The medical affairs outsourcing market in the MEA is further segmented into the UAE, Saudi Arabia, South Africa, and the Rest of MEA. The market growth is expected due to rising R&D expenses. Thus, the pressure to curtail value is encouraging the regulative affairs outsourcing trend. Also, contract analysis organizations offer price-efficient solutions and compliance with the health authority necessities, changes in reimbursement scenario and pricing pressure and developments by the market players in medical affairs outsourcing technology in countries such as South Africa, Saudi Arabia and the UAE. The countries are developing their healthcare facilities, undertaking heavy investments in the research of novel drug therapies, and increasing partnerships with foreign entities are likely to propel market growth during the forecast period.

The countries in the MEA region have taken precautionary measures and imposed stringent regulations to control the spread of COVID-19. Countries such as the UAE, Saudi Arabia, Jordan, Iraq, and Iran have strictly imposed lockdowns. The majority of the countries in the region are dependent on other regions for medical devices and other products. As a result of the COVID-19 crisis, the World Bank forecasts that remittances to the MENA region are projected to fall sharply by 19.6%, after a total of US$ 42 billion in 2020 after a 2.6% increase in 2019. MENA countries and the global community also have a role to play in tackling COVID-19. For the first time in decades, MENA countries are facing a common issue with no political or religious agenda. The advent of high-throughput screens of approved compounds and small molecules has allowed researchers to effectively evaluate large drug libraries for their in vitro antiviral activity against novel targets. Russia has developed a new treatment for the COVID-19 patients and will soon conduct a trial in partnership with Saudi Arabian health. The current pharmaceutical markets in the MENA region vary significantly between different nations. For example, high spending power and a cultural preference for expensive foreign brands in Saudi Arabia have resulted in 85% of pharmaceuticals being imported. In contrast, 90% of the consumption in Egypt is domestically produced, with a much greater market share for generics. In recent years, South Africa has turned increasingly to generic drugs, providing an excellent opportunity for domestic and foreign manufacturers. Medical affairs play a pivotal role in overcoming barriers to accessing healthcare professionals (HCPs). Moreover, compliance requirements mean medical affairs is responsible for providing HCPs with real-time, unbiased, and transparent medical information in the MEA.

Strategic insights for the Middle East & Africa Medical Affairs Outsourcing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

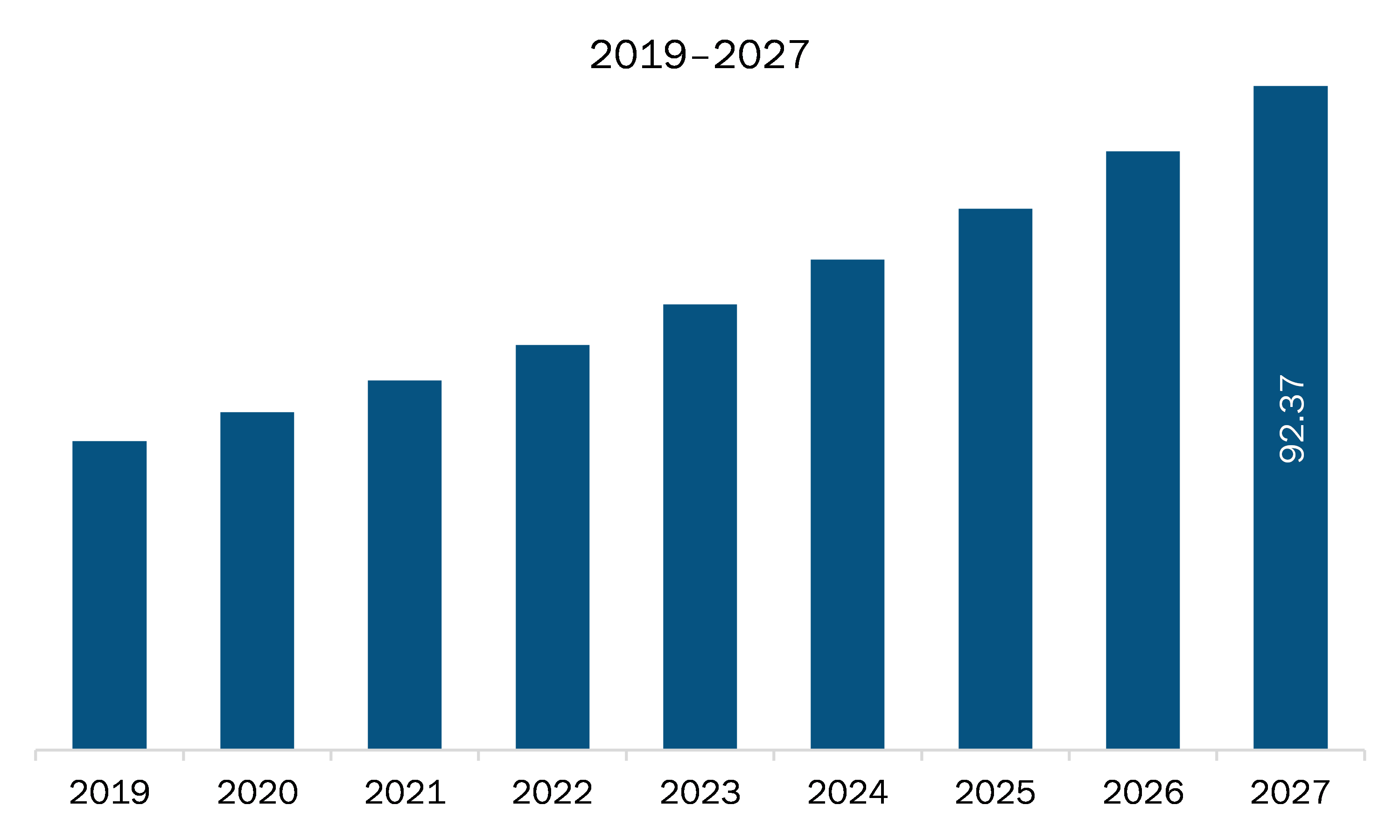

| Market size in 2020 | US$ 46.99 Million |

| Market Size by 2027 | US$ 92.37 Million |

| Global CAGR (2020 - 2027) | 10.1% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Medical Affairs Outsourcing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The medical affairs outsourcing market in MEA is expected to grow from US$ 46.99 million in 2020 to US$ 92.37 million by 2027; it is estimated to grow at a CAGR of 10.1% from 2020 to 2027. The contract research organization (CRO) services’ industry is highly fragmented, with several hundred small and medium-sized limited-service providers, and a small number of large, full-service, MEA CROs. There are few barriers to entry for smaller CROs into the MEA market, whereas a full-service CRO with MEA capabilities requires building the necessary infrastructure with the ability to simultaneously manage multiple complex testing services across numerous geographies, establishing the requisite relationships with strategic partners, developing relevant therapeutic and development of expertise to serve the needs of the end users. Over the past few years, the consolidation across the industry is an emerging trend followed by the majority of the prime players to strengthen their service offerings and garner the major market share in the MEA CRO market. For instance, For instance, Parexel International Corp. acquired The Medical Affairs Company in 2017.

MEA medical affairs outsourcing market is segmented into services, application, and country. The MEA medical affairs outsourcing market, by services, is segmented into medical writing and publishing, medical monitoring, medical science liaisons (MSLs), medical information, and others. The medical writing and publishing segment held the largest share of the market in 2019. Based on application, the MEA medical affairs outsourcing market is segmented into pharmaceutical, biopharmaceutical, and medical devices. The medical devices market is further segmented into therapeutic medical devices, and diagnostic medical devices. The pharmaceutical segment held the largest share of the market in 2019. Based on country, the MEA medical affairs outsourcing market is segmented into Saudi Arabia, South Africa, UAE, and rest of MEA. South Africa held the largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the medical affairs outsourcing market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ICON PLC, IQVIA Inc, PAREXEL INTERNATIONAL CORPORATION, PPD Inc,

The Middle East & Africa Medical Affairs Outsourcing Market is valued at US$ 46.99 Million in 2020, it is projected to reach US$ 92.37 Million by 2027.

As per our report Middle East & Africa Medical Affairs Outsourcing Market, the market size is valued at US$ 46.99 Million in 2020, projecting it to reach US$ 92.37 Million by 2027. This translates to a CAGR of approximately 10.1% during the forecast period.

The Middle East & Africa Medical Affairs Outsourcing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Medical Affairs Outsourcing Market report:

The Middle East & Africa Medical Affairs Outsourcing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Medical Affairs Outsourcing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Medical Affairs Outsourcing Market value chain can benefit from the information contained in a comprehensive market report.