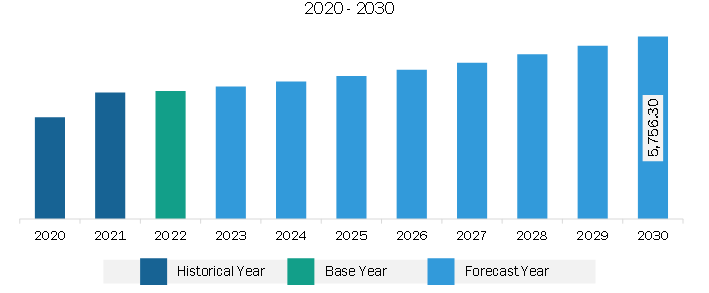

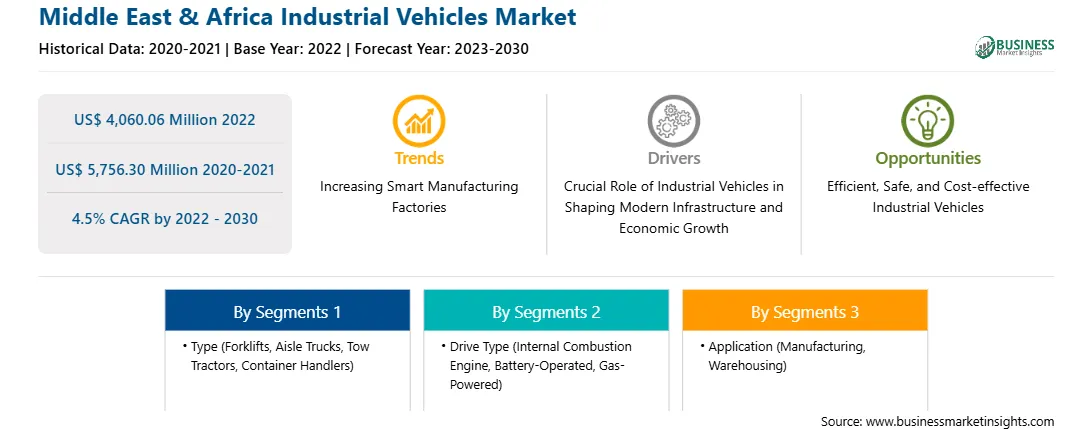

The Middle East & Africa industrial vehicles market was valued at US$ 4,060.06 million in 2022 and is expected to reach US$ 5,756.30 million by 2030; it is estimated to register at a CAGR of 4.5% from 2022 to 2030. Crucial Role of Industrial Vehicles in Shaping Modern Infrastructure and Economic Growth Bolsters Middle East & Africa Industrial Vehicles Market

The modern economic landscape relies heavily on an expansive and intricate infrastructure network. This infrastructure encompasses a wide spectrum, ranging from the construction of roads and bridges to the efficient functioning of freight trains, cargo ships, internet provision, and electrical grids. As urban centers undergo rapid expansion, the demand for infrastructural development is also increasing.

The growth in industrial vehicle demand is also driven by the thriving global construction market, which amounted to US$ 7.3 trillion in 2021; the figure is projected to double by 2030. Furthermore, there is a surge in construction activities, and the emphasis on enhancing operational efficiency on worksites has emerged as a paramount priority for major industry players worldwide. This shift toward improving efficiency is due to an increased focus on the development of technologically advanced industrial vehicles equipped with features such as GPS tracking, autonomous capabilities, and telematics. Such innovations enhance the overall efficiency of construction and logistics operations.

There is a rise in urbanization and infrastructure projects in various countries across the globe, which leads to continuous demand for industrial machinery, construction equipment, and specialized vehicles to navigate the intricate needs of modern infrastructure development. Thus, industrial vehicles play a crucial role in shaping modern infrastructure and economic growth, which drives the market for industrial vehicles.Middle East & Africa Industrial Vehicles Market Overview

The rising demand for the material handling equipment and vehicles around the globe across the manufacturing sector drives the Middle East & Africa industrial vehicles market growth. According to the World Industrial Vehicle Statistics Association (WITS), more than 2.34 million material-handling vehicles and equipment sales were recorded during 2021. The material handling industry saw a 43.0% increase in orders in 2021 compared to the previous year, 2020. Among the 2.34 million material handling units, around 68.8%, that is 1.61 million units, were recorded as electric-powered forklifts. Electric forklift demand is increasing at a rapid pace with a surge in consumer popularity. With a surge in the number of orders, the demand for industrial vehicles such as forklifts, aisle trucks, and pallet trucks has increased.

The Middle East & Africa industrial vehicles market is driven by increasing investment in the warehouse & packaging industry, along with a significant rise in online shopping. In the Gulf States, the e-commerce industry was valued at ~US$ 32.85 billion in 2023 and is projected to register a CAGR of 11% from 2023 to 2027, reaching US$ 49.78 billion by 2027. Such growth in the e-commerce sector has created a massive demand for industrial vehicles in this region.

Middle East & Africa Industrial Vehicles Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Industrial Vehicles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Industrial Vehicles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Industrial Vehicles Strategic Insights

Middle East & Africa Industrial Vehicles Report Scope

Report Attribute

Details

Market size in 2022

US$ 4,060.06 Million

Market Size by 2030

US$ 5,756.30 Million

Global CAGR (2022 - 2030)

4.5%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Drive Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Industrial Vehicles Regional Insights

Middle East & Africa Industrial Vehicles Market Segmentation

The Middle East & Africa industrial vehicles market is segmented based on type, drive type, level of autonomy, application, and country.

Based on type, the Middle East & Africa industrial vehicles market is segmented into forklifts, aisle trucks, tow tractors, container handlers, and others. The forklifts segment held the largest share in 2022.

In terms of drive type, the Middle East & Africa industrial vehicles market is segmented into internal combustion engine, battery-operated, and gas-powered. The battery-operated segment held the largest share in 2022.

By level of autonomy, the Middle East & Africa industrial vehicles market is bifurcated into non/semi-autonomous and autonomous. The non/semi-autonomous segment held a larger share in 2022.

Based on application, the Middle East & Africa industrial vehicles market is segmented into manufacturing, warehousing, and others. The manufacturing segment held the largest share in 2022.

Based on country, the Middle East & Africa industrial vehicles market is categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa industrial vehicles market in 2022.

Kion Group AG, Toyota Industries Corp, Mitsubishi Heavy Industries Ltd, Komatsu Ltd, Hyster-Yale Materials Handling Inc, Jungheinrich AG, Crown Equipment Corp, Konecranes Plc, and Anhui Heli Co Ltd are some of the leading companies operating in the Middle East & Africa industrial vehicles market.

1. Kion Group AG

2. Toyota Industries Corp

3. Mitsubishi Heavy Industries Ltd

4. Komatsu Ltd

5. Hyster-Yale Materials Handling Inc

6. Jungheinrich AG

7. Crown Equipment Corp

8. Konecranes Plc

9. Anhui Heli Co Ltd

The Middle East & Africa Industrial Vehicles Market is valued at US$ 4,060.06 Million in 2022, it is projected to reach US$ 5,756.30 Million by 2030.

As per our report Middle East & Africa Industrial Vehicles Market, the market size is valued at US$ 4,060.06 Million in 2022, projecting it to reach US$ 5,756.30 Million by 2030. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East & Africa Industrial Vehicles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Industrial Vehicles Market report:

The Middle East & Africa Industrial Vehicles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Industrial Vehicles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Industrial Vehicles Market value chain can benefit from the information contained in a comprehensive market report.