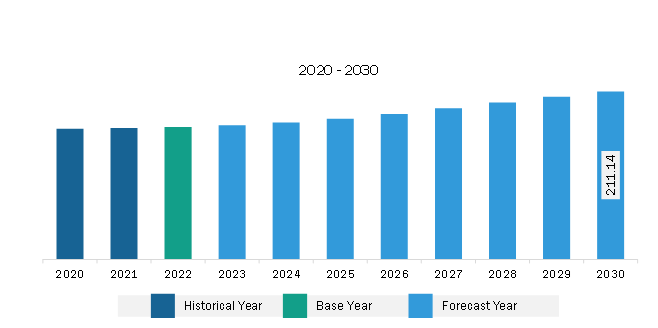

The Middle East & Africa lubricating grease market was valued at US$ 166.39 million in 2022 and is expected to reach US$ 211.14 million by 2030; it is estimated to register a CAGR of 3.0% from 2022 to 2030.

In the industrial sector, lubricating grease is one of the key components that help the equipment operate efficiently and with maximum reliability. The lubricating greases are used across various industries, including automotive, oil & gas, textile, automotive, power generation, paper & pulp, chemicals & petrochemicals, agriculture, manufacturing, food & beverages, and pharmaceuticals. Mineral and synthetic lubricants pollute the environment in small but extensive quantities. Most of these lubricants are nonaqueous liquids. They can also cause major environmental damage due to accidental spillage, improper disposal, leakages, and lost lubrication. Increasing environmental and climate-protection directives ensure robust demand for bio-based products in high-growth and specialty-product categories. Compared to traditional mineral oil lubricating grease, synthetic and quasi-synthetic oils and biolubricants have gained strong traction owing to benefits such as environmental compatibility, longer product life, and high performance. Conventional mineral-based lubricants can adversely affect the operators' health and the environment. Also, several studies have proven that these lubricants may contain carcinogenic additives and impurities in their formulation, which causes dermatitis and skin cancer.

Mineral oil is inferior in biodegradability, with a range of 15-35% biodegradation. The said biodegradation values are below the accepted guideline for environmentally acceptable lubricant, which is 80%. Properly disposing of the mineral-based cutting lubricant is challenging and involves numerous processes that are expensive. Therefore, bio-based lubricating grease is preferred over conventional mineral-based lubricating grease. Bio-based lubricating grease is made from renewable resources such as vegetable oils or animal fats, offering a sustainable alternative. This alignment with eco-friendly practices positions biobased lubricating grease as a preferred choice for industries looking to reduce their environmental footprint.

Strong environmental concerns and growing regulations over environmental contamination and pollution have increased the need for renewable and biodegradable lubricating grease. Biobased lubricating greases, being biodegradable and exhibiting lower toxicity, contribute to a reduction in environmental impact. Industries are increasingly recognizing the importance of adopting greases that provide effective lubrication and align with their sustainability goals, driving the incorporation of biobased alternatives into their operations. Public demand, industrial concern, and government agencies have also driven accelerated research and development in biobased lubricating grease. Moreover, better ways to protect the ecosystem or reduce the negative impact of spills or leakage of lubricants are required to be highlighted. Regulatory initiatives around the world are further propelling the role of biobased lubricating greases in the market. Compliance with these regulations is prompting industries to transition toward biobased lubricants to ensure adherence to environmental standards, thereby fostering market growth.

The Middle East & Africa market is evolving due to the increasing passenger vehicle production. The demand for vehicles made in the region is growing consistently. Rising middle-class income, growing population, and increasing passenger vehicle production are also driving the market growth. The growing automotive sales in South Africa and Saudi Arabia create a significant demand for lubricating greases. In September 2022, Renault Group Morocco announced that its two factories in Tangier and Casablanca, Morocco, produced 350,000 vehicles in 2022, a 15.3% increase over the production numbers in 2021. The Middle East & Africa market is evolving due to increasing passenger vehicle production, rising middle-class income, and growing population. Furthermore, the construction and infrastructure boom in the Middle East, marked by ambitious projects and urban development, has played a pivotal role in the escalating demand for lubricating grease. Construction machinery, heavy equipment, and vehicles essential for these projects need effective lubrication solutions to withstand demanding operating conditions and maintain optimal performance.

The oil & gas sector is also a significant contributor to the growing demand for lubricating grease in the Middle East & Africa. The industry's critical infrastructure, including pipelines, refineries, and extraction facilities, requires lubricating solutions to perform smoothly in such a harsh environment. Lubricating greases are used to protect process equipment operating under high temperatures, high loads, and long service intervals, addressing the specific challenges posed by the extreme temperatures and corrosive elements prevalent in oil & gas operations across the region. Thus, all these factors bolster the demand for lubricating grease in the Middle East & Africa.

The report published by the Minerals Council of South Africa in 2022 revealed that the mining production in South Africa was valued at US$ 57 billion in 2021 and reached US$ 61 billion in 2022. Further, in South Africa, mining exports accounted for US$ 46.3 billion, or 24% of the country's international trade in 2022. The total sales of iron ore in South Africa accounted for US$ 5.4 billion in 2022, representing a rise of 47.3% as compared to 2019. In addition, according to the International Trade Administration, Saudi Arabia's untapped mineral reserves accounted for US$ 1.3 trillion in 2021. Further, the World Mining Data 2022 report by the Federal Ministry Republic of Austria revealed that Africa accounted for 889,634,740 metric tons of mineral production (excluding bauxite). The mining production rate of minerals in Africa increased by 16.2% from 2000 to 2020. As countries in the Middle East & Africa, particularly in Africa, experience a surge in mining activities, the need for robust lubrication solutions becomes paramount. Mining operations involve heavy-duty machinery and equipment subjected to extreme conditions, such as high temperatures, heavy loads, and abrasive environments. Lubricating grease plays a crucial role in ensuring the efficient functioning of these machines by reducing friction, preventing wear and corrosion, and extending the lifespan of critical components.

Strategic insights for the Middle East & Africa Lubricating Grease provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 166.39 Million |

| Market Size by 2030 | US$ 211.14 Million |

| Global CAGR (2022 - 2030) | 3.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Base Oil

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Lubricating Grease refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Strategic insights for the Middle East & Africa Lubricating Grease provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Lubricating Grease refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Lubricating Grease Strategic Insights

Middle East & Africa Lubricating Grease Report Scope

Report Attribute

Details

Market size in 2022

US$ 166.39 Million

Market Size by 2030

US$ 211.14 Million

Global CAGR (2022 - 2030)

3.0%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Base Oil

By Thickener Type

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Lubricating Grease Regional Insights

The Middle East & Africa lubricating grease market is categorized into base oil, thickener type, end-use industry, and country.

Based on base oil, the Middle East & Africa lubricating grease market is segmented mineral oil, synthetic oil, and bio-based. The mineral oil segment held the largest market share in 2022. The synthetic oil segment is further sub segmented into polyalkylene glycol, polyalphaolefin, and esters.

In terms of thickener type, the Middle East & Africa lubricating grease market is categorized into lithium, lithium complex, polyurea, calcium sulfonate, anhydrous calcium, aluminum complex, and others. The lithium segment held the largest market share in 2022.

By end-use industry, the Middle East & Africa lubricating grease market is segmented into conventional vehicles, electric vehicles, building & construction, mining, marine, food, energy & power, and others. The conventional vehicles segment held the largest market share in 2022.

By country, the Middle East & Africa lubricating grease market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa lubricating grease market share in 2022.

BP Plc, Chevron Corp, Exxon Mobil Corp, Fuchs SE, Kluber Lubrication GmbH & Co KG, Petroliam Nasional Bhd, Shell Plc, TotalEnergies SE, and Valvoline Inc are some of the leading companies operating in the Middle East & Africa lubricating grease market.

The Middle East & Africa Lubricating Grease Market is valued at US$ 166.39 Million in 2022, it is projected to reach US$ 211.14 Million by 2030.

As per our report Middle East & Africa Lubricating Grease Market, the market size is valued at US$ 166.39 Million in 2022, projecting it to reach US$ 211.14 Million by 2030. This translates to a CAGR of approximately 3.0% during the forecast period.

The Middle East & Africa Lubricating Grease Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Lubricating Grease Market report:

The Middle East & Africa Lubricating Grease Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Lubricating Grease Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Lubricating Grease Market value chain can benefit from the information contained in a comprehensive market report.