Middle East & Africa Inertial Sensors for Land Defense Market

No. of Pages: 70 | Report Code: BMIRE00030458 | Category: Electronics and Semiconductor

No. of Pages: 70 | Report Code: BMIRE00030458 | Category: Electronics and Semiconductor

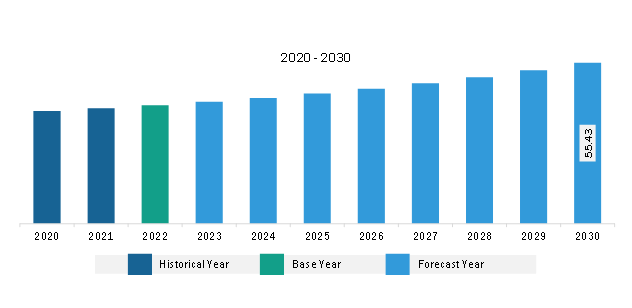

The Middle East & Africa inertial sensors for land defense system market was valued at US$ 40.71 million in 2022 and is expected to reach US$ 55.43 million by 2030; it is estimated to record a CAGR of 3.9% from 2022 to 2030. Integration of Inertial Sensors with Other Sensor Technologies Bolsters Middle East & Africa Inertial Sensors for Land Defense System Market

Inertial sensors, such as accelerometers and gyroscopes, play a crucial role in navigation and motion-sensing applications. These sensors are often integrated with other sensor technologies to enhance the accuracy and robustness of navigation systems. For example, by combining inertial sensors with GPS, navigation systems can overcome the limitations of GPS, such as signal loss in urban canyons or indoor environments. Inertial sensors provide continuous position, velocity, and orientation estimates, which can be used to bridge gaps in GPS data and improve the overall accuracy of navigation systems. Inertial sensors can also be integrated with vision systems to enhance motion-sensing capabilities. Vision systems provide visual information about the environment, while inertial sensors provide precise motion measurements. By combining the data from both sensors, navigation systems can correctly track the position and movement of objects in real time.

Also, advancements in accelerometers for inertial sensors contribute to a rise in the integration of these sensors with other sensor technologies. For instance, in December 2023, Inertial Labs introduced a revolutionary advancement in navigation-grade accelerometers called the high-precision three-axis accelerometers (TAA). These compact devices offer unmatched accuracy in measuring linear accelerations. The development of the TAA series, which spanned over two decades, showcases Inertial Labs' unwavering commitment to delivering innovative solutions in the field of navigation technology. Furthermore, the integration of inertial sensors with other technologies, such as GPS and vision systems, enhances navigation and motion-sensing capabilities, resulting in more robust and accurate measurements. Thus, the integration of inertial sensors with other sensor technologies is expected to fuel the inertial sensors for land defense system market growth in the coming years.Middle East & Africa Inertial Sensors for Land Defense System Market Overview

The Middle East & Africa consists of South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East & Africa inertial sensors for land defense systems market is expected to experience significant growth in the coming years. The MEA has seen a steady increase in defense spending fueled by political instability, regional conflicts, and the need to innovate military capabilities. This increased spending is translating into investments in advanced land defense systems, including those that utilize inertial sensors. For instance, in June 2023, the Israeli Ministry of Defense received its first new Namer 1500 armored personnel carrier (APC). The Namer 1500 APC was developed as part of Israel's Merkava and Armored Vehicle Directorate tank flagship project that will replace the country's aging M113 APC vehicles. In addition, in June 2022, Israel purchased hundreds of combat vehicles from Israel Aerospace Industries for the country's special forces in a deal of ~US$ 28 million.

The demand for precision weapons is propelling the growth of the inertial sensor for land defense system market. These sensors play a crucial role in guiding missiles, rockets, and other munitions to their targets accurately, minimizing collateral damage, and increasing effectiveness. Moreover, advancements in inertial sensors are making them smaller, more accurate, and more affordable. This is making them increasingly attractive for integration into land defense systems, even for budget-constrained militaries. Therefore, the market for inertial sensors for land defense systems in the MEA is poised for significant growth in the coming years.

Middle East & Africa Inertial Sensors for Land Defense System Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Inertial Sensors for Land Defense provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Inertial Sensors for Land Defense refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Inertial Sensors for Land Defense Strategic Insights

Middle East & Africa Inertial Sensors for Land Defense Report Scope

Report Attribute

Details

Market size in 2022

US$ 40.71 Million

Market Size by 2030

US$ 55.43 Million

Global CAGR (2022 - 2030)

3.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Technology

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Inertial Sensors for Land Defense Regional Insights

Middle East & Africa Inertial Sensors for Land Defense System Market Segmentation

The Middle East & Africa inertial sensors for land defense system market is categorized into technology, application, and country.

Based on technology, the Middle East & Africa inertial sensors for land defense system market is categorized into FOG, MEMS, and others. The FOG segment held the largest market share in 2022.

In terms of application, the Middle East & Africa inertial sensors for land defense system market is segmented into stabilization missile systems, stabilization turret/ cannon systems, land navigation including land survey, missile GGM/ SSM, stabilization active protection systems, stabilization of optronic systems, and others. The stabilization missile systems segment held the largest market share in 2022.

By country, the Middle East & Africa inertial sensors for land defense system market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa inertial sensors for land defense system market share in 2022.

Collins, Honeywell International Inc, Northrop Grumman Corp, and Thales SA are some of the leading companies operating in the Middle East & Africa inertial sensors for land defense system market.

1. Collins Aerospace

2. Honeywell International Inc

3. Northrop Grumman Corp

4. Thales SA

The Middle East & Africa Inertial Sensors for Land Defense Market is valued at US$ 40.71 Million in 2022, it is projected to reach US$ 55.43 Million by 2030.

As per our report Middle East & Africa Inertial Sensors for Land Defense Market, the market size is valued at US$ 40.71 Million in 2022, projecting it to reach US$ 55.43 Million by 2030. This translates to a CAGR of approximately 3.9% during the forecast period.

The Middle East & Africa Inertial Sensors for Land Defense Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Inertial Sensors for Land Defense Market report:

The Middle East & Africa Inertial Sensors for Land Defense Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Inertial Sensors for Land Defense Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Inertial Sensors for Land Defense Market value chain can benefit from the information contained in a comprehensive market report.