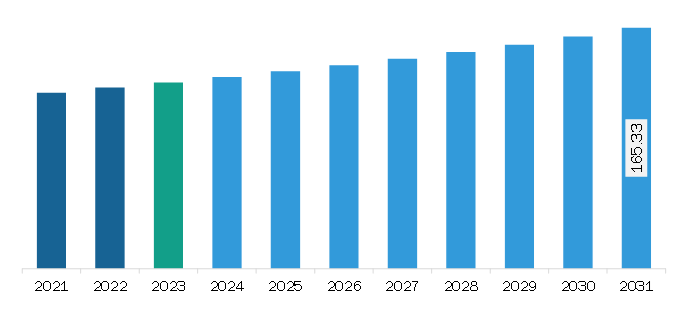

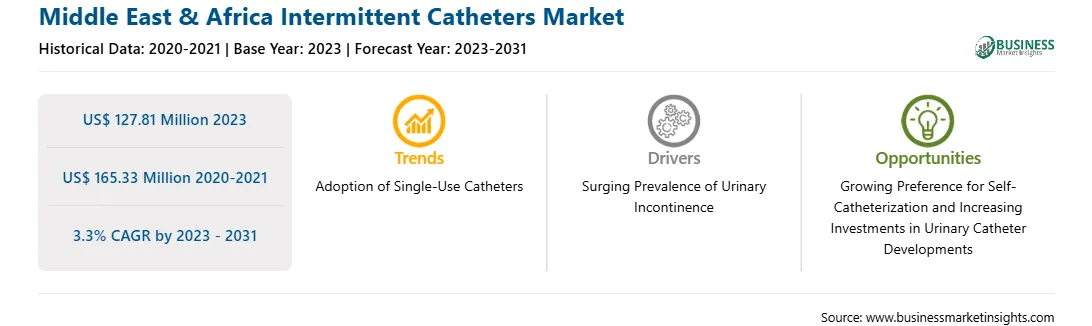

The Middle East & Africa intermittent catheters market was valued at US$ 127.81 million in 2023 and is expected to reach US$ 165.33 million by 2031; it is estimated to register a CAGR of 3.3% from 2023 to 2031.

UTIs are common complications associated with intermittent catheterization (CIC), which hampers individuals’ quality of life and adds to their healthcare expenditures. Residual urine, presumably related to the intermittent catheter's design, has been found as one of several risk factors for infections. Micro-hole zone catheters (MHZCs) have been developed to address the issue of incomplete bladder emptying. MHZCs include a drainage zone with multiple micro-holes from the tip and extending down the catheter's tube, contrary to conventional eyelet catheters (CEC) that typically have two drainage eyelets by the catheter tip. Micro-hole drainage zone catheters are claimed to reduce the probability of early flow stoppages in intermittent catheter users. As a result, the drainage is typically unbroken, ensuring bladder emptying regardless of the user’s approach. Further, avoiding mucosal suctions eliminates the need for catheter repositioning and lowers the risk of mucosal microtrauma. In February 2023, Coloplast introduced Luja, a new catheter for males that redefines bladder emptying. Luja's unique design facilitates complete bladder emptying in a single free flow and represents a paradigm shift within intermittent catheterization. Thus, the advantages related to micro-hole intermittent catheters are expected to bring new intermittent catheter market trends in the coming years.

The prevalence of urinary incontinence in Saudi Arabia is rapidly growing. As per the study, “Patterns of Urinary Incontinence Among Women in Asir Region, Saudi Arabia,” published in 2022, in Asir province, Saudi Arabia, approximately half of the participants (47.5%) had urinary incontinence, of which 26.8%, 16.3%, and 4.3% had a slight, moderate, and severe case of UI, respectively. Moreover, factors contributing to the prevalence of UI in Saudi Arabia include age, obesity, diabetes, and other chronic health conditions. As per the Global Obesity Observatory, 20.2% of the population in Saudi Arabia is categorized as obese. Thus, the high prevalence of urinary incontinence and a rise in risk factors contributing to UI are a few factors contributing to the growth of the market in Saudi Arabia.

Strategic insights for the Middle East & Africa Intermittent Catheters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 127.81 Million |

| Market Size by 2031 | US$ 165.33 Million |

| Global CAGR (2023 - 2031) | 3.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Intermittent Catheters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa intermittent catheters market is categorized into product, indication, category, system type, end user, and country.

By product, the Middle East & Africa intermittent catheters market is bifurcated into coated intermittent catheters and uncoated intermittent catheters. The coated intermittent catheters segment held a larger share of the Middle East & Africa intermittent catheters market share in 2023.

In terms of indication, the Middle East & Africa intermittent catheters market is segmented into urinary incontinence, general surgeries, spinal cord injuries, Parkinson’s Disease (PD), multiple sclerosis, and others. The urinary incontinence segment held the largest share of the Middle East & Africa intermittent catheters market share in 2023.

Based on category, the Middle East & Africa intermittent catheters market is female length catheters, male length catheters, and kid length catheters. The female length catheters segment held the largest share of the Middle East & Africa intermittent catheters market share in 2023.

By system type, the Middle East & Africa intermittent catheters market is bifurcated into closed intermittent catheters systems and open intermittent catheters systems. The closed intermittent catheters systems segment held a larger share of the Middle East & Africa intermittent catheters market share in 2023.

In terms of end user, the Middle East & Africa intermittent catheters market is segmented into hospitals, ambulatory surgical centers, home care settings, and others. The hospitals segment held the largest share of the Middle East & Africa intermittent catheters market share in 2023.

Based on country, the Middle East & Africa intermittent catheters market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia segment held the largest share of Middle East & Africa intermittent catheters market in 2023.

Advin Health Care Pvt Ltd, B Braun SE, Boston Scientific Corp, Cardinal Health Inc, Coloplast Corp, Convatec Group Plc, Teleflex Inc, and Wellspect HealthCare are some of the leading companies operating in the Middle East & Africa intermittent catheters market.

The Middle East & Africa Intermittent Catheters Market is valued at US$ 127.81 Million in 2023, it is projected to reach US$ 165.33 Million by 2031.

As per our report Middle East & Africa Intermittent Catheters Market, the market size is valued at US$ 127.81 Million in 2023, projecting it to reach US$ 165.33 Million by 2031. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East & Africa Intermittent Catheters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Intermittent Catheters Market report:

The Middle East & Africa Intermittent Catheters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Intermittent Catheters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Intermittent Catheters Market value chain can benefit from the information contained in a comprehensive market report.