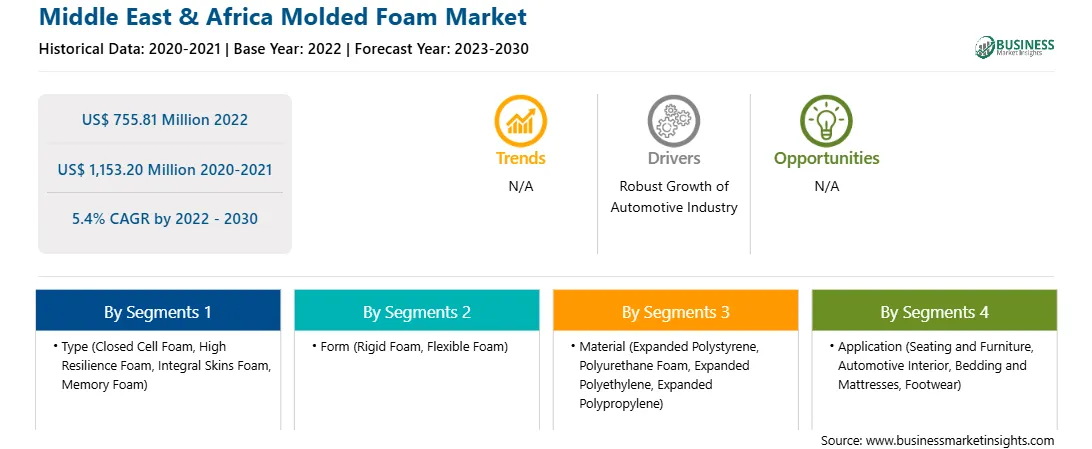

The Middle East & Africa molded foam market was valued at US$ 755.81 million in 2022 and is expected to reach US$ 1,153.20 million by 2030; it is estimated to record a CAGR of 5.4% from 2022 to 2030.

The escalating demand for sustainable and eco-friendly materials is propelling a notable shift towards the adoption of biobased and recycled molded materials. This trend reflects a growing global consciousness regarding environmental preservation and resource conservation. Manufacturers and consumers alike are increasingly prioritizing materials that minimize carbon footprint and reduce reliance on finite resources. Biobased molded foam materials, derived from renewable sources like plant-based polymers, offer a compelling alternative to traditional, petroleum-based foams, significantly reducing environmental impact throughout their lifecycle. Additionally, the upsurge in recycled molded foam materials addresses the pressing need for wastage reduction and circular economy practices by repurposing post-consumer or post-industrial foam waste into new products. Also, the product has excellent biodegradability in a wide range of environments. As sustainability continues to drive purchasing decisions across industries, the adoption of biobased and recycled molded foam materials is poised to witness further acceleration, reshaping the landscape of material sourcing and manufacturing processes.

The Middle East & Africa has a massive demand for molded foam in various countries such as the UAE, South Africa, and Saudi Arabia due to the growing requirement for seating & furniture, mattresses, and thermal insulation in residential, industrial, and commercial sectors. The demand for new residential projects has increased due to a migration surge from rural to urban areas. The increasing populace is also boosting the construction of residential areas. According to the United Nations report on Urbanization and Migration in Africa, the region's urban population has been increasing at a high rate (i.e., from ~27% in 1950 to 40% in 2015). It is expected to reach 60% by 2050. Thus, the demand for seating and furniture, mattresses, and air conditioners in the region is expected to grow due to the increasing number of new constructions. Subsequently, the need for molded foam is also expected to grow. In addition, in the automotive industry, molded foam is used in components such as seats, armrests & headrests, and door panels.

Further, the automotive industry is pivotal in driving demand for molded foam in the Middle East & Africa. As car manufacturers in the region strive to meet consumer demand for modern, comfortable vehicles, they increasingly turn to molded foam for various applications. Molded foam is a critical component in car seats, providing cushioning and support for passengers. With consumers in the Middle East & Africa region becoming more discerning about the quality of their vehicles and seeking improved driving experience, there is a growing demand for high-quality foam materials that contribute to superior seating comfort. According to the Organization of the Petroleum Exporting Countries (OPEC), the Middle East & Africa is projected to have 90 million vehicles on the road by 2040, up from 59 million in 2018. As the automakers in the Middle East & Africa strive to meet the evolving demands of consumers and adhere to regulatory requirements, molded foam remains a critical material in the production of vehicles that provide both superior driving experience and safety.

Strategic insights for the Middle East & Africa Molded Foam provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 755.81 Million |

| Market Size by 2030 | US$ 1,153.20 Million |

| Global CAGR (2022 - 2030) | 5.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Molded Foam refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa molded foam market is segmented based on type, form, material, application, and country.

Based on type, the Middle East & Africa molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. The closed cell foam segment held the largest Middle East & Africa molded foam market share in 2022.

In terms of form, the Middle East & Africa molded foam market is bifurcated into rigid foam and flexible foam. The flexible foam segment held a larger Middle East & Africa molded foam market share in 2022.

By material, the Middle East & Africa molded foam market is segmented into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. The polyurethane foam segment held the largest Middle East & Africa molded foam market share in 2022.

By application, the Middle East & Africa molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. The bedding and mattresses segment held the largest Middle East & Africa molded foam market share in 2022.

Based on country, the Middle East & Africa molded foam market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa molded foam market in 2022.

Foam Factory Mattresses, INTERNATIONAL INDUSTRIES LLC, Poly Chem Molding Solutions, and SABIC are some of the leading companies operating in the Middle East & Africa molded foam market.

1. Foam Factory Mattresses

2. INTERNATIONAL INDUSTRIES LLC

3. Poly Chem Molding Solutions

4. SABIC

The Middle East & Africa Molded Foam Market is valued at US$ 755.81 Million in 2022, it is projected to reach US$ 1,153.20 Million by 2030.

As per our report Middle East & Africa Molded Foam Market, the market size is valued at US$ 755.81 Million in 2022, projecting it to reach US$ 1,153.20 Million by 2030. This translates to a CAGR of approximately 5.4% during the forecast period.

The Middle East & Africa Molded Foam Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Molded Foam Market report:

The Middle East & Africa Molded Foam Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Molded Foam Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Molded Foam Market value chain can benefit from the information contained in a comprehensive market report.