Middle East and Africa Mechanical Ventilation Systems Market

No. of Pages: 91 | Report Code: TIPRE00025850 | Category: Electronics and Semiconductor

No. of Pages: 91 | Report Code: TIPRE00025850 | Category: Electronics and Semiconductor

The Middle East & Africa region is focusing on ways to address the issue of air quality conditions and atmospheric pollution through consideration of energy production and energy consumption patterns. Increased chemical exposure, high Indoor levels of pollutants, and short-term health problems—such as allergies, headaches and asthma—are leading to the increased installations of mechanical ventilation systems. Efficient ventilation and air quality control equipment together with successful urban planning can clean the air and reduce the environment damage to a large extent. Increased rate of industrialization and generation of contaminants that cause deficient indoor air quality, and significant investments and innovations in energy recovery ventilators (ERVs) and heat recovery ventilators (HRVs), as well as rising awareness about the benefits and efficiencies of energy recovery ventilation systems, are among the various factors propelling the growth of the mechanical ventilation systems market in the Middle East & Africa.

The Middle East & Africa mechanical ventilation system market is majorly impacted owing to supply chain disruption. Further, as country boarders were closed, the supply chain of several industrial equipment and components were disturbed. This has led to decline in revenue among the mechanical ventilation system manufacturers and distributors offering their products to manufacturing, oil & gas, and aerospace & defense industry. However, the restrictions were eased, and manufacturing of mechanical ventilation system gained traction the demand for mechanical ventilation system witness steady adoption rate by the Q1 of 2021.

Strategic insights for the Middle East and Africa Mechanical Ventilation Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

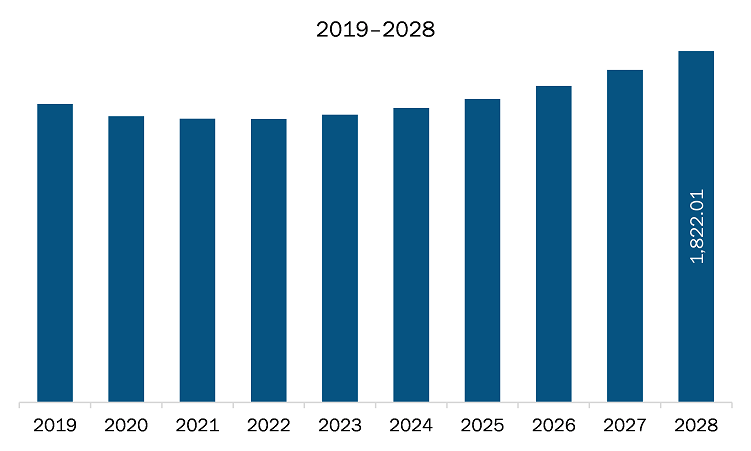

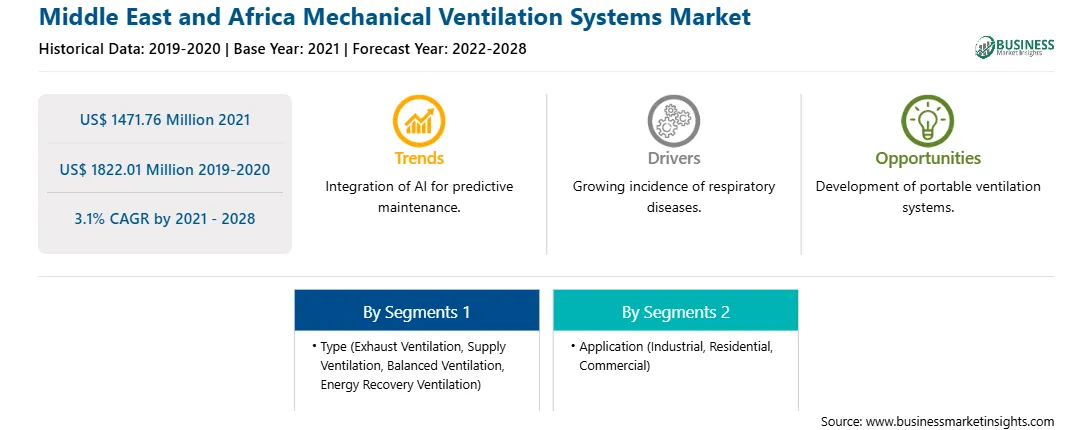

| Market size in 2021 | US$ 1471.76 Million |

| Market Size by 2028 | US$ 1822.01 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Mechanical Ventilation Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The mechanical ventilation systems market in Middle East & Africa is expected to grow from US$ 1471.76 million in 2021 to US$ 1822.01 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028. The residential sector consumes a signi?cant amount of energy equivalent to one third of total primary energy resources available. Increase in building service demands and improvised lifestyle have further increased the energy consumption. Thus, energy-efficient ventilation systems, such as energy recovery ventilation (ERV), can drastically save energy by reducing the demands for electricity and power for heating and cooling and providing appropriate ventilation to residential or commercial buildings. Moreover, energy-efficient mechanical ventilation systems improve humidity control by pre-drying the incoming ventilation air. They also encourage building operators to improve quality of the indoor air and meet simplified building codes for consistent increase in energy consumption. Further, the integration of energy-efficient mechanical ventilators into the ductwork of residential or commercial buildings helps to achieve proper ventilation. The demands for energy-efficient ventilation system is further augmented for removing pollutants emitted by indoor sources. The high rates of air change can cause energy burden on a building’s heating or cooling needs. Ventilation accounts for 30% or more of space conditioning energy and has increased the demand to minimize ventilation rate, reduce energy, and ensure optimum indoor air quality. The proportion of airborne energy loss is much higher in buildings constructed at high standards of thermal insulation. The amount of energy consumed is dependent on the flow rate of ventilation and the amount of air conditioning necessary to achieve thermal comfort. Additional energy is needed to drive mechanical ventilation systems, cool air by refrigeration, and maintain humidity levels. Exponential growth in the rate of energy consumption and dissipation in the commercial and residential sectors have created an emphasis on energy conservation development, which has, in turn, increased the demand for energy-efficient mechanical ventilation systems.

In terms of type, the exhaust ventilation segment accounted for the largest share of the Middle East & Africa mechanical ventilation systems market in 2020. In term of application, commercial segment held a larger market share of the mechanical ventilation systems market in 2020.

A few major primary and secondary sources referred to for preparing this report on the mechanical ventilation systems market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Vortice, BLAUBERG, Infineon Technologies AG, AERMEC, Mitsubishi Electric Corporation, and Caladair International among others.

The Middle East and Africa Mechanical Ventilation Systems Market is valued at US$ 1471.76 Million in 2021, it is projected to reach US$ 1822.01 Million by 2028.

As per our report Middle East and Africa Mechanical Ventilation Systems Market, the market size is valued at US$ 1471.76 Million in 2021, projecting it to reach US$ 1822.01 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The Middle East and Africa Mechanical Ventilation Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Mechanical Ventilation Systems Market report:

The Middle East and Africa Mechanical Ventilation Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Mechanical Ventilation Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Mechanical Ventilation Systems Market value chain can benefit from the information contained in a comprehensive market report.