The United Arab Emirates (UAE), Saudi Arabia and South Africa are the 3 major countries in the Middle East and South Africa. Saudi Arabia was the largest market for metabolomics services in this region in 2021. The market for metabolomics services in the Middle East and Africa is anticipated to grow at a CAGR 19.6% during the forecast period; this growth is attributed to the rising prevalence of various diseases and increasing government initiatives in terms of funding and healthcare related policies. Saudi Arabia is one of the fastest-growing countries in the Middle East and Africa, with a large population suffering from cancer fueling its growth. The government is taking initiatives to develop and strengthen its healthcare sector. As part of The Riyadh Medical Biotechnology Summit in September 2021, health affairs at the Ministry of National Guard aim to reach the vision goals by 2030 through strengthening the health sector and promoting investment in biomedical technology. The Saudi Food and Drug Authority Strategic Plan (2018–2022) was recently proposed by the government as its third annual strategic plan. The project incorporates the vision and strategic priorities developed by the drug, food, and medical device regulators. They also intend to establish a central testing lab in Riyadh for research purposes. Use of artificial intelligence (AI) and biomarkers in biomarker-related analysis and personalized therapy is the major factor driving the growth of the MEA metabolomics services market.

As per the Worldometer, as of September 2021, South Africa reported 2,787,203 COVID-19 cases; the case count of Saudi Arabia and the UAE had reached 544,634 and 719,355, respectively. Economic uncertainties and ongoing conflicts are worsening the condition in the region. For instance, countries such as Syria, Libya, and Yemen are suffering violent conflicts and are not capable of implementing robust public health measures. Iran was in deep economic recession due to the US sanctions. The major source of economic stabilization in Middle East countries is oil production and export. However, a sudden drop in domestic and external demand for goods and products, especially crude oil, and halted production due to labor shortage have affected the economic growth of these oil-based economies. The spread of SARS-CoV-2 has led to heavy burden on healthcare professionals in the MEA. Cardiac surgeons are overloaded with emergency cardiac surgeries, management of COVID patients, and implementation of safety guidelines to prevent the spread of virus, which have led them to deprioritize elective surgeries. Thus, the overburdening of the healthcare sector is hampering the performance of the Middle East and Africa metabolomics services market.

Strategic insights for the Middle East and Africa Metabolomics Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

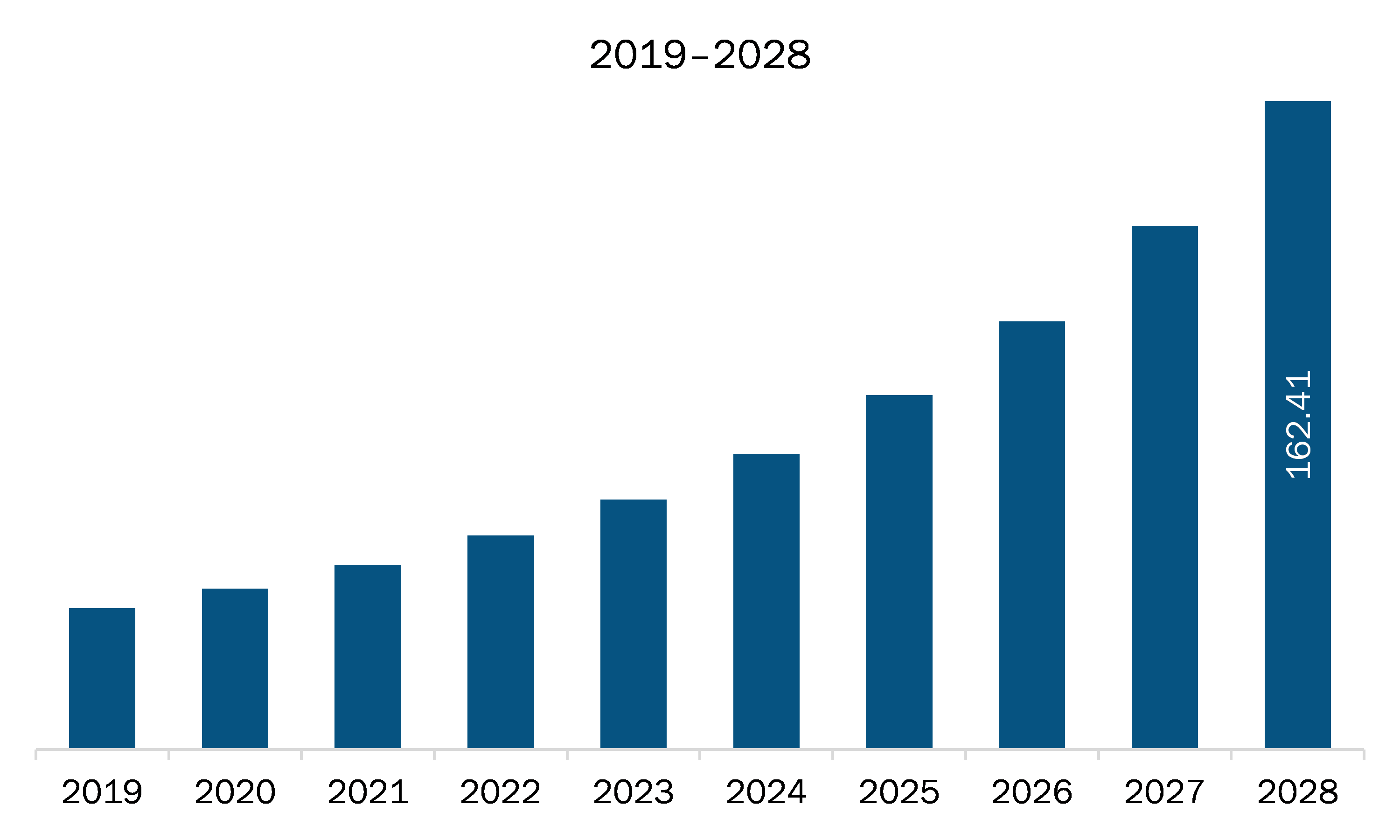

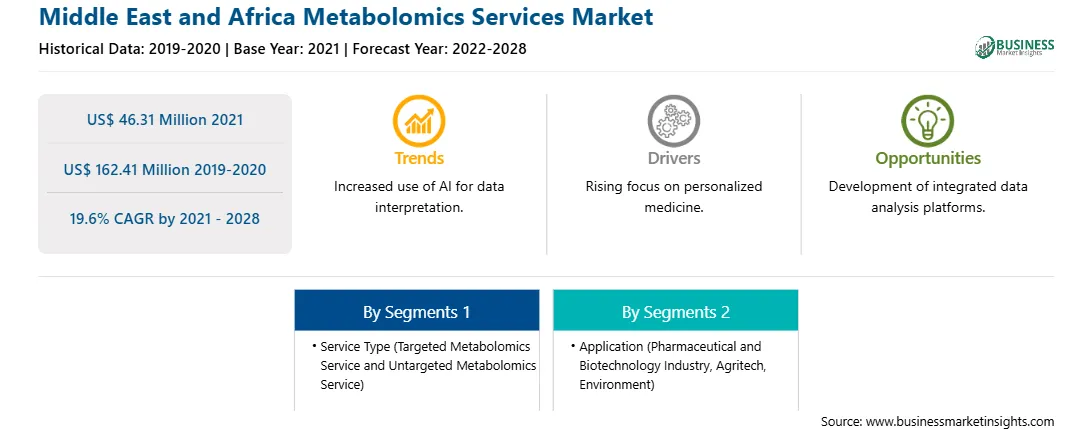

| Market size in 2021 | US$ 46.31 Million |

| Market Size by 2028 | US$ 162.41 Million |

| Global CAGR (2021 - 2028) | 19.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Metabolomics Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The metabolomics services market in MEA is expected to grow from US$ 46.31 million in 2021 to US$ 162.41 million by 2028; it is estimated to grow at a CAGR of 19.6% from 2021 to 2028. Metabolomics is among the growing and robust technologies for detecting a wide range of metabolites in tissues and biofluids. This process has a significant application in the analysis and studies associated with cancer disease. The rising prevalence of different types of cancer is expected to drive the market during the forecast period. Cancer diagnostics play an essential role in cancer treatment. As per the data published by the World Health Organization (WHO) in September 2021, nearly 70% of deaths from cancer were reported from the low- and mid-income countries across the region. Therefore, rising incidences of cancer is expected to surge the demand of metabolomics services, thereby driving the market growth.

The MEA metabolomics services market has been segmented based on service type, application, and country. On the basis of service type, the MEA metabolomics services market is segmented into targeted metabolomics service and untargeted metabolomics service. The targeted metabolomics service segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Based on application, the market is segmented into pharmaceutical and biotechnology industry, agritech, and environment. The pharmaceutical and biotechnology industry segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Likewise, the pharmaceutical and biotechnology industry segmented is categorized into biomarker discovery, drug discovery, toxicological testing, and others.

A few major primary and secondary sources referred to for preparing this report on metabolomics services market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE, biocrates life sciences ag, Creative Proteomics, Fred Hutchinson Cancer Research Center, and RTI International are among others.

The Middle East and Africa Metabolomics Services Market is valued at US$ 46.31 Million in 2021, it is projected to reach US$ 162.41 Million by 2028.

As per our report Middle East and Africa Metabolomics Services Market, the market size is valued at US$ 46.31 Million in 2021, projecting it to reach US$ 162.41 Million by 2028. This translates to a CAGR of approximately 19.6% during the forecast period.

The Middle East and Africa Metabolomics Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Metabolomics Services Market report:

The Middle East and Africa Metabolomics Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Metabolomics Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Metabolomics Services Market value chain can benefit from the information contained in a comprehensive market report.