Middle East & Africa Horizontal Directional Drilling Market

No. of Pages: 98 | Report Code: BMIRE00030637 | Category: Manufacturing and Construction

No. of Pages: 98 | Report Code: BMIRE00030637 | Category: Manufacturing and Construction

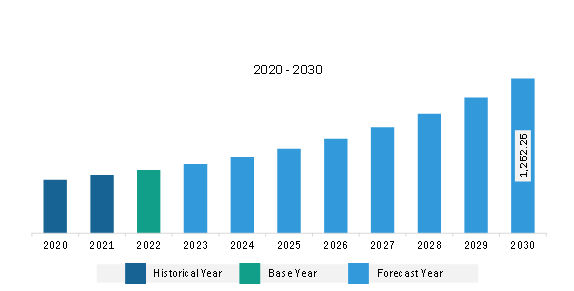

The Middle East & Africa horizontal directional drilling market was valued at US$ 515.74 million in 2022 and is expected to reach US$ 1,262.26 million by 2030; it is estimated to register a CAGR of 11.8% from 2022 to 2030. Increasing Application of Horizontal Directional Drilling Equipment in Sewer & Water and Oil & Gas Sectors Bolsters Middle East & Africa Horizontal Directional Drilling Market

The volume of sewage is rising with population growth. The majority of wastewater is generated by households and industries. Every year, ~380 billion m3 (cubic meters) of municipal wastewater is produced globally. As a result, the demand for proper infrastructure development in the sewer & water sector is increasing due to the growing population and rising urbanization. Governments of several countries are focusing on installing proper wastewater and sewage treatment facilities to protect the environment from pollution. For instance, in 2024, Egypt's Minister of International Cooperation inked a US$ 53.6 million (50 million) funding agreement with the French Development Agency (AFD), in addition to a further grant of US$ 1.6 million (1.5 million). The partnership seeks to facilitate the completion of the Al Gabal Al Asfar Wastewater Treatment Plant's third phase. According to Hassan Allam Holding, the 1,800,000 m3/day wastewater treatment plant in Cairo is the biggest in the MENA region. The growing emphasis on proper sewer and water infrastructure is boosting drilling activities, which is increasing the application of horizontal directional drilling equipment worldwide.

Moreover, there is a surge in energy demand due to the growing global population. According to Exxon Mobil Corporation's report, the global energy demand is expected to reach 660 quadrillion Btu in 2050, up around 15% from 2021 due to population growth and increased affluence. Natural gas has the potential application in electricity generation, which boosts its demand in various industries. For instance, in 2022, an agreement was made between Kuwait and Saudi Arabia regarding the joint development plan for the offshore gas resource known as Dorra. In 2023, in order to conduct offshore exploration in the Mediterranean Sea and the Nile Delta, Egypt intends to invest US$ 1.8 billion in the drilling of additional gas wells. Chevron, Eni, ExxonMobil, Shell, and BP are among the multinational corporations involved in the offshore exploration program. From now until July 2025, the program intends to drill 35 exploration gas wells.

Furthermore, the growing offshore drilling activities for crude oil and gas exploration are boosting the demand for horizontal directional drilling equipment. For instance, in November 2023, Shell Egypt announced that it had successfully completed the drilling of the first well in its three-well exploration campaign, Mina West, located in the Northeast El-Amriya block in the Mediterranean Sea. Thus, an increase in offshore oil & gas exploration activities bolsters the expansion of gas pipeline infrastructure, which is propelling the application of horizontal directional drilling equipment. Thus, the rising infrastructure development in the sewer & water and oil & gas sectors drives the horizontal directional drilling market.Middle East & Africa Horizontal Directional Drilling Market Overview

As per the IEA, the Middle East & Africa generate ~95% of their electricity from oil & gas. More than 290 billion cubic meters of gas, or more than one-third of the region's gas production, are consumed by thermal plants. The Middle East has a high potential for natural gas production, owing to the major gas fields in the Arabian Iranian basin. The Permian Khuff formation signifies a crucial gas-bearing horizon. The abundance of natural gas and growing demand for natural gas in different end use applications are increasing the growth of the oil & gas pipeline infrastructure in the region, which is expanding the scope of drilling activities and leading to a positive impact on the Middle East & Africa horizontal directional drilling market. Offshore oil drilling activities are also boosting the demand for horizontal directional drilling equipment in the region. For instance, in January 2023, Masirah Oil, a subsidiary of Singapore-headquartered independent Rex International, announced that it had completed an offshore drilling campaign in Oman's Block 50. In October 2023, KCA Deutag, a leading drilling, engineering, and technology partner, announced its first locally made rig in Oman during a ceremony of Petroleum Development Oman (PDO). Similarly, in November 2023, Shell Egypt announced that it had completed the drilling of the first well in its three-well exploration campaign, Mina West, located in the Northeast El-Amriya block in the Mediterranean Sea. Thus, such factors are boosting the growth of offshore oil & gas drilling activities, contributing to the Middle East & Africa horizontal directional drilling market expansion.

Middle East & Africa Horizontal Directional Drilling Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Horizontal Directional Drilling provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Horizontal Directional Drilling refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Horizontal Directional Drilling Strategic Insights

Middle East & Africa Horizontal Directional Drilling Report Scope

Report Attribute

Details

Market size in 2022

US$ 515.74 Million

Market Size by 2030

US$ 1,262.26 Million

Global CAGR (2022 - 2030)

11.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By End Use

By Rig Size

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Horizontal Directional Drilling Regional Insights

Middle East & Africa Horizontal Directional Drilling Market Segmentation

The Middle East & Africa horizontal directional drilling market is categorized into end use, rig size, application, and country.

Based on end use, the Middle East & Africa horizontal directional drilling market is segmented telecommunications, oil & gas, sewer & water, environmental wells, and utility. The oil & gas segment held the largest market share in 2022.

By rig size, the Middle East & Africa horizontal directional drilling market is segmented into small (below 40,000 Lbs), medium (40,000 - 100,000 Lbs), and large (above 100,000 Lbs). The large (above 100,000 Lbs) segment held the largest market share in 2022.

Based on application, the Middle East & Africa horizontal directional drilling market is bifurcated into onshore and offshore. The onshore segment held a larger market share in 2022.

By country, the Middle East & Africa horizontal directional drilling market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa horizontal directional drilling market share in 2022.

American Augers Inc, Drillto Trenchless Co Ltd, Epiroc AB, Herrenknecht AG, Laney Directional Drilling Co, Nabors Industries Ltd, Prime Drilling GmbH, Tracto-Technik GmbH & Co KG, and Vermeer Corp are some of the leading companies operating in the Middle East & Africa horizontal directional drilling market.

1. American Augers Inc

2. Drillto Trenchless Co Ltd

3. Epiroc AB

4. Herrenknecht AG

5. Laney Directional Drilling Co

6. Nabors Industries Ltd

7. Prime Drilling GmbH

8. Tracto-Technik GmbH & Co KG

9. Vermeer Corp

The Middle East & Africa Horizontal Directional Drilling Market is valued at US$ 515.74 Million in 2022, it is projected to reach US$ 1,262.26 Million by 2030.

As per our report Middle East & Africa Horizontal Directional Drilling Market, the market size is valued at US$ 515.74 Million in 2022, projecting it to reach US$ 1,262.26 Million by 2030. This translates to a CAGR of approximately 11.8% during the forecast period.

The Middle East & Africa Horizontal Directional Drilling Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Horizontal Directional Drilling Market report:

The Middle East & Africa Horizontal Directional Drilling Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Horizontal Directional Drilling Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Horizontal Directional Drilling Market value chain can benefit from the information contained in a comprehensive market report.