Middle East & Africa consists of three major countries namely United Arab Emirates (UAE), Saudi Arabia and South Africa. People are opting different aesthetics surgeries to maintain themselves, which give them better results without any stressful physical efforts. Medical aesthetics is one of the most trending concepts of the 21st Century which will show a substantial increase in the future as there is a great technological advancement and innovation in the field by the companies dealing with these devices making them safer and even less invasive leading to more population opting for these procedures. The market is driven by the factors such as increasing government initiatives, growing number of research and development activities, and increasing number of product launches and approvals in the region. Saudi Arabia is one of the fastest-growing regions in the Middle East and Africa, which is being driven by a huge population base and increasing acceptance of medical devices. To achieve Vision 2030, the government of Saudi Arabia launched a National Transformation Program in 2016. The government had launched this program for the overall development of Saudi Arabia across all industries. In addition, this program is linked to the implementation of primary and digital infrastructure projects in several industries. Under this program, the government focuses on consolidating and transforming the health system by increasing the accessibility of health services, improving health efficiency and quality, and preventing chronic diseases. This government-approved strategic policy creates lucrative medical device launch opportunities that will ultimately fuel the medical aesthetics market growth in Saudi Arabia over the forecast period. Increased awareness of health issues and increased consumption of health services contribute to a significant market for medical devices. With an expected population growth of 33% over the next three decades, the Saudi Arabian health sector must meet the ever-growing population and the need for health services. The demand for health services is much higher compared to the supply of health services; this is a scenario recognized by the Saudi Arabian government, which therefore recently encouraged the private sector to make up for the shortage and capitalize on this potentially lucrative sector. Aesthetic procedures are among the most commonly performed procedures in the medical field. Such methods are becoming increasingly popular. Social media is a term that is mainly used for describing electronic platforms that promote the dissemination of information for targeting users. These platforms play a vital role in promoting aesthetic procedures. Despite the wonderful advances in the field of plastic surgery, knowledge of the field remains inadequate among the general public, particularly in relation to cosmetic surgery. It also remains unclear whether the medical community is well informed about cosmetic surgery. The public's knowledge of aesthetic plastic surgery would increase in proportion to the knowledge of health workers who are likely to inform or misinform the public about these surgical procedures

The COVID-18 pandemic has had a significant impact on the Middle East and Africa. The increasing number of COVID-19 cases have been reported in South Africa (2,553,466), Israel (900,482), the UAE (692,964), and Saudi Arabia (533,516) as of August 9th, 2021. The pandemic has increased the demand for medical devices, which can use in home care. The region is witnessing an increase in the number of patients being admitted to intensive care units (ICU), the rising number of drugs that pose multiple diagnostic and therapeutic challenges to strained health systems, leading to an increase in medical devices. Radiologists in South Africa have the highest number of COVID-19 infections in the country. There were changes in staff assignments and working hours and the implementation of strict infection protection and social distancing measures. In addition, they faced mental, physical, emotional, and financial challenges. In the Middle East and Africa, digital technology in healthcare is still in its infancy. In this region, the UAE has the highest level of technology adoption in the healthcare industry. Many doctors and medical experts from different countries have moved to the region to provide better medical care to patients. The rapid spread of the novel coronavirus has resulted in a significant decrease in the number of elective procedures, particularly cosmetic procedures. Although many measures have been taken to ease the burden on the health system, it is unclear whether these changes impacted the perception of cosmetic interventions in the population. Due to the suspension of all non-urgent surgical cases across the region, many doctors' practices are negatively affected by the COVID-19 pandemic, especially of plastic surgeons, aesthetic/aesthetic-plastic surgeons, as most of their cases are semi-elective and elective. In the field of plastic surgery, several articles have summarized plastic surgery practices during the COVID-19 pandemic and made recommendations on preoperative care and case prioritization based on current evidence, such as low visual acuity, moderate visual acuity, and high visual acuity while assessing the risk and benefit every surgical procedure.

Strategic insights for the Middle East and Africa Medical Aesthetics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

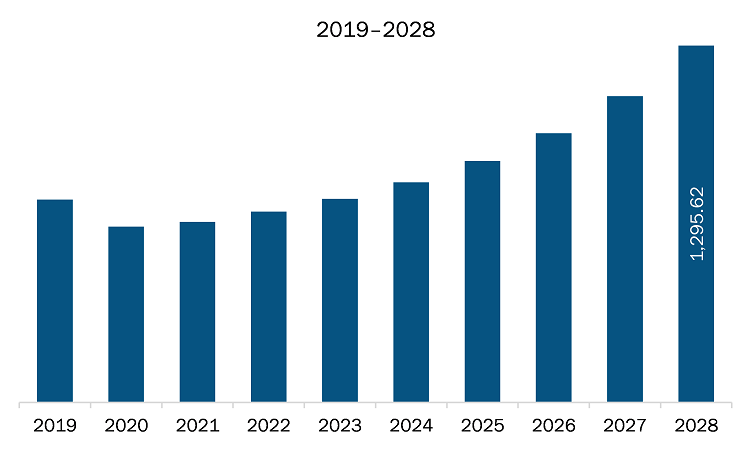

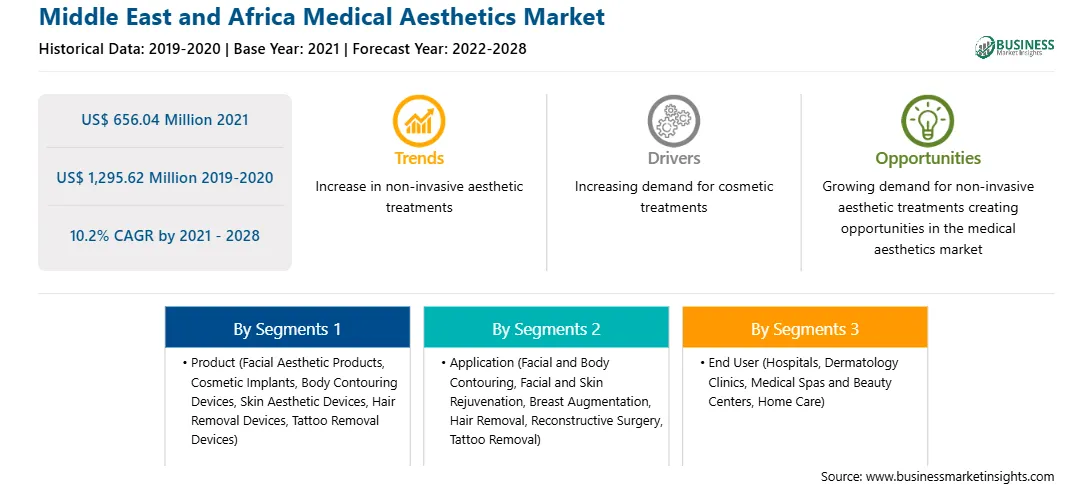

| Market size in 2021 | US$ 656.04 Million |

| Market Size by 2028 | US$ 1,295.62 Million |

| Global CAGR (2021 - 2028) | 10.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Medical Aesthetics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The medical aesthetics market in MEA is expected to grow from US$ 656.04 million in 2021 to US$ 1,295.62 million by 2028; it is estimated to grow at a CAGR of 10.2% from 2021 to 2028. Technological advancements associated with medical aesthetic devices; All medical devices used for various cosmetic procedures, including plastic surgery, unwanted hair removal, excess fat removal, anti-aging, aesthetic implants, skin tightening, etc., are categorized under the medical aesthetic products umbrella. Technological advancements in devices, increasing awareness about aesthetic procedures, growing acceptance of minimally invasive devices, and surge in obese population are the main forces boosting the medical aesthetics market growth. With the establishment of the advanced, high-speed internet infrastructure and the growing trend of social media, information is becoming more accessible to everyone, and people are becoming more aware of aesthetic procedures. An increasing number of social media users and the sensitization of the masses to medical aesthetic procedures are being correlated with the improved sales of medical aesthetic devices. The aesthetic outcome in patient demand for cosmetic treatments was influenced by several parameters, such as clinical improvement after surgery, risks and potential complications, and downtime. These parameters could validate plasma technology as a new regenerative modality. The plasma skin regeneration (PSR) technology has great potential in dermatology; it helps treat facial arrhythmias, sun keratosis, seborrheic keratosis, and warts. A few studies have examined the clinical effects of PSR technology on periorbital rejuvenation. With conventional blepharoplasty, more than 90% improvement and with PSR ~20% and 30% improvement in the tightening of the upper eyelid and the periorbital folds, respectively, were achieved. After six months, ~40% improvement in acne scars on the face was achieved after the single PSR treatment. PSR has also been explored for the rejuvenation of the skin of chest, neck, and back of the hands. In addition, it can be used to treat traumatic scars, benign familial pemphigus, and porokeratosis. Understanding the impact of the PSR technology on aesthetic medicine requires the basic knowledge of the physics and histopathological aspects of plasma. Recent advancements in the technology are likely to bring dramatic improvements in the aesthetic treatment of the skin. The emergence of laser and light-based technologies are very promising among skin rejuvenation therapies. New laser resurfacing techniques for skin rejuvenation offer significant advantages over conventional ablative lasers such as the CO2 and erbium-YAG laser systems. Non-ablative and fractional lasers, although not as effective as ablative therapies, are associated with significantly lower complication rates and shorter recovery periods. New devices combining ablative and fractional technologies are available in the medical aesthetics market, and they are showing remarkable results. This is bolstering the growth of the medical aesthetics market.

Based on product market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, tattoo removal devices and others. In 2020, the facial aesthetic products segment held the largest share of the market, by product. Based on the application market was segmented into facial and body contouring, facial and skin rejuvenation, breast augmentation, hair removal, reconstructive surgery, tattoo removal and others. In 2020, the facial and body contouring segment held the largest share of the market, by application. Based on the end user market was segmented into hospitals, dermatology clinics, medical spas and beauty centers and home care. In 2020, the hospitals segment held the largest share of the market, by end user.

A few major primary and secondary sources referred to for preparing this report on the medical aesthetics market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allergan Plc, Alma Lasers, Galderma, Hologic, Inc., and Mentor Worldwide, LLC among others.

The Middle East and Africa Medical Aesthetics Market is valued at US$ 656.04 Million in 2021, it is projected to reach US$ 1,295.62 Million by 2028.

As per our report Middle East and Africa Medical Aesthetics Market, the market size is valued at US$ 656.04 Million in 2021, projecting it to reach US$ 1,295.62 Million by 2028. This translates to a CAGR of approximately 10.2% during the forecast period.

The Middle East and Africa Medical Aesthetics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Medical Aesthetics Market report:

The Middle East and Africa Medical Aesthetics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Medical Aesthetics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Medical Aesthetics Market value chain can benefit from the information contained in a comprehensive market report.