle East & Africa Natural Fiber Composites Market, the market size is valued at US$ 136.39 Million in 2022, projecting it to reach US$ 166.69 Million by 2028. This translates to a CAGR of approximately 3.4% during the forecast period.

The Middle East & Africa Natural Fiber Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Natural Fiber Composites Market report:

The Middle East & Africa Natural Fiber Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Natural Fiber Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Natural Fiber Composites Market value chain can benefit from the information contained in a comprehensive market report.