Emerging markets in the MEA are witnessing significant growth in the Middle East & Africa industrial robotics market. Rise in industrialization, economic development, and the need for efficient manufacturing processes are driving the demand for industrial robots in this region. In Jan 2023, Saudi Arabia that it plans to increase the number of its factories to 36,000 by 2035 as part of its ambitious goal of becoming a digital superpower. Up to 4,000 of these, such as the facilities will manufacture autonomous vehicles for the kingdom's first electric car brand, Ceer. It would include cutting-edge robotics and AI—a sector that, according to a PwC assessment, has the potential to contribute more than US$ 135.2 billion (or 12.4% of the country's GDP) by 2030. Dubai announced its Robotics and Automation Program just days before the new Saudi National Industrial Strategy specifics were revealed. The program intends to accelerate the deployment of 200,000 robots over the next decade to boost production and efficiency in various areas, including logistics and precision manufacturing. Thus, the increasing demand from emerging countries propels the Middle East & Africa industrial robotics market growth.

The Middle East & Africa industrial robotics market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Countries in the region are adopting factory automation and smart working technique to enhance their manufacturing capabilities. For instance, Saudi Arabia is automating 4,000 factories to curb reliance on low-skilled workers. To transform the country's manufacturing sector, the Ministry of Industry and Mineral Resources launched The Future Factories Program to build a robust tech ecosystem. Similarly, the UAE is focusing on Fourth Industrial Revolution (4IR) or Industry 4.0 to increase productivity and provide more innovative products using automated systems. Through such initiatives, the Middle East & Africa is advancing toward automation, which is fueling the growth of the Middle East & Africa industrial robotics market. According to the World Bank, manufacturing accounted for 14% of the GDP of the Middle East and North Africa in 2018. Moreover, through the MEA’s country initiatives such as Saudi Arabia’s Vision 2030, the government is further promoting manufacturing. Thus, the growth in the manufacturing industry in GCC countries will further fuel the demand for industrial robots and factory automation solutions, boosting the Middle East & Africa industrial robotics market growth.

Strategic insights for the Middle East & Africa Industrial Robotics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Industrial Robotics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Industrial Robotics Strategic Insights

Middle East & Africa Industrial Robotics Report Scope

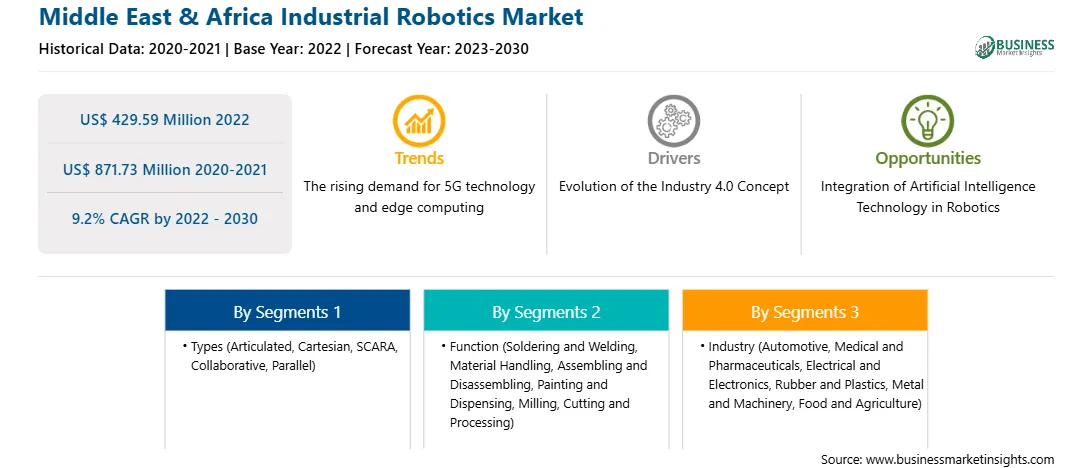

Report Attribute

Details

Market size in 2022

US$ 429.59 Million

Market Size by 2030

US$ 871.73 Million

Global CAGR (2022 - 2030)

9.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Types

By Function

By Industry

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Industrial Robotics Regional Insights

Middle East & Africa Industrial Robotics Market Segmentation

The Middle East & Africa industrial robotics market is segmented into types, function, industry, and country.

Based on types, the Middle East & Africa industrial robotics market is segmented into articulated, cartesian, SCARA, collaborative, parallel, and others. In 2022, the articulated segment registered the largest share in the Middle East & Africa industrial robotics market.

Based on function, the Middle East & Africa industrial robotics market is segmented into soldering and welding, material handling, assembling and disassembling, painting and dispensing, milling, and cutting and processing. In 2022, the soldering and welding segment registered the largest share in the Middle East & Africa industrial robotics market.

Based on industry, the Middle East & Africa industrial robotics market is segmented into automotive, medical and pharmaceuticals, electrical and electronics, rubber and plastics, metal and machinery, and food and agriculture. In 2022, the automotive segment registered the largest share in the Middle East & Africa industrial robotics market.

Based on country, the Middle East & Africa industrial robotics market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. In 2022, the Rest of Middle East & Africa registered the largest share in the Middle East & Africa industrial robotics market.

ABB Ltd, Fanuc Corp, Kawasaki Heavy Industries Ltd, Kuka AG, Mitsubishi Electric Corp, Seiko Epson Corp, Staubli International AG, Universal Robots AS, and Yaskawa Electric Corp are some of the leading companies operating in the Middle East & Africa industrial robotics market.

The Middle East & Africa Industrial Robotics Market is valued at US$ 429.59 Million in 2022, it is projected to reach US$ 871.73 Million by 2030.

As per our report Middle East & Africa Industrial Robotics Market, the market size is valued at US$ 429.59 Million in 2022, projecting it to reach US$ 871.73 Million by 2030. This translates to a CAGR of approximately 9.2% during the forecast period.

The Middle East & Africa Industrial Robotics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Industrial Robotics Market report:

The Middle East & Africa Industrial Robotics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Industrial Robotics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Industrial Robotics Market value chain can benefit from the information contained in a comprehensive market report.