Middle East & Africa Microwave Transmission Equipment Market

No. of Pages: 127 | Report Code: TIPRE00022810 | Category: Electronics and Semiconductor

No. of Pages: 127 | Report Code: TIPRE00022810 | Category: Electronics and Semiconductor

The microwave transmission equipment market in the Middle East and Africa is segmented into South Africa, Saudi Arabia, UAE and the Rest of the Middle East and Africa. The region is expected experience rapid rise in industrialization, which would further boost the growth of a diverse range of industries. The Gulf countries are economically advanced, while the African countries are yet to match up to their economic conditions. Factors such as huge growth in demand for 4G internet has been instrumental in the growing demand for this equipment in emerging economies are fueling the microwave transmission equipment market growth in the MEA. For instance, in the Middle East and North Africa, Etisalat announced the first major partnership with a public cloud company in February 2020 – a deal with Microsoft to underpin future 5G services and facilitate the evolution of its public-cloud-first strategy. Etisalat also partnered with Parallel Wireless to trial 2G, 3G, 4G and 5G OpenRAN across its markets in Middle East, and Africa. Moreover, higher penetration of internet, growing demand for high-speed internet and elevated disposable income are propelling the demand for microwave transmission equipment systems in this region governments of several countries have redirected their focus on this sector, to reduce their dependency on any particular sector. For instance, Initiatives such as Smart Dubai and Smart Abu Dhabi in the UAE and Bahrain’s Cloud-First Policy are driving public cloud spending as governments look for efficient and interoperable platforms to implement their digital strategies. The modern microwave transmission equipment can efficiently support such demand, compatibility issues with the legacy systems is restraining the growth of the microwave transmission equipment market in the region. In Saudi Arabia, the telecoms regulator and all six telecoms service providers in Saudi Arabia have signed an open-access agreement guaranteeing the provision of FTTH broadband on an open-access model. This allows subscribers to select a service provider independent of fiber-infrastructure ownership. Saudi Arabia’s largest operator, STC has launched a 5G smart campus to facilitate the development of use cases and service standards for enterprises in different verticals, including energy, education, health, and mining.

Strategic insights for the Middle East & Africa Microwave Transmission Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

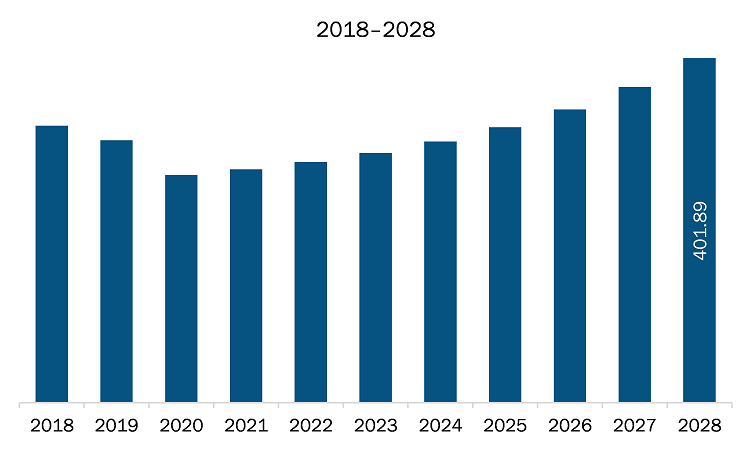

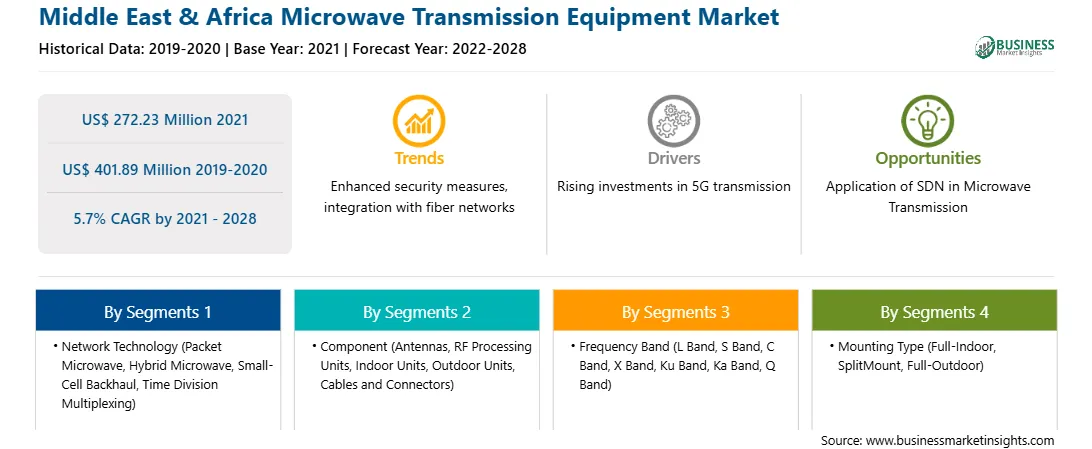

| Market size in 2021 | US$ 272.23 Million |

| Market Size by 2028 | US$ 401.89 Million |

| Global CAGR (2021 - 2028) | 5.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Network Technology

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Microwave Transmission Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Microwave Transmission Equipment Market in MEA is expected to grow from US$ 272.23 million in 2021 to US$ 401.89 million by 2028; it is estimated to grow at a CAGR of 5.7% from 2021 to 2028. Increment Spectrum Efficiency and Growing Level of Automation. Spectrum efficiency is achieved through techniques such as superior system gain of a well-designed solution; higher-order modulation and adaptive modulation; and multiple input, multiple output (MIMO). In the past few years, the spectrum for microwave applications was more relaxed; over the years, new frequency bands were made available, along with brining continuous technological developments to meet capacity requirements. However, many countries are facing running out of spectrum resources left for microwave applications, which is necessitating the development of new technologies to meet future demands. MIMO at microwave frequencies is a new technology that offers a practical way to boost spectrum efficiency. Further, the increasing automation and simplification of troubleshooting, fault management, and performance management also assists in maintaining or lowering the network operation and field service costs. The Wavence portfolio offers a complete microwave solution for all use cases, including short-haul, long-haul, e-band, and SDN-based management for both service providers and enterprises. This is bolstering the growth of the microwave transmission equipment.

In terms of Mounting type, the Split-Mount Segment accounted for the largest share of the MEA microwave transmission equipment in 2020. In terms of Component, type, the Outdoor Units (ODU) segment held a larger market share of microwave transmission equipment market in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA microwave transmission equipment are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are NEC Corporation

The Middle East & Africa Microwave Transmission Equipment Market is valued at US$ 272.23 Million in 2021, it is projected to reach US$ 401.89 Million by 2028.

As per our report Middle East & Africa Microwave Transmission Equipment Market, the market size is valued at US$ 272.23 Million in 2021, projecting it to reach US$ 401.89 Million by 2028. This translates to a CAGR of approximately 5.7% during the forecast period.

The Middle East & Africa Microwave Transmission Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Microwave Transmission Equipment Market report:

The Middle East & Africa Microwave Transmission Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Microwave Transmission Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Microwave Transmission Equipment Market value chain can benefit from the information contained in a comprehensive market report.