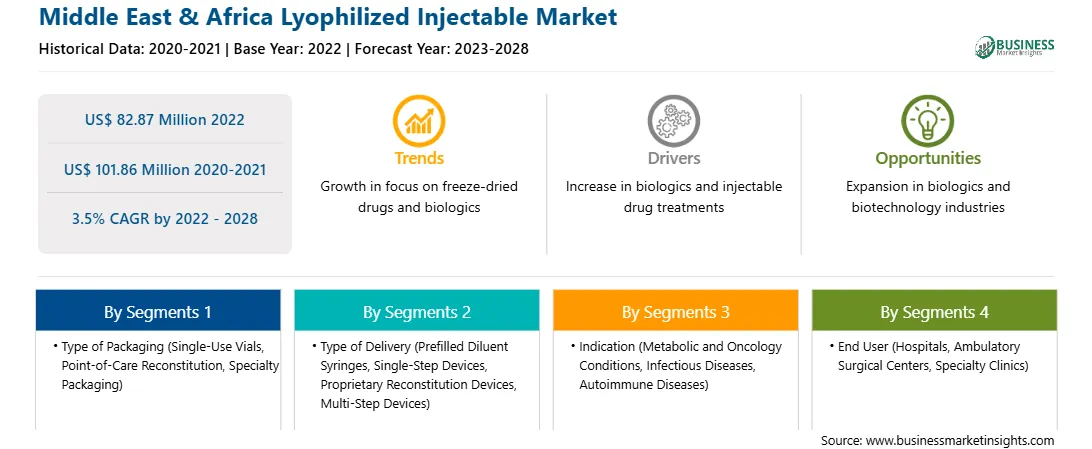

The MEA lyophilized injectable market is expected to grow from US$ 82.87 million in 2022 to US$ 101.86 million by 2028. It is estimated to grow at a CAGR of 3.5% from 2022 to 2028.

Expansion of Pipeline of Lyophilized Injectable Drugs

The continuous research to invent drugs to treat chronic diseases has driven the development of lyophilized injectable drugs in the pharmaceutical industry. Product innovation and strategic activities by critical key players provide opportunities to penetrate a new therapeutic area/market. Approximately 2,400 injectable products are present in the development pipeline. Drug developers are increasingly interested in the lyophilization technique as it can extend the shelf life of small and large-molecule drugs. The prevalence of formulation stability challenges for complex APIs and biologics resulted in more pharmaceutical and biopharmaceutical manufacturers turning to lyophilization. The use of lyophilization for pharmaceutical and biopharmaceutical product manufacturing has grown by ~13.5% per year in the past five years. Because liquids are the preferred formulation for commercial-scale production of many parenteral products, lyophilization is increasingly essential in bringing liquid products to market. Lyophilization is significant for two reasons—increasing the number of new drug applications and decreasing review times for new drug approvals. More than 3,000 drug candidates are in the pipeline in therapeutic areas where parenteral delivery dominates. Of these 3,000 products, ~2,250 are in pre-clinical development/Phase I. Of the remaining candidates, ~750 are in Phase II and III. This pipeline of lyophilized products will add to the established list of lyophilized drugs in the upcoming period. Thus, it is expected to augment the lyophilized injectable market.

Market Overview

The MEA lyophilized injectable market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of MEA. South Africa dominated the market in 2022. South Africa is one of the developing economies in the region, with a GDP of USD 301.92 billion, and healthcare accounts for 33% of the GDP, with the second largest share. South Africa does not have a universal healthcare system, but it has two parallel systems—public healthcare system and private healthcare system—which work hand in hand. Approximately 84% of the population of South Africa relies on the public healthcare system and 16% on the private healthcare system. South Africa has a high prevalence rate of infectious diseases, cancer, and other chronic disorders. As per the World Health Organization, a total of 116,391 new cancer cases were diagnosed in South Africa during 2020, out of which breast cancer and prostate cancer accounted for the maximum share of 14.2% and 12%, respectively. Additionally, South Africa had the highest prevalence rate of Hepatitis B, with 6.7% (3.4 million people) in 2019. Moreover, an increase in government initiatives to boost awareness among people and the supply of therapeutic drugs in the region have boosted the demand for lyophilized injectables. Additionally, the development of healthcare services and increased affordability of advanced treatment options for chronic disorders, followed by new product launches and approvals, are further expected to amplify the market growth.

MEA Lyophilized Injectable Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Middle East & Africa Lyophilized Injectable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 82.87 Million |

| Market Size by 2028 | US$ 101.86 Million |

| Global CAGR (2022 - 2028) | 3.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type of Packaging

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Lyophilized Injectable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

MEA Lyophilized Injectable Market Segmentation

The MEA lyophilized injectable market is segmented based on type of packaging, type of delivery, indication, end user, and country.

In terms of type of delivery, the MEA lyophilized injectable market is segmented into prefilled diluent syringes, single-step devices, proprietary reconstitution devices, and multi-step devices. The prefilled diluent syringes segment held the largest market share in 2022.

Aristopharma Ltd.; Baxter; Credence MedSystems, Inc.; Jubilant HollisterStier (Jubilant Pharma Limited); Nipro; Recipharm AB; S.G. Biopharm Pvt. Ltd.; and Vetter Pharma are among the leading companies operating in the MEA lyophilized injectable market.

The Middle East & Africa Lyophilized Injectable Market is valued at US$ 82.87 Million in 2022, it is projected to reach US$ 101.86 Million by 2028.

As per our report Middle East & Africa Lyophilized Injectable Market, the market size is valued at US$ 82.87 Million in 2022, projecting it to reach US$ 101.86 Million by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The Middle East & Africa Lyophilized Injectable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Lyophilized Injectable Market report:

The Middle East & Africa Lyophilized Injectable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Lyophilized Injectable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Lyophilized Injectable Market value chain can benefit from the information contained in a comprehensive market report.